Best Car Insurance Uk 2023

Best Car Insurance UK 2023

Car Insurance in the UK - Why Do You Need It?

Car insurance is a necessary expense for anyone who owns a car in the UK. It is a legal requirement and even those who don’t drive their car regularly need to have at least third-party insurance. This is to protect you and other road users from unexpected costs should an accident occur. It can also cover you for theft and vandalism, as well as any damage caused to your own car. Therefore, if you are looking for the best car insurance UK 2023, it is important to understand the different types available and to make sure you are getting the best deal for your needs.

Types of Car Insurance

The most basic type of car insurance UK 2023 is third-party insurance. This covers you for any damages you cause to other people’s property, or to another person’s car in the event of an accident. It does not cover you for repairs to your own car, however. Comprehensive insurance covers you for both third-party claims and damage to your own car. It also covers you for theft and vandalism, as well as accidental damage. This type of insurance is more expensive, but it provides the most protection.

Finding the Best Car Insurance Deals in the UK

When looking for the best car insurance UK 2023, it is important to shop around and compare different providers. Different insurance companies offer different levels of coverage, so make sure you understand what each provider offers before you make a decision. It is also important to consider any discounts or incentives that a provider may offer. For example, some providers offer discounts for drivers with a clean driving record or for those who have multiple cars insured with them.

Factors That Affect Your Car Insurance Premiums

Your premium will be affected by a number of factors, such as the type of car you drive, your age, and your driving record. By understanding these factors, you can make sure you get the best car insurance UK 2023 for your needs. The type of car you drive will influence your premium, as cars with more powerful engines and more expensive parts will cost more to insure. Your age is also taken into consideration, as younger drivers are considered to be more of a risk. Finally, your driving record will determine the premium you pay, so make sure you are driving safely and not accumulating too many points on your license.

Save Money on Your Car Insurance

There are a number of ways to save money on your car insurance UK 2023. One way is to increase your excess. This is the amount you are willing to pay out of your own pocket in the event of a claim. The higher the excess, the lower your premium will be. It is important to make sure that you can afford the excess you choose, however, as you will be required to pay it if you make a claim. Other ways to save money on your car insurance include considering multi-car policies, opting for a black box policy, or taking a defensive driving course.

Conclusion

Car insurance is an essential expense for anyone who owns a car in the UK. There are different types of insurance available, and it is important to shop around to get the best deal for your needs. Factors such as the type of car you drive, your age, and your driving record will all affect the premium you pay. There are a number of ways to save money on your car insurance, such as increasing your excess, considering a multi-car policy, opting for a black box policy, or taking a defensive driving course.

Best motor insurance uk

Hastings Direct enhances customer service with centralised knowledge

The best tips to pay less for your car insurance

|CAR INSURANCE| ♥ TOP 10 CAR INSURANCE ☀️ LIST OF BEST INSURANCE

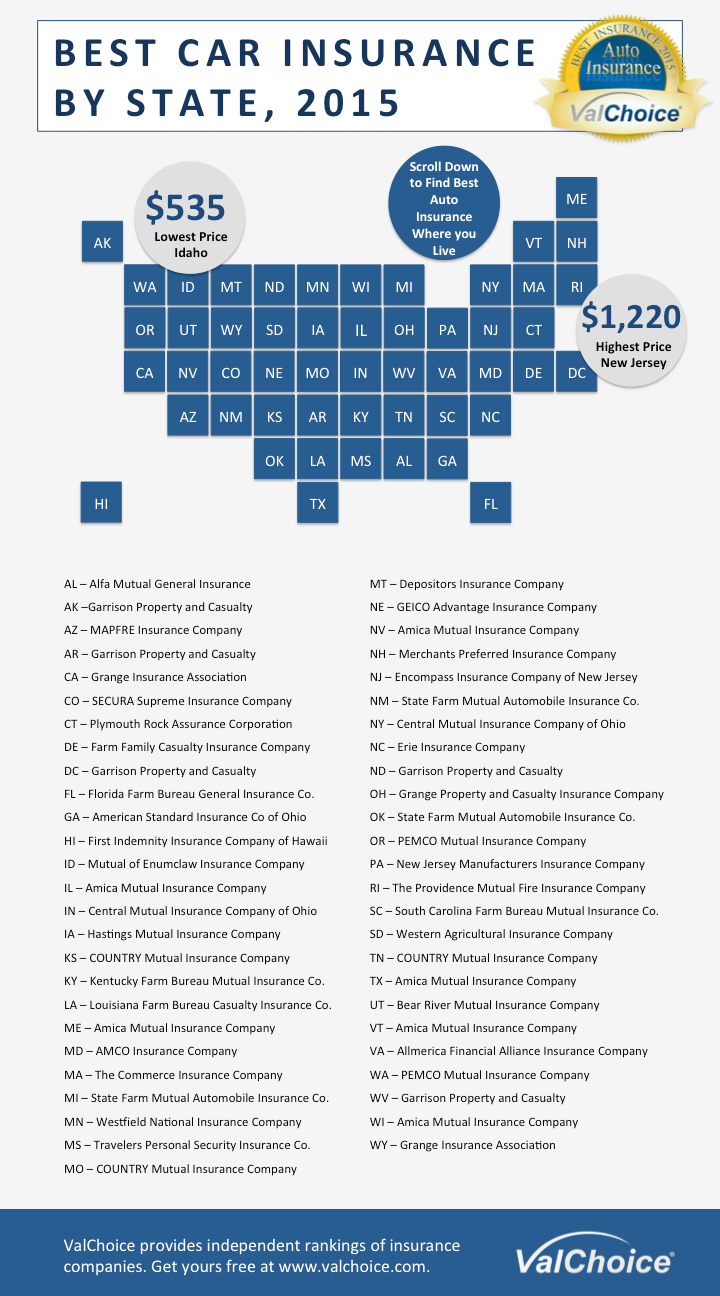

Best Car Insurance Companies by State - ValChoice