Banks That Offer Car Insurance

Banks That Offer Car Insurance: Exploring the Options

What Is Car Insurance?

Car insurance is a type of insurance policy that provides coverage for your car against financial losses. It is a type of contract that you enter into with an insurance company, in which you agree to pay a certain amount of money each month, in exchange for coverage for any potential losses or damages to your car. Car insurance can help you to protect your vehicle from damage caused by accidents, theft, vandalism, and other unforeseen events. Car insurance can also help to cover the costs of medical bills in the event of an accident or illness.

Why Do I Need Car Insurance?

Car insurance is not only important for protecting your car from damage or losses caused by accidents, theft, or vandalism, but it is also essential for protecting you from financial liability. Without car insurance, you may be held liable for any damages or medical costs caused by an accident that you are responsible for. This means that if you are responsible for an accident, you could be held legally responsible for any damages or costs associated with the accident, such as medical bills, repairs, and legal fees. Car insurance can help to protect you from these costs, and thus it is an important financial safety net.

Which Banks Offer Car Insurance?

A number of banks offer car insurance policies to their customers. Some of the banks that offer car insurance include Bank of America, Chase, Citibank, US Bank, and Wells Fargo. These banks usually offer multiple car insurance policies, so you can find one that fits your budget and needs. Additionally, many of these banks also offer discounts for their customers who purchase additional car insurance policies. It is important to shop around for the best rates and coverage for your car insurance needs.

What Are the Benefits of Buying Car Insurance from a Bank?

Buying car insurance from a bank can be beneficial for several reasons. One of the main benefits is that banks usually offer better rates than other providers. Additionally, banks are often more reliable and have more customer service options available. Banks also often offer discounts and incentives for customers who purchase multiple car insurance policies, which can help to save you money. Finally, when you buy car insurance from a bank, you can be sure that your policy is backed by a company with a solid financial track record.

What Should I Consider When Choosing a Car Insurance Policy?

When choosing a car insurance policy, it is important to consider the coverage that is offered, the deductibles and limits, and the customer service offered by the provider. Additionally, it is important to research the financial stability of the provider, as this can affect their ability to pay out on a claim. It is also important to compare the rates and coverage offered by different providers in order to get the best deal possible. Finally, it is important to review the terms and conditions of the policy carefully, to make sure that it meets your needs.

In Conclusion

Buying car insurance from a bank can be a great way to get the coverage you need at a competitive rate. Banks typically offer better rates than other providers, and they often offer discounts and incentives for customers who purchase multiple car insurance policies. Additionally, banks are generally more reliable and have better customer service options than other providers. It is important to shop around and compare the rates and coverage offered by different banks in order to find the best deal for your car insurance needs.

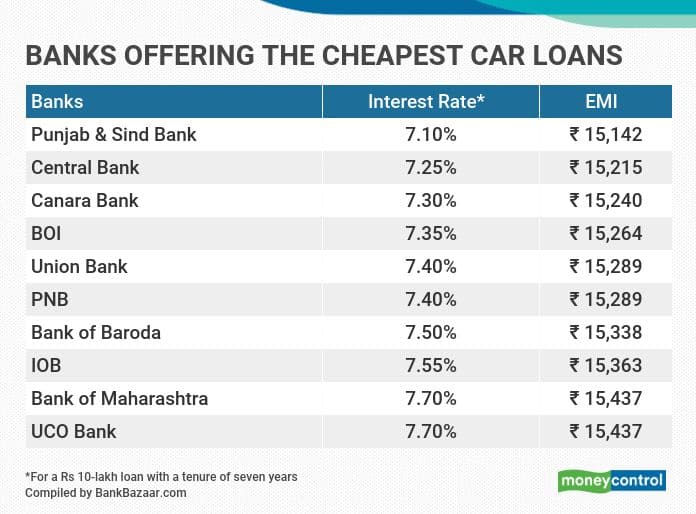

Banks offering cheapest car loans in Ghana [Infographic]

Here are the banks that offer the cheapest car loans

Bank of Maharashtra Car Loan at affordable Interest rates | Avail Car

Tesco Car Insurance Excess

Banks roll out support for clients affected by COVID-19 | Your Mortgage