Bank Of Scotland Car Insurance Cancellation Policy

Saturday, August 9, 2025

Edit

Bank Of Scotland Car Insurance Cancellation Policy

Overview of Bank Of Scotland Car Insurance

Bank Of Scotland Car Insurance provides a range of comprehensive car insurance coverage to individuals and businesses. The company's products are designed to meet the needs of a wide range of customers and are tailored to meet the specific requirements of each individual customer. Customers can choose from a variety of coverages, including liability, comprehensive, collision, and uninsured or underinsured motorist coverage. Customers can also select from a variety of deductible levels and coverage limits to fit their budget and needs. Bank Of Scotland Car Insurance also offers a variety of discounts and other incentives to help customers save money on their car insurance premiums.

Bank Of Scotland Car Insurance Cancellation Policy

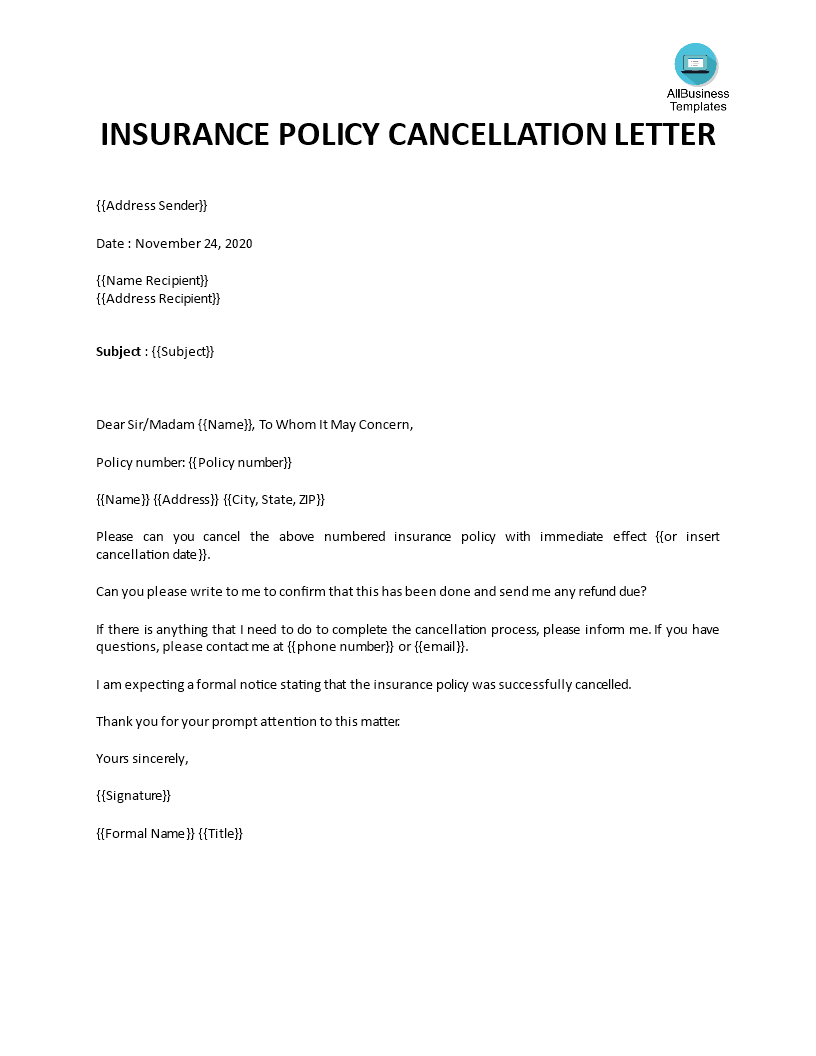

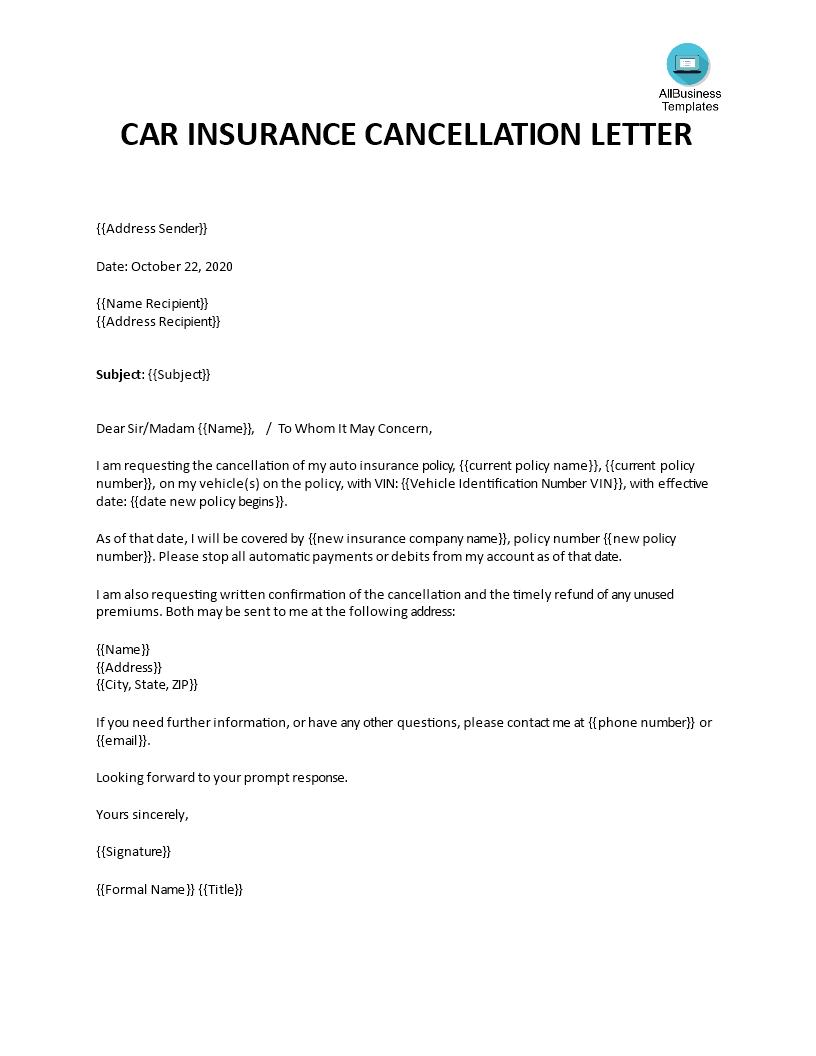

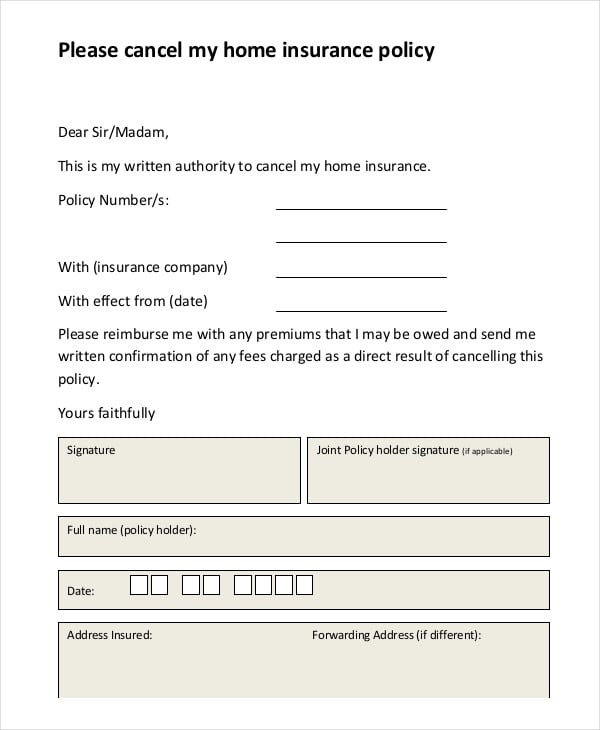

If you are a customer of Bank Of Scotland Car Insurance, you may have the right to cancel your policy at any time. The policyholder must provide written notice to the insurance company at least seven days before the policy is due to be cancelled. The written notice must include the policyholder's name, address and the date of cancellation. Once the notice is received by the insurance company, the policy will be cancelled and any unused premiums will be refunded to the policyholder.

The insurance company may cancel the policy if the policyholder fails to make payments on time, has been convicted of a crime or has failed to provide the company with accurate information. In these cases, the policyholder will be notified of the cancellation in writing. The policyholder will be given the opportunity to pay any outstanding premiums or penalties before the policy is cancelled.

In some cases, the insurance company may also cancel the policy if the policyholder has made an excessive number of claims or has been involved in an accident that is deemed to be the fault of the policyholder. The policyholder will be notified of the cancellation in writing and will be given the opportunity to provide proof of a clean driving record or to take other steps to avoid cancellation.

What Happens After Cancellation?

When a Bank Of Scotland Car Insurance policy is cancelled, the policyholder will receive a refund of any unused premiums. In some cases, the policyholder may also be liable for any additional fees or penalties that the insurance company may charge. Depending on the reasons for cancellation, the policyholder may also be required to pay any outstanding claims before the policy is cancelled.

If the policyholder has a claim pending at the time of cancellation, the insurance company will continue to process the claim. The policyholder will still be responsible for any claims costs or damages that are incurred as a result of the accident. If the policyholder is found to be at fault for the accident, the insurance company may increase the policyholder's premiums or deny coverage to the policyholder in the future.

Conclusion

Bank Of Scotland Car Insurance provides a range of comprehensive car insurance coverage to individuals and businesses. Customers can choose from a variety of coverages, including liability, comprehensive, collision, and uninsured or underinsured motorist coverage. Customers have the right to cancel their policy at any time with seven days' notice. The policyholder may be liable for additional fees or penalties, depending on the reasons for cancellation. The policyholder will receive a refund of any unused premiums and will still be responsible for any pending claims at the time of cancellation.

Tail Coverage Insurance Example References - Galeries

Car Insurance Cancellation Letter | Templates at allbusinesstemplates.com

Best Letters - 13+ Free Word, PDF Documents Download | Free & Premium

Cancellation Letter Insurance Policy | Templates at