Average Cost Of Life Insurance Per Month For One Person

What is the Average Cost of Life Insurance?

Life insurance is an important investment that many people make to ensure their families are taken care of in the event of a tragedy. It provides financial coverage in the event of your death, ensuring that your loved ones are provided for in the future. But what is the average cost of life insurance?

The cost of life insurance depends on a variety of factors, including your age, health, and lifestyle. On average, a healthy adult can expect to pay around $30-$50 per month for a term life insurance policy. However, the cost of life insurance can vary greatly depending on the type of policy you choose and the coverage amount.

Types of Life Insurance Policies

When considering life insurance, it’s important to understand the different types of policies available. The two most common types of life insurance are term and whole life policies.

Term life insurance is a policy that provides coverage for a specific period of time, usually 10-20 years. Once the term ends, the policy will no longer provide coverage. Term life insurance is typically the most affordable type of life insurance and is ideal for those who are looking for a low-cost option to provide coverage for a set period of time. The average cost of term life insurance can range from $30-$50 per month depending on the amount of coverage and the term length.

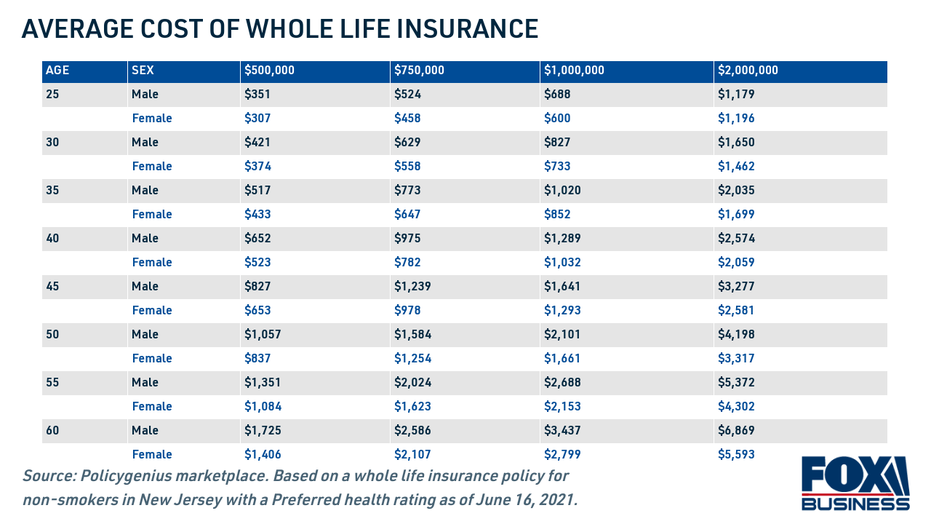

Whole life insurance is a permanent policy that provides coverage for your entire life. Whole life insurance typically requires a higher monthly premium than term life insurance, but it does provide the added benefit of accumulating cash value over time. The average cost of whole life insurance can range from $50-$100 per month depending on the amount of coverage and the policy features.

Factors That Affect Cost

In addition to the type of policy, there are other factors that can affect the cost of life insurance. Your age and health are two of the most important factors that insurance companies consider when determining the cost of life insurance. Generally, the younger and healthier you are, the lower your premiums will be. Additionally, lifestyle choices such as smoking and alcohol consumption can also affect the cost of life insurance.

It’s also important to consider your family’s financial situation when choosing a life insurance policy. The amount of coverage you need will depend on factors such as your family’s current and future expenses, as well as any debts or liabilities. Taking the time to consider these factors will ensure that you have the right amount of coverage for your family’s needs.

Conclusion

The average cost of life insurance can vary greatly depending on the type of policy, the coverage amount, and other factors. On average, a healthy adult can expect to pay around $30-$50 per month for a term life insurance policy. However, the cost of life insurance can vary greatly depending on the type of policy you choose and the coverage amount.

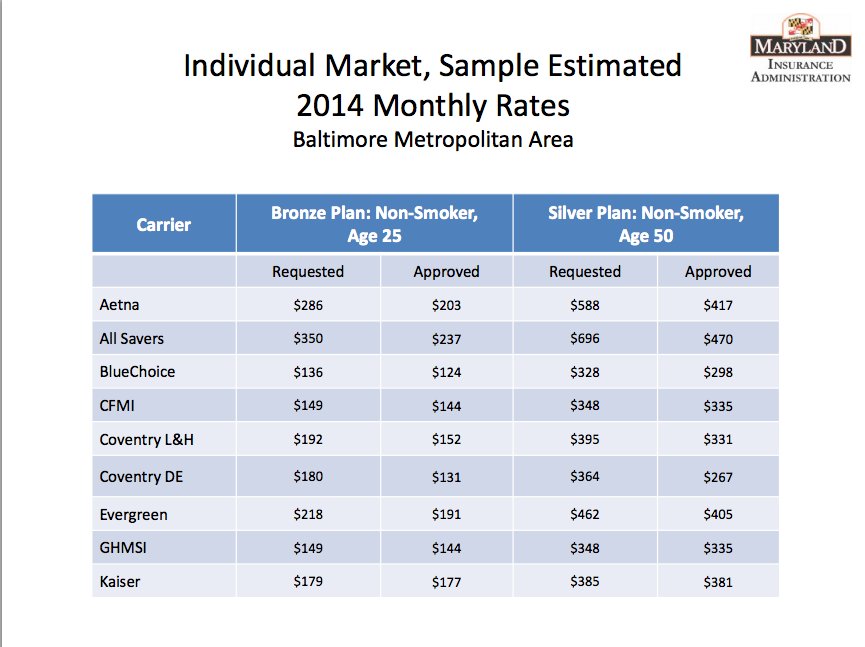

Maryland Touts Low Obamacare Health Insurance Premiums

Medical Insurance Cost Per Month / Average Cost of Car Insurance (2019

Average Life Insurance Rates for 2021 | Policygenius

Here's Why It Costs $1,204 a Month to Maintain the Average Home

How much should life insurance cost? See the breakdown by age, term and