Average Cost For Full Coverage Car Insurance Annually

Saturday, August 2, 2025

Edit

Average Cost For Full Coverage Car Insurance Annually

The Average Cost of Car Insurance

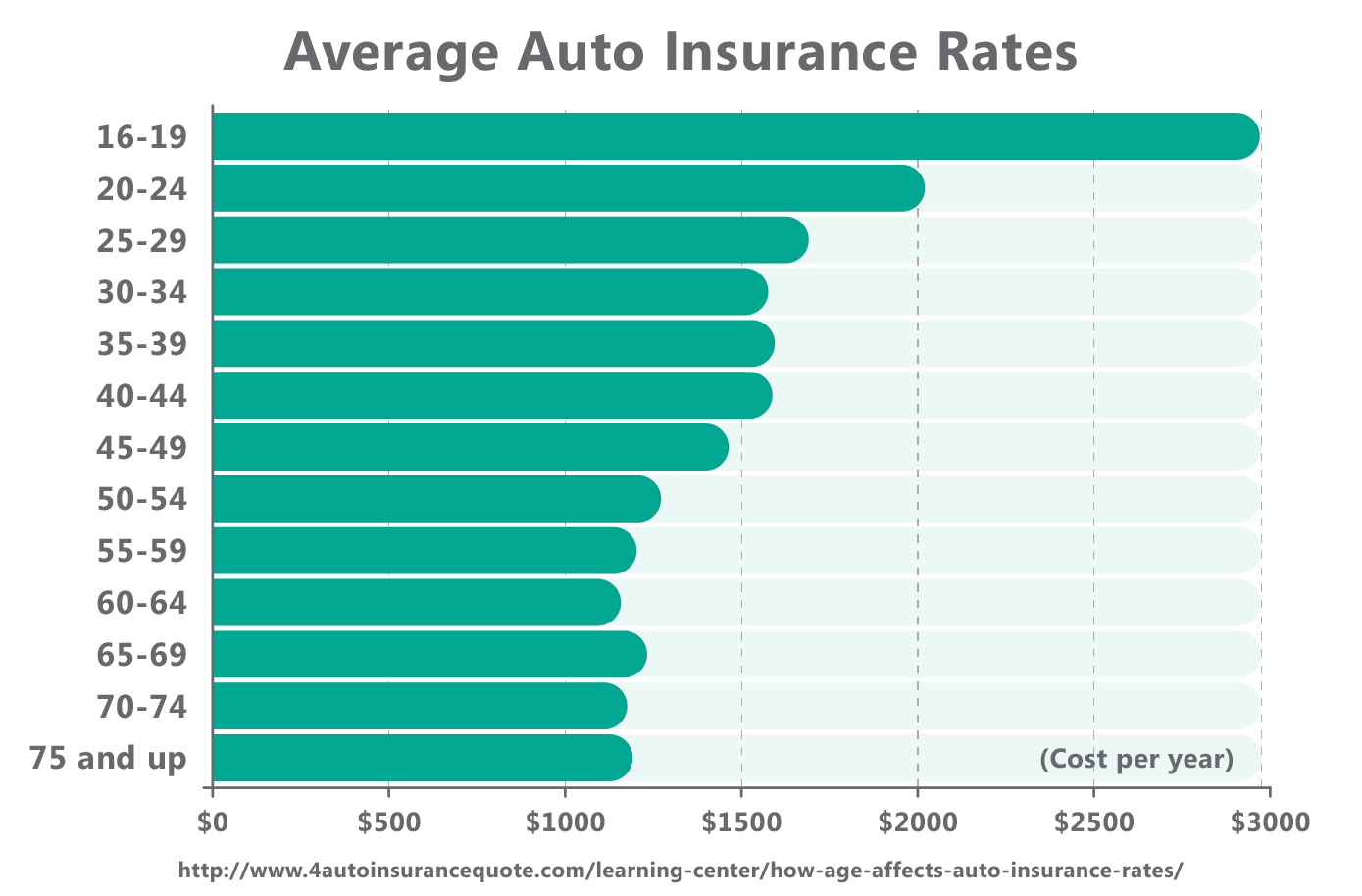

Buying car insurance is an important decision for any driver. Car insurance can be expensive, but it is a necessary expense. The average cost for full coverage car insurance annually is around $1,500, but this number can vary greatly depending on your age, driving history, and other factors. In order to get a better idea of what your car insurance may cost, you should compare quotes from multiple providers. This can help you get the coverage you need at a price you can afford.

Factors That Affect The Cost of Car Insurance

There are a variety of factors that can affect the cost of car insurance. Your age, driving record, type of vehicle, and location are all important factors that can influence the cost of your car insurance. Younger drivers are typically seen as riskier than older drivers, so they will generally pay higher premiums. Drivers with a history of accidents or traffic violations will also pay more for car insurance. The type of vehicle you drive can also affect the cost of car insurance. Sports cars and luxury vehicles are typically seen as higher risk and may cost more to insure. Additionally, where you live can affect your car insurance rates. In states with high population density, there typically is more traffic and therefore higher rates of accidents. This can make car insurance more expensive in those states.

Discounts That Can Help Lower The Cost of Car Insurance

There are a variety of discounts available that can help lower the cost of car insurance. For example, if you’ve completed a defensive driving course, you may be eligible for a discount. Additionally, if you have multiple cars insured with the same provider, you may be eligible for a multi-car discount. There are also discounts available for drivers who are members of certain organizations, such as the AARP or AAA. Finally, if you have a good driving record, you may be eligible for a good driver discount.

Tips To Help Lower The Cost of Car Insurance

In addition to taking advantage of discounts, there are a few other tips to help you lower the cost of car insurance. First, you should look into raising your deductible. This can help lower your premiums, although it will also mean you will have to pay more out of pocket if you have an accident. Additionally, you should shop around and compare quotes from multiple providers to make sure you are getting the best possible rate. Finally, you should make sure to keep your driving record clean. This will help ensure you get the best rates from your car insurance provider.

Conclusion

The average cost for full coverage car insurance annually is around $1,500, but this number can vary based on a variety of factors. In order to get the best rate, it is important to compare quotes from multiple providers and take advantage of any discounts you may be eligible for. Additionally, raising your deductible and keeping a clean driving record can help you save money on car insurance. By following these tips, you can make sure you get the coverage you need at a price you can afford.

The average cost of car insurance in the US, from coast to coast

Cheap Car Insurance in North Carolina | QuoteWizard

What is No-Fault Insurance and How Does it Work? | QuoteWizard

Which is better? Amica® vs. Auto Owners Insurance | quote.com

Quick Answer: What Is The Average Car Insurance Rate?? - AutoacService