Aa Motor Insurance Policy Booklet

Understanding Your Aa Motor Insurance Policy Booklet

When you purchase a motor insurance policy with Aa, you will receive a booklet outlining the terms and conditions of your insurance. It contains important information you need to know and understand. This article will provide a detailed overview of your Aa Motor Insurance Policy Booklet and help you understand what it covers.

What Is Covered in My Motor Insurance Policy Booklet?

Your Aa Motor Insurance Policy Booklet provides cover for a variety of risks associated with driving, such as damage to your car, medical costs, and even legal fees should you be involved in an accident. It also covers you for any liabilities you may incur as a result of an accident, such as damage to another person's property or injury to another person. Additionally, your policy may also offer additional benefits such as windscreen cover, breakdown cover and personal accident cover.

What Is Not Covered in My Motor Insurance Policy Booklet?

Your Aa Motor Insurance Policy Booklet does not cover any costs associated with your vehicle that are not directly related to driving, such as repairs or maintenance. Additionally, it does not cover any intentional damage or loss, or damage caused by another person who is not covered under the policy. Your policy also does not cover any damage to property that is owned by you or a family member, or any damage to your vehicle that is not caused by a road traffic accident.

What Do I Need to Know About My Motor Insurance Policy?

Your Aa Motor Insurance Policy Booklet outlines the terms and conditions of your policy, as well as any exclusions or limitations that may apply. Before signing your policy, it's important to read and understand it so that you know exactly what is and isn't covered. Additionally, it's important to keep your policy documents in a safe place, as you will need to refer to them if you need to make a claim.

What Should I Do If I Need to Make a Claim?

If you need to make a claim on your Aa Motor Insurance Policy, you should contact your insurer immediately. You will need to provide details of the circumstances of the claim, as well as any relevant documents and information. Your insurer will assess your claim and inform you of the outcome. If your claim is accepted, you will be paid out in accordance with the terms and conditions of your policy.

Conclusion

Your Aa Motor Insurance Policy Booklet is an important document that outlines the terms and conditions of your cover. It's important to read and understand your policy before signing it, as this will ensure that you are aware of any exclusions and limitations that may apply. If you ever need to make a claim on your policy, you should contact your insurer immediately and provide all the necessary information.

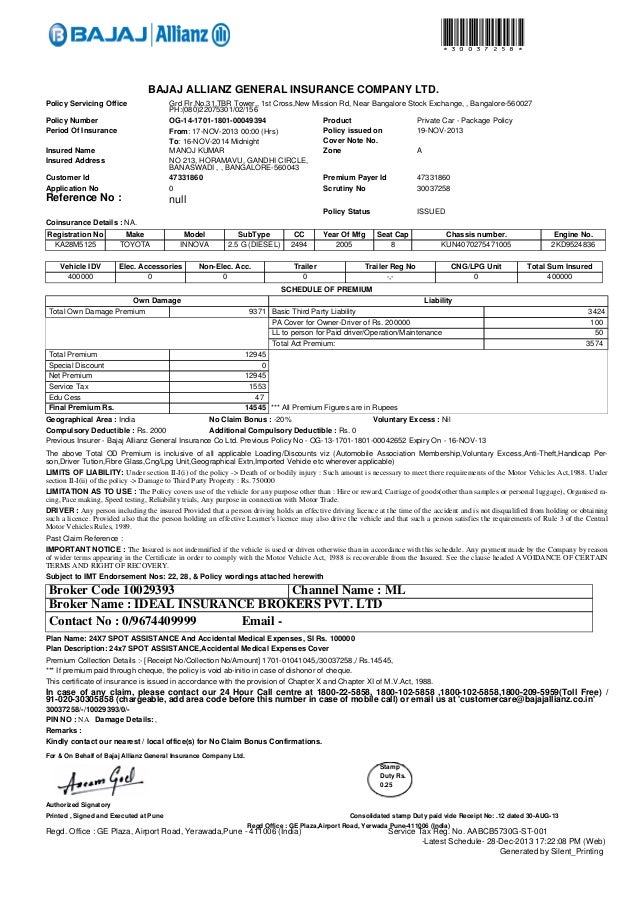

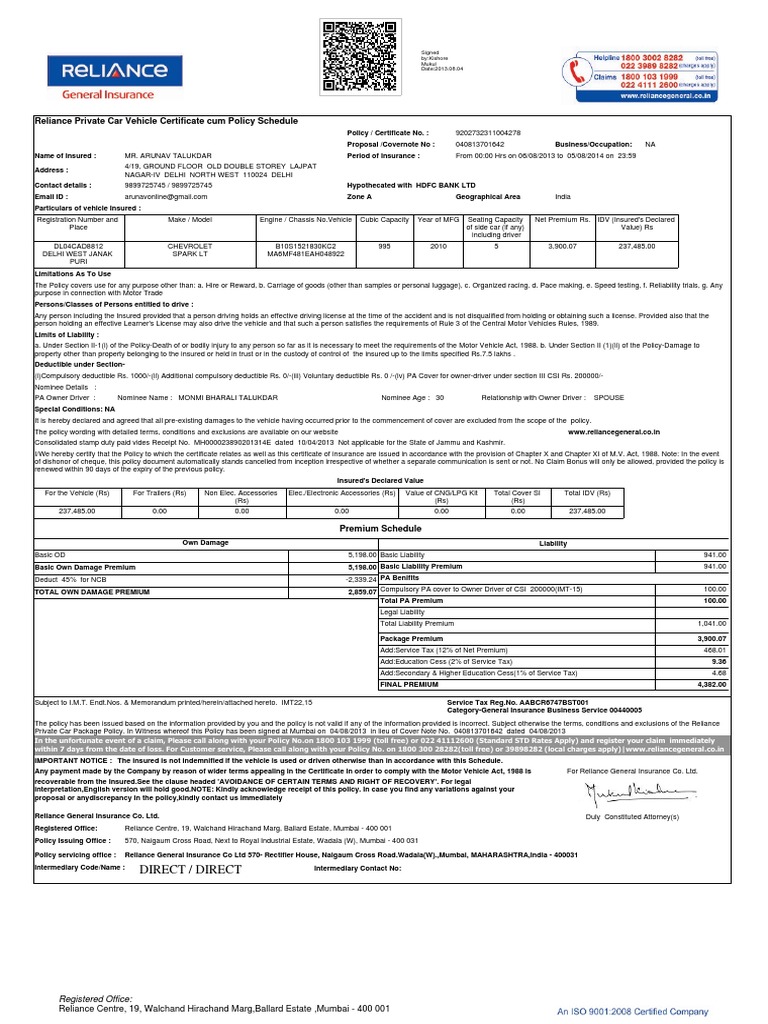

81 reference of Auto Insurance Policy Number | Car insurance, Insurance

Car Insurance Policy: Car Insurance Policy Number Format

Vehicle Insurance Policy Format | Vehicle Insurance | Liability Insurance

Markerstudy - Brokers | Policies

State Auto Home Insurance Policy - Insurance Reference