3 Day New Car Insurance California Policy

3 Day New Car Insurance California Policy

Why You Need a Three Day New Car Insurance Policy in California

Are you in the market for a new car in California? If so, you'll need to get three day new car insurance. This type of policy is special, because it provides you with coverage for a brief period of time, so you can drive your new car legally. It is important to understand why you need a three day new car insurance policy and what it covers.

California state law requires that all vehicles registered in the state must have the minimum liability insurance. This includes vehicles purchased from a dealership, as well as private sellers. This is to protect motorists and other drivers in the event of an accident. The three day new car insurance policy is designed to bridge the gap between the time you purchase a new car and the time you purchase a long-term policy.

The three day car insurance policy provides coverage for the first three days after you purchase your new car. This means that you won't have to worry about the hassle of purchasing a long-term policy right away. The policy will cover damages that you may cause to another vehicle or property in the event of an accident. It will also cover medical expenses and lost wages in the event that you are injured in an accident. It is important to note that the policy does not cover damages to your own vehicle.

How to Obtain a Three Day New Car Insurance Policy in California

Obtaining a three day new car insurance policy is a relatively simple process. Many insurance companies offer this type of policy, and you can easily find one that meets your needs. The easiest way is to use an online insurance comparison website. These websites will allow you to compare different policies from different companies, so you can find the best option for your needs.

When you use an online insurance comparison website, you will need to provide some basic information about yourself and your vehicle. This includes your age, gender, driving record, and the make and model of the car you are purchasing. The website will then generate quotes from different insurance companies, so you can compare them and find the best policy for your needs.

Once you have chosen a policy, you can purchase it online or over the phone. You will need to provide your payment information and some basic information about your vehicle. Once you have purchased the policy, you can print out a copy of the policy and keep it in your car. This will provide proof that you have coverage in case you are pulled over by the police.

Conclusion

A three day new car insurance policy is an important requirement for anyone purchasing a new car in California. It provides you with the coverage you need to drive your new car legally. The process of obtaining a three day car insurance policy is relatively simple, and you can easily find a policy that meets your needs. Be sure to keep a copy of the policy in your car and follow the terms of the policy to ensure that you are covered.

Mercury Insurance Quote California - Insurance Reference

Insuring New Cars - Door to better car insurance in California

Cheapest Car Insurance Our Research Shows That Geico Has The Cheapest

car-insurance-policy

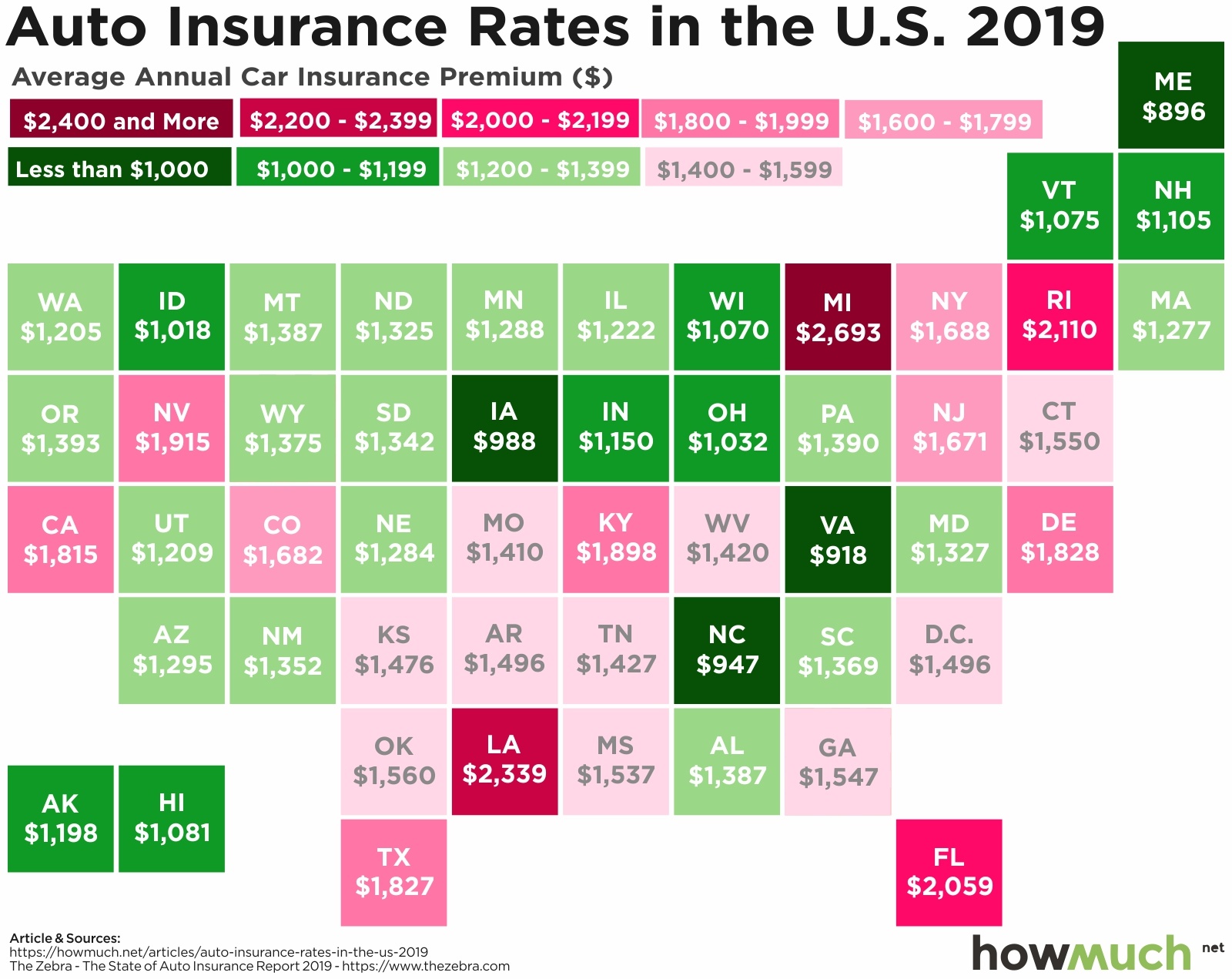

California Car Insurance Rates ~ designlocust