Typical Car Insurance Monthly Cost

Wednesday, July 2, 2025

Edit

Typical Car Insurance Monthly Cost

What Is Car Insurance?

Car insurance is a type of insurance policy that provides financial protection to drivers in the event of an accident, theft or any other type of damage to their vehicle. It is important to understand that car insurance does not cover all types of damages, including damages caused by the driver themselves. It is also important to note that car insurance policies vary from one company to another, so it is important to compare different policies before deciding on a provider.

How Much Does Car Insurance Cost?

The cost of car insurance depends on a variety of factors, including the type of car, the driver's age and driving record, and the amount of coverage desired. Generally speaking, the average cost of car insurance in the United States is around $115 per month, although this can vary greatly depending on the factors mentioned above. Additionally, the cost of car insurance can also vary greatly depending on the state in which the driver resides.

What Factors Affect Car Insurance Cost?

As mentioned above, the cost of car insurance can vary greatly depending on a variety of factors. For example, drivers with a good driving record and a newer model car can often get lower rates than those with a poor driving record or an older model car. Additionally, the type of car and its safety features can also affect the cost of car insurance. For example, cars with more safety features and a better safety rating may be eligible for lower rates. Additionally, some states may also offer discounts for drivers who have taken defensive driving courses or who have maintained a good driving record for a certain period of time.

How Can I Save Money on Car Insurance?

There are several ways to save money on car insurance. First, drivers should shop around and compare different policies to ensure they are getting the best rate. Additionally, drivers should consider raising their deductibles, which will lower their premiums. Other ways to save money on car insurance include taking defensive driving courses and maintaining a good driving record. Finally, drivers should consider bundling their car insurance with other types of policies, such as homeowners or renters insurance, to get the best rate.

What Are the Benefits of Car Insurance?

The most obvious benefit of car insurance is that it provides financial protection in the event of an accident or theft. Additionally, having car insurance also ensures that drivers are in compliance with state laws and regulations, which are often necessary in order to legally drive a car. Finally, car insurance can also provide some peace of mind for drivers, knowing that they have some form of financial protection in case of an emergency.

In Summary

Car insurance is an important purchase for any driver, as it provides financial protection in the event of an accident or theft. The cost of car insurance can vary greatly depending on a variety of factors, including the type of car, the driver's age and driving record, and the amount of coverage desired. There are several ways to save money on car insurance, such as shopping around, raising deductibles, and bundling policies. Finally, car insurance provides a variety of benefits, including financial protection, compliance with state laws, and peace of mind.

The average cost of car insurance in the US, from coast to coast

ALL You Need to Know About the Average Car Insurance Cost

Average Monthly Car Insurance Maryland - blog.pricespin.net

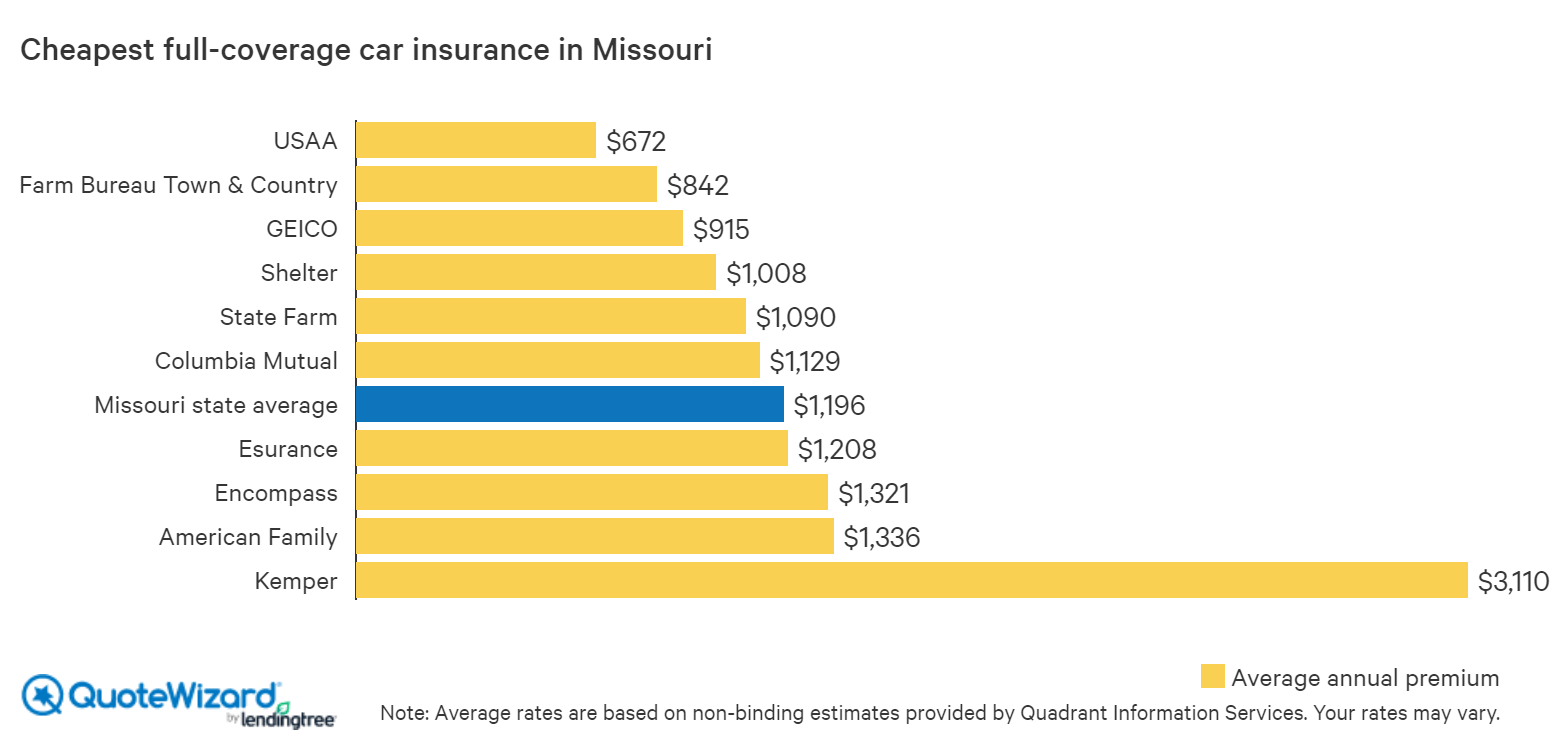

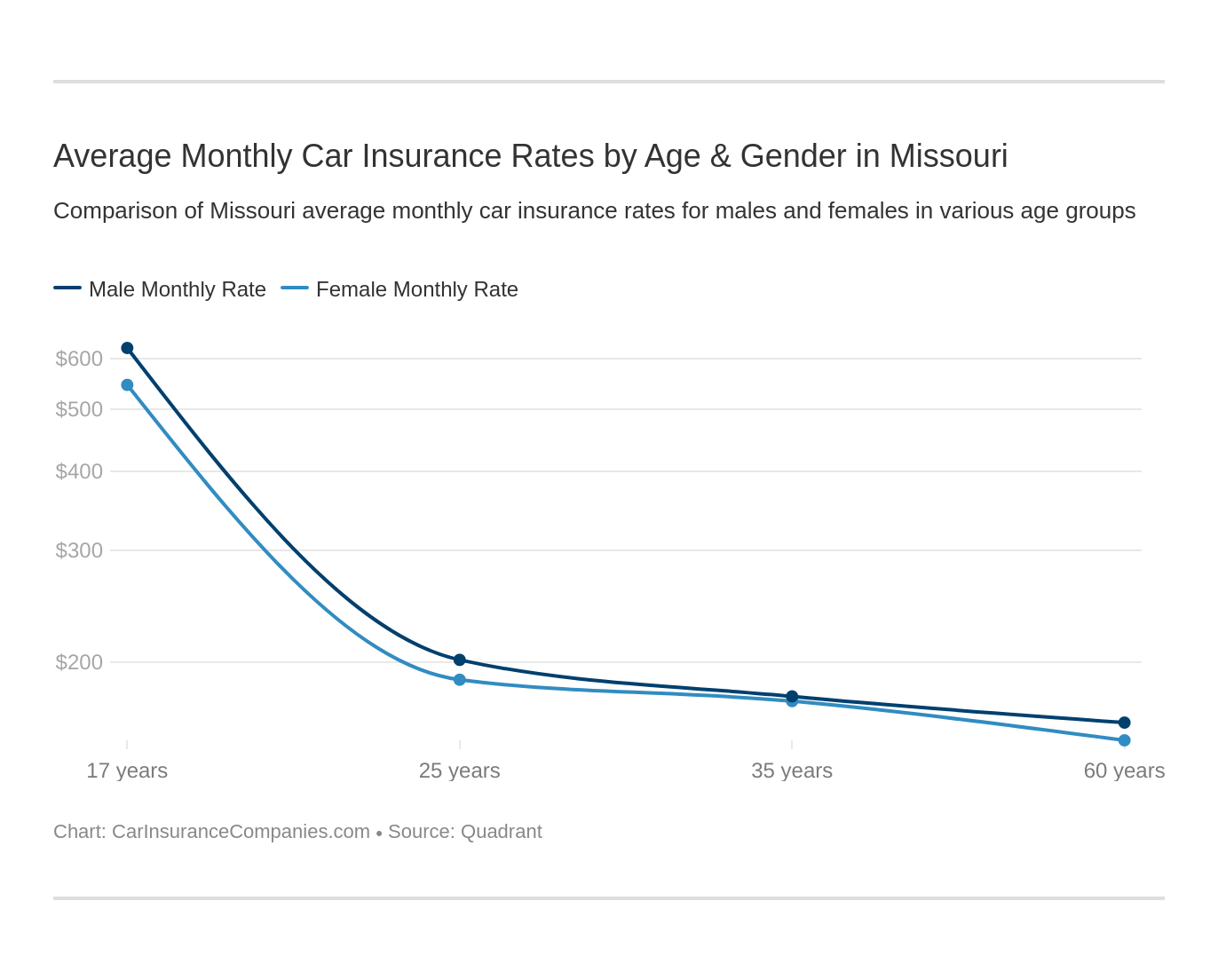

Missouri Car Insurance (Coverage, Companies, & More)

Average Car Insurance Cost In Missouri Per Month