Turo Insurance Cost For Renters

Thursday, July 31, 2025

Edit

Turo Insurance Cost For Renters

What is Turo Insurance?

Turo is an online car sharing company that allows people to rent their cars to others. Turo provides insurance to renters and car owners, so that in the case of an accident, the renter and the car owner can be protected from any potential financial losses. Turo insurance is designed to cover the cost of damage to the car, as well as the cost of any medical bills resulting from an accident. Turo insurance is also designed to cover the cost of liability if the renter is found to be at fault for an accident.

How Much Does Turo Insurance Cost?

The cost of Turo insurance can vary widely based on the type of coverage that is chosen. The cost of Turo insurance for renters can range from as low as $15 to as much as $50 per day, depending on the type of coverage that is selected. There are several different types of coverage available, including liability coverage, collision coverage, and comprehensive coverage. Depending on the type of coverage that is chosen, the cost of the Turo insurance for renters can fluctuate.

What Does Turo Insurance Cover?

Turo insurance covers the cost of damage to the car, as well as the cost of any medical bills resulting from an accident. Turo insurance also provides liability coverage if the renter is found to be at fault for an accident. Additionally, Turo insurance will cover the cost of repairs to the car, as well as the cost of a rental car if the original car is not able to be driven due to the accident.

What is Not Covered by Turo Insurance?

Turo insurance does not cover the cost of personal items that may have been damaged in the accident, nor does it cover the cost of any damage to the car that is caused by wear and tear. Additionally, Turo insurance does not cover the cost of any damage to the car that is caused by the renter’s negligence, such as driving recklessly or failing to follow the laws of the road.

Is Turo Insurance Worth The Cost?

Turo insurance can be a wise investment for renters, as it provides protection from potential financial losses in the event of an accident. While the cost of Turo insurance for renters can vary, it is typically a relatively small cost in comparison to the potential costs that can occur in the event of an accident. Turo insurance is an important part of ensuring that renters are protected in the event of an accident, and it is important to consider the cost of Turo insurance when renting a car.

Conclusion

Turo insurance can be a wise investment for renters, as it provides protection from potential financial losses in the event of an accident. The cost of Turo insurance for renters can vary widely depending on the type of coverage that is chosen, but it is typically a relatively small cost in comparison to the potential costs that can occur in the event of an accident. Turo insurance is an important part of ensuring that renters are protected in the event of an accident, and it is important to consider the cost of Turo insurance when renting a car.

Turo, the 'Airbnb for cars,' could upend the car-rental industry

Pros and Cons of Turo Car Rental for Travellers – Sling Adventures

Is Renting a Car on Turo a Good Deal? My Experience & Review

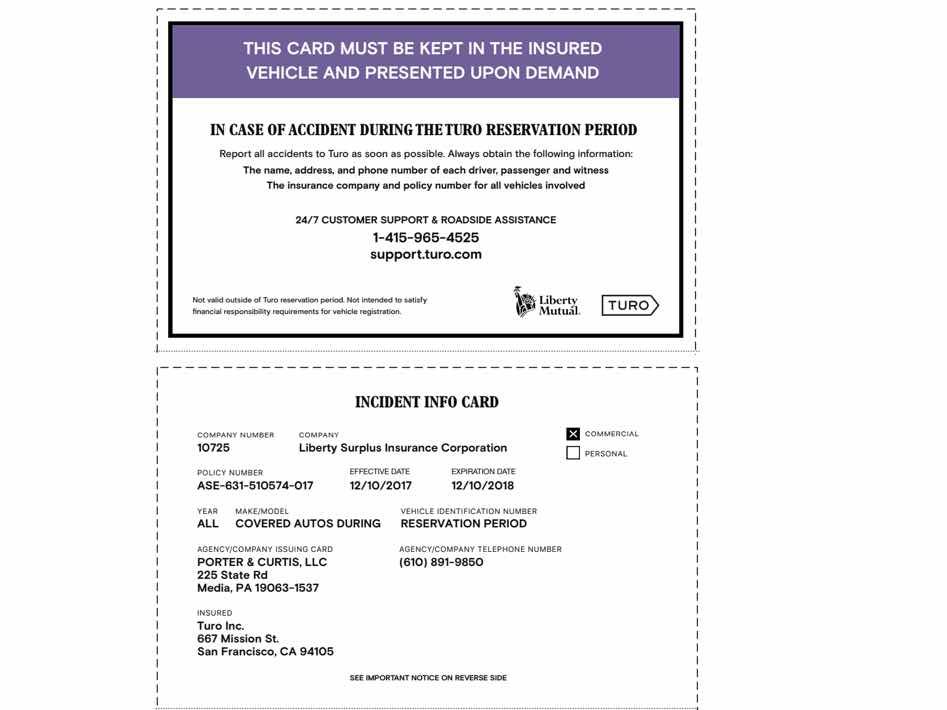

Turo insurance card - insurance

Turo Insurance: How Coverage Works for Renters and Hosts | Ridester.com