State Minimum Car Insurance Michigan

Saturday, July 26, 2025

Edit

State Minimum Car Insurance Michigan

What is State Minimum Car Insurance in Michigan?

The state of Michigan requires all drivers to possess car insurance and the minimum requirements for coverage are known as the State Minimum Car Insurance. Under the Michigan No-Fault Law, motorists are required to carry the following types of coverage: personal injury protection (PIP), property protection insurance (PPI), and residual liability insurance (RLI). The purpose of the State Minimum Car Insurance is to provide protection for individuals who are injured in an auto accident.

Personal Injury Protection (PIP)

Personal Injury Protection (PIP) coverage is the most important type of coverage that you must have in order to comply with the Michigan No-Fault Law. PIP is designed to provide coverage for medical expenses that you may incur due to an auto accident. The minimum coverage required is $50,000 per person and $100,000 per accident. PIP coverage also includes benefits for lost wages, replacement services, and funeral expenses.

Property Protection Insurance (PPI)

Property Protection Insurance (PPI) coverage is the second type of coverage required under the Michigan No-Fault Law. PPI is designed to provide coverage for damage to another person's property, such as their vehicle, if you are found to be at fault in an accident. The minimum coverage required is $1,000,000 per accident.

Residual Liability Insurance (RLI)

Residual Liability Insurance (RLI) coverage is the third type of coverage required under the Michigan No-Fault Law. RLI is designed to provide coverage for bodily injury or property damage to another person that you may be found to be at fault for. The minimum coverage required is $20,000 per person and $40,000 per accident.

Penalties for Not Having Insurance

If you are found to be in violation of the Michigan No-Fault Law by not having the required State Minimum Car Insurance, you may face fines, jail time, and other penalties. Additionally, your license may be suspended and you may have to pay a restoration fee to get it back. It's important to understand the State Minimum Car Insurance requirements in order to avoid any potential penalties.

Conclusion

The State of Michigan requires all motorists to carry the minimum State Minimum Car Insurance in order to comply with the Michigan No-Fault Law. The types of coverage required are PIP, PPI, and RLI. It's important to be aware of the requirements and penalties for not having the required coverage in order to avoid any potential problems.

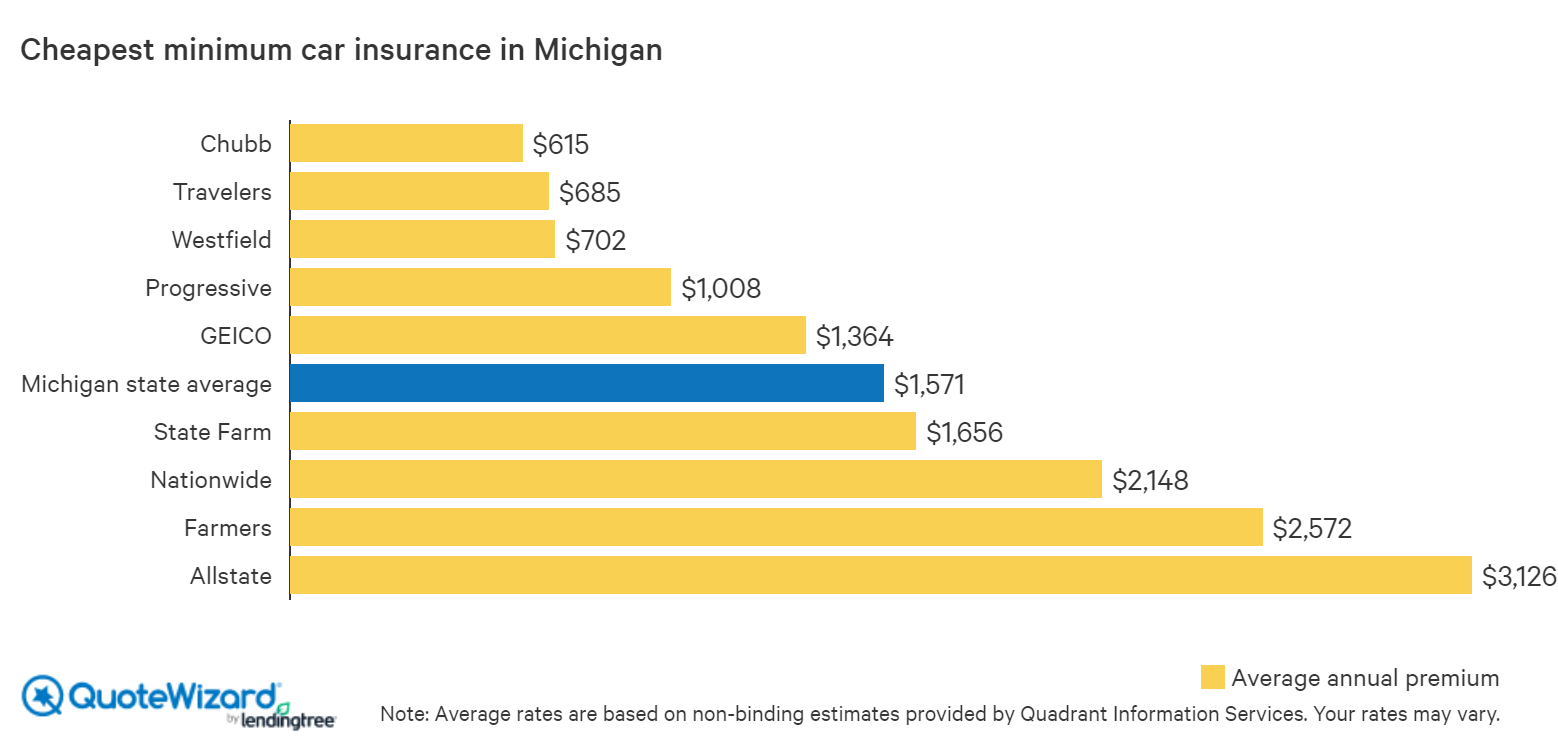

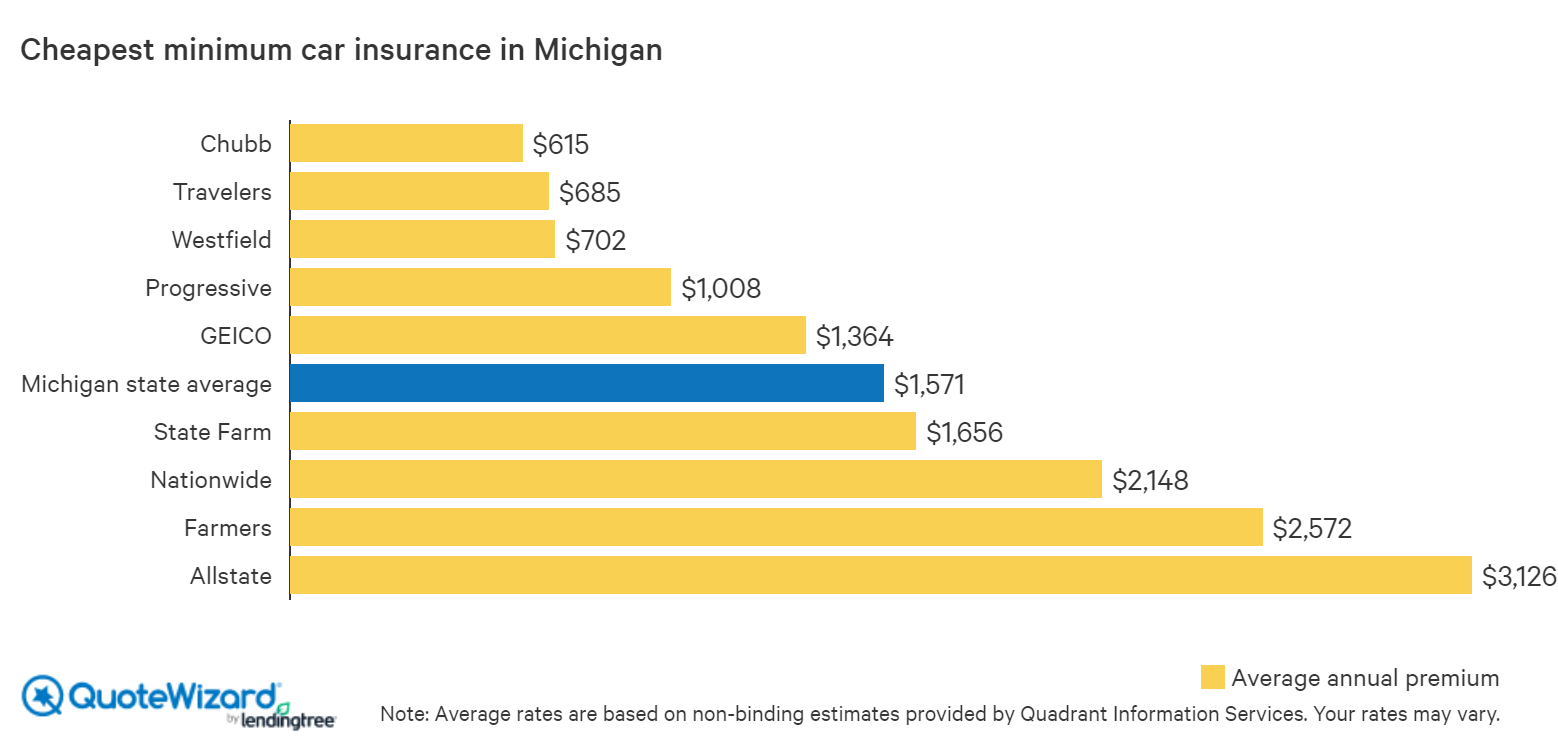

Cheapest Car Insurance in Michigan | QuoteWizard

Best Car Insurance Rates In Michigan - worlddesignjobs

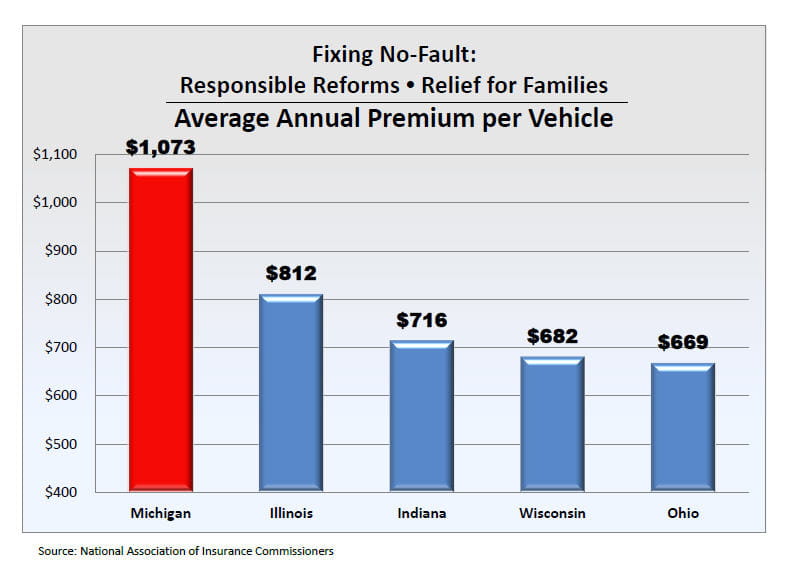

Car Insurance Michigan - Michigan Lawmakers Try To Tackle Car Insurance

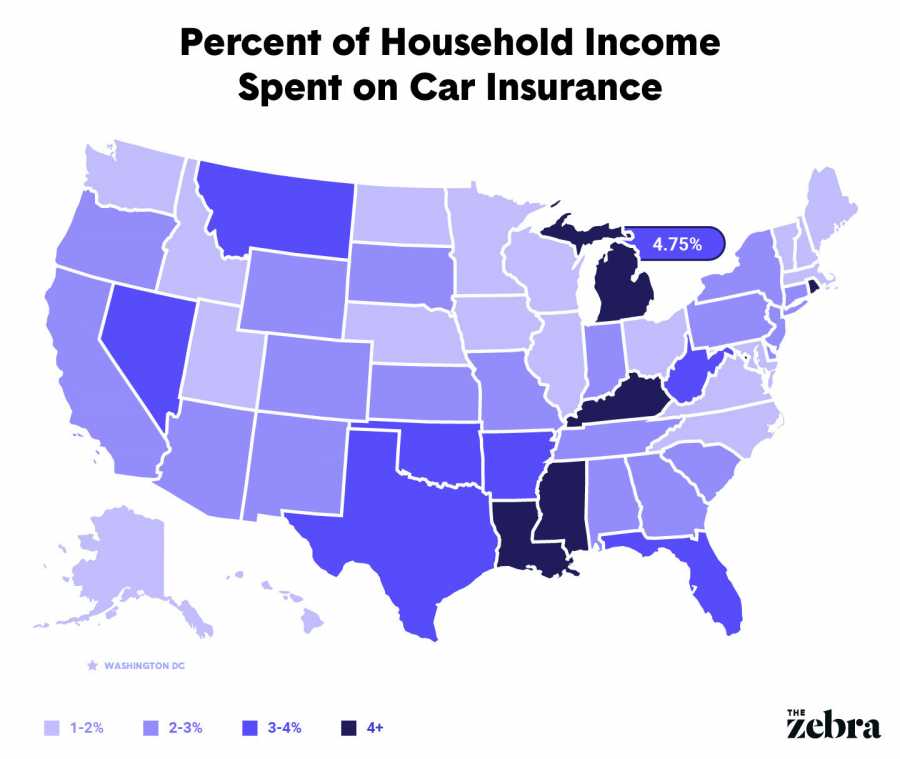

Average Car Insurance In Michigan / Michigan Auto Insurance (Cheap

Why State Minimum Liability Auto Insurance Coverage Sucks! - YouTube