Renters Insurance Cover Theft From Car

What is Renters Insurance Cover Theft From Car?

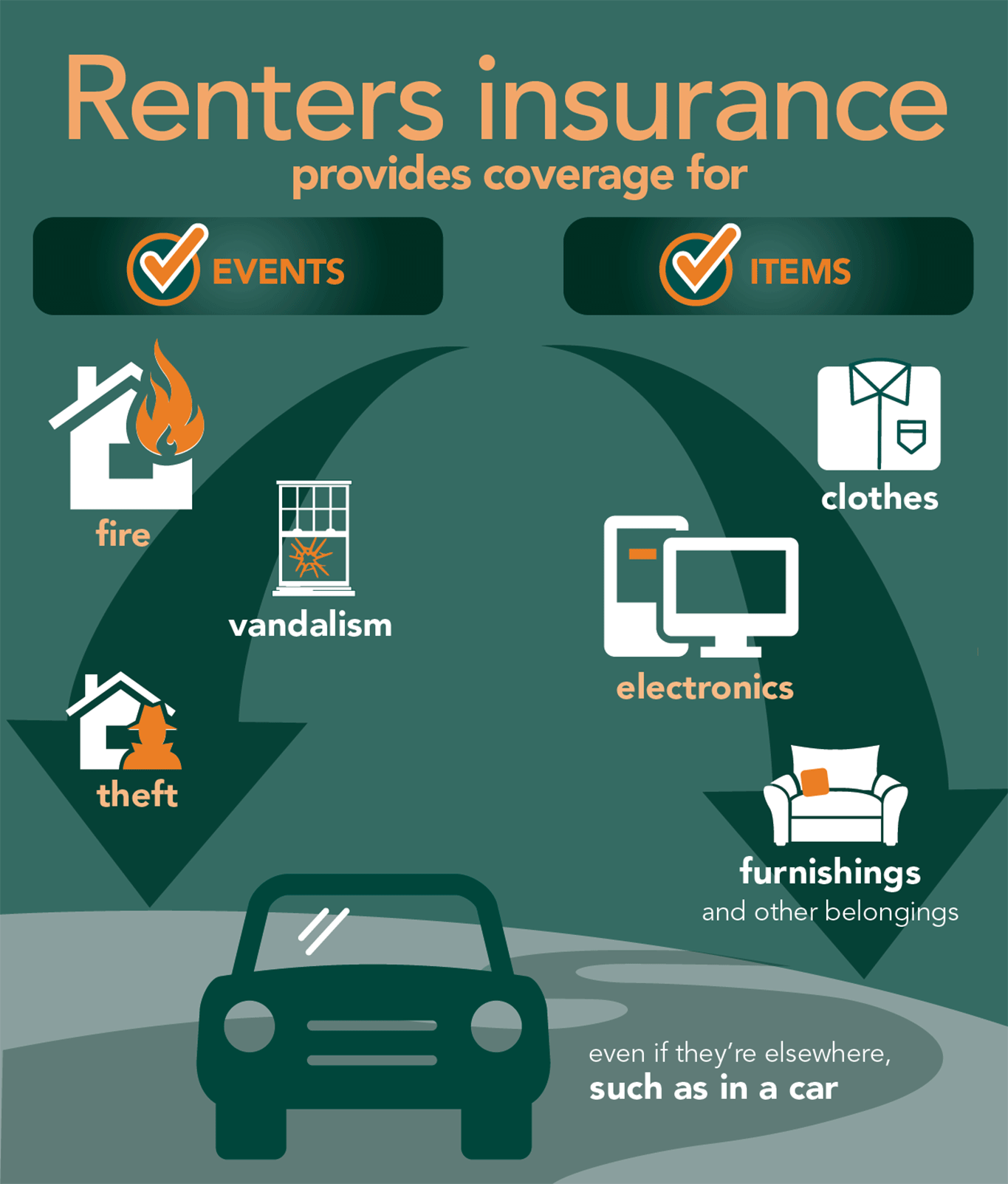

Renters insurance is a specialized form of insurance that is designed to protect tenants from damage to their belongings and personal property. The insurance covers theft from a car, as well as other damages that may occur while the tenant is living in the rental unit. The policy also covers liability for any injuries that may occur on the premises. Renters insurance can provide peace of mind for tenants, as it can protect them from unexpected events and financial losses.

Why Do You Need Renters Insurance Cover Theft From Car?

Renters insurance is important for anyone who is renting a home, apartment, or other dwelling. Renters insurance can provide coverage for a variety of losses, including theft from a car. In the event of a theft, this coverage can help the tenant to replace their belongings and recover some of the financial losses that may have been incurred. Renters insurance can also provide coverage for other damages that may occur while the tenant is living in the rental unit, such as fire or water damage.

What Does Renters Insurance Cover Theft From Car?

Renters insurance covers theft from a car, as well as other damages that may occur while the tenant is living in the rental unit. The policy will provide coverage for the cost of replacing any stolen items, as well as for any medical bills that may be incurred as a result of the theft. Additionally, renters insurance can provide coverage for any liability that may arise as a result of the theft, such as if the tenant is sued for negligence. Renters insurance can also provide coverage for any damage to the rental unit itself, such as from a fire.

How Much Does Renters Insurance Cover Theft From Car?

The amount of coverage provided by renters insurance for theft from a car varies depending on the policy. Generally, the amount of coverage will be determined by the value of the items that are stolen. The policy may also provide coverage for any medical bills that may result from the theft. Additionally, the policy may provide coverage for any liability that may arise as a result of the theft, such as if the tenant is sued for negligence.

What Should I Do If My Car Is Stolen?

If your car is stolen, the first thing you should do is contact the police to report the theft. Next, you should contact your renters insurance provider to file a claim. You will need to provide documentation of the theft and the value of the items that were stolen. Once the claim is approved, your renters insurance provider will reimburse you for the cost of replacing the items that were stolen, as well as any related medical bills.

Conclusion

Renters insurance can provide peace of mind for tenants, as it can help protect them from unexpected events and financial losses. Renters insurance covers theft from a car, as well as other damages that may occur while the tenant is living in the rental unit. The amount of coverage provided for theft from a car varies depending on the policy, and can provide coverage for the cost of replacing any stolen items, as well as for any medical bills that may be incurred as a result of the theft. If your car is stolen, you should contact the police and your renters insurance provider to file a claim.

Does Renters Insurance Cover Theft From Car - Insurance Reference

Does Renters Insurance Cover Theft? | Protective Agency

Renting in America | Amica

Renters Insurance and Car Theft: Everything You Need To Know

What Does Renter's Insurance Cover in a Fire? | SERVPRO of Summit, Lake