Rac Home And Contents Insurance Claim

RAC Home and Contents Insurance Claim – What You Need To Know

When it comes to protecting your home and the contents within, having the right insurance is essential. RAC Home and Contents Insurance offers homeowners a comprehensive range of benefits, including the ability to make a claim when the unexpected happens. But what do you need to know about making a RAC Home and Contents Insurance claim?

What Is Covered?

RAC Home and Contents Insurance provides cover for a range of risks, including damage caused by storms and floods, theft and malicious damage, and even damage or loss caused by vermin. The policy also provides cover for personal property and additional living expenses should you need to move out of your property while repairs are carried out. The policy also includes public liability cover in the event of a third-party injury or damage to their property.

How To Make A Claim

If you need to make a claim, the process is simple and straightforward. First, you’ll need to contact RAC Home and Contents Insurance to report the claim. You will be asked to provide details about the incident, such as when and where it occurred and who was involved. You will also need to provide details of any witnesses, photographs of the incident, and any other evidence that will help support your claim.

What Happens Next?

Once your claim is reported, RAC Home and Contents Insurance will arrange for an assessor to inspect the damage and determine the most appropriate course of action. The assessor will provide you with an estimate of the cost to repair or replace the damaged items. Depending on the severity of the damage, they may also recommend additional measures, such as structural repairs or additional security measures. Once the assessment is complete, the insurer will determine whether or not your claim is valid.

Repairs And Replacement

If your claim is approved, RAC Home and Contents Insurance will arrange for the necessary repairs or replacements to be carried out. Depending on the severity of the damage, the insurer may arrange for the repairs to be carried out by a third-party contractor or may ask you to organise the repairs yourself. If you choose to organise the repairs yourself, the insurer will reimburse you for the cost of the repairs.

Conclusion

Making a claim on your RAC Home and Contents Insurance policy is a relatively simple process, providing you with peace of mind that your home and belongings are protected. The insurer will assess the damage and arrange for the necessary repairs or replacements to be carried out, ensuring that you can get your home and contents back to their former glory as quickly as possible.

RAC WA Home & Contents Insurance | ProductReview.com.au

Buying a House, Property or Land? Find Tips, Advice & Guides

Home Contents Insurance: Raa Home Contents Insurance

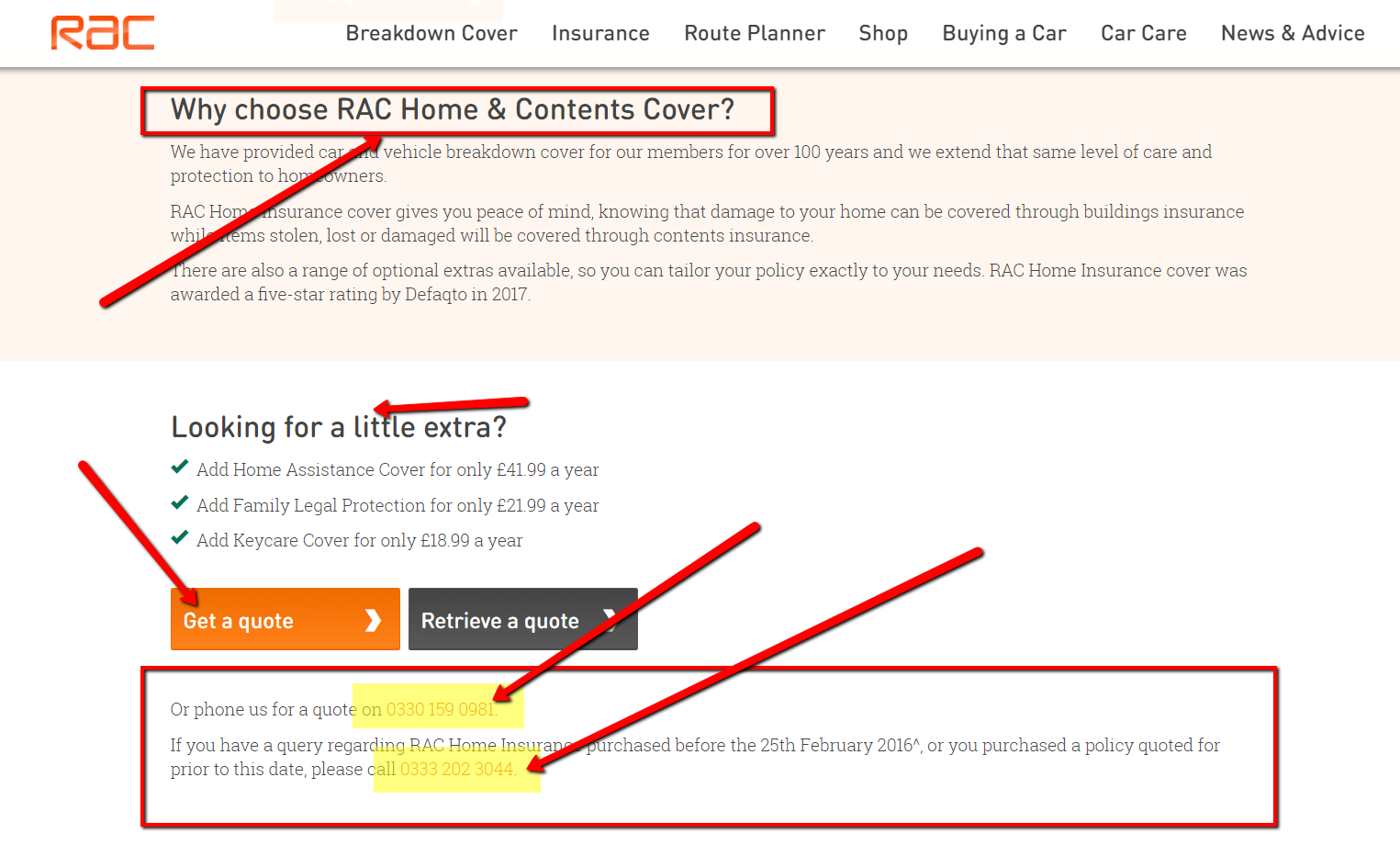

RAC Home Insurance - UK Contact Numbers

RAC Home Insurance [Review] 2019 - Compare Best UK Home Insurers

![Rac Home And Contents Insurance Claim RAC Home Insurance [Review] 2019 - Compare Best UK Home Insurers](https://media.drewberry.co.uk/RAC-Insurance-Logo.jpg)