No Fault Car Insurance States

No Fault Car Insurance States: A Comprehensive Guide

What is No Fault Car Insurance?

No fault car insurance is a type of insurance system in which drivers are compensated by their own insurance company for losses due to an accident, regardless of who is at fault. This type of insurance is designed to reduce the amount of paperwork and stress associated with filing a claim. It also helps keep insurance premiums lower, since the insurance companies don't have to fight over who is to blame. No fault car insurance is offered in certain states and is not available in all states, so it's important to understand the differences between no fault and traditional car insurance.

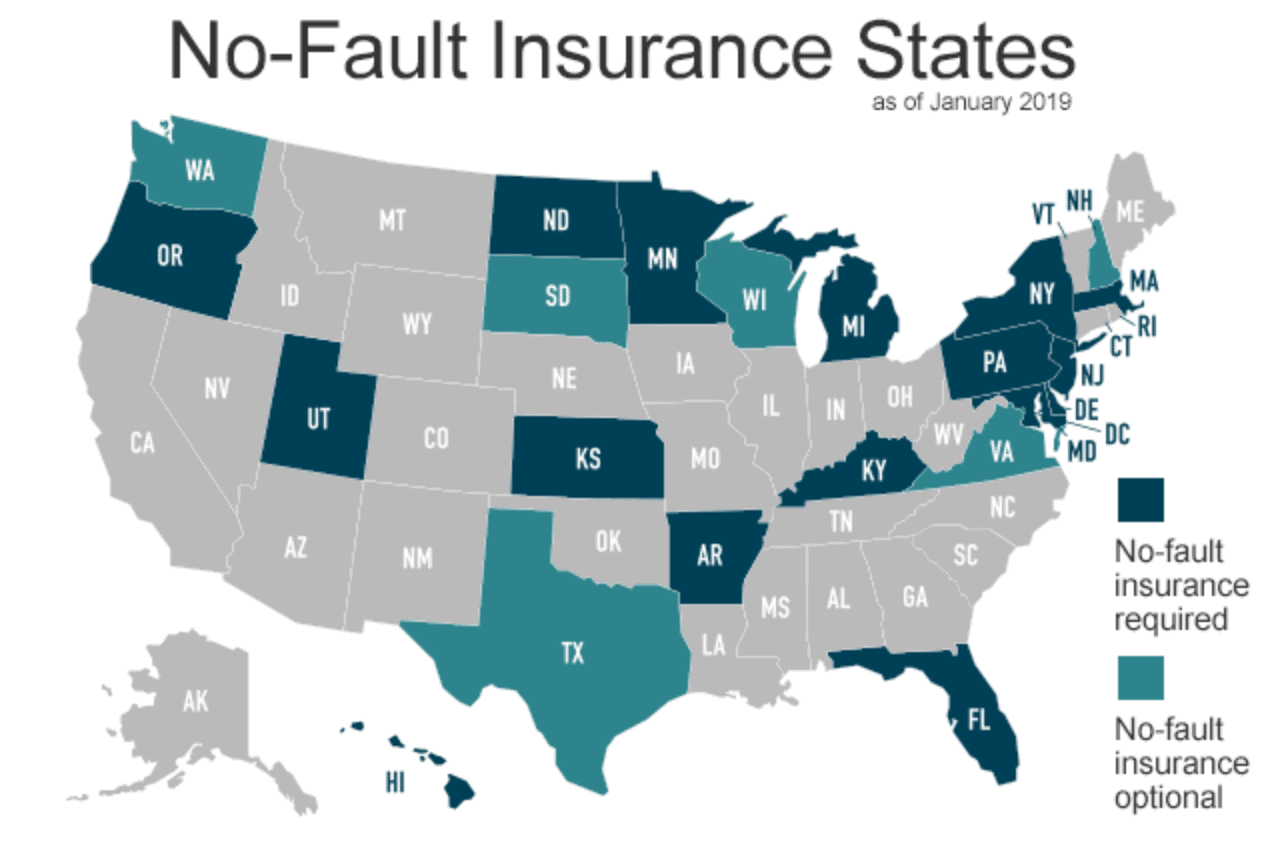

No Fault Car Insurance States

Currently, there are 12 states that offer no fault car insurance. These states include Florida, Hawaii, Kansas, Kentucky, Massachusetts, Michigan, Minnesota, New Jersey, New York, North Dakota, Pennsylvania, and Utah. Each of these states has its own rules and regulations regarding no fault car insurance. For example, some states require drivers to carry certain levels of no fault coverage, while others may require drivers to carry additional coverage if they are involved in an accident.

Benefits of No Fault Car Insurance

One of the main benefits of no fault car insurance is that it can help keep insurance premiums lower. Since the insurance companies don't have to fight over who is to blame for an accident, they can focus on providing the best coverage to their customers at the most affordable price. Additionally, no fault car insurance can help reduce the amount of paperwork and stress associated with filing a claim. Instead of having to prove who is at fault, the insurance companies can quickly process the claim and provide compensation.

Disadvantages of No Fault Car Insurance

There are a few disadvantages to no fault car insurance. For example, if you are involved in an accident in a state with no fault insurance, you may not be able to sue the other driver for damages. This means that if you are injured in the accident, you may not be able to receive compensation for your medical bills or other losses. Additionally, some states with no fault car insurance may require drivers to carry a certain level of coverage, which can be more expensive than traditional car insurance.

Conclusion

No fault car insurance is a type of insurance system that is offered in certain states. It can help keep insurance premiums lower and reduce the amount of paperwork and stress associated with filing a claim. However, there are a few drawbacks to this type of insurance, such as the inability to sue the other driver for damages and the requirement to carry a certain level of coverage. It's important to understand the differences between no fault and traditional car insurance before selecting a policy.

Ultimate Guide to No-Fault Auto Insurance

Out of State Visitors Hurt in Car Accidents in Florida (Settlements)

Did Your Car Accident Happen in a No-Fault State? - Dailey Law Firm

States With No-Fault Auto Insurance | Reviews.com - Infogram

Reduced No Fault Explained | Harvard Western Insurance