Name Non Owner Policy Georgia

What is a Non-Owner Policy in Georgia?

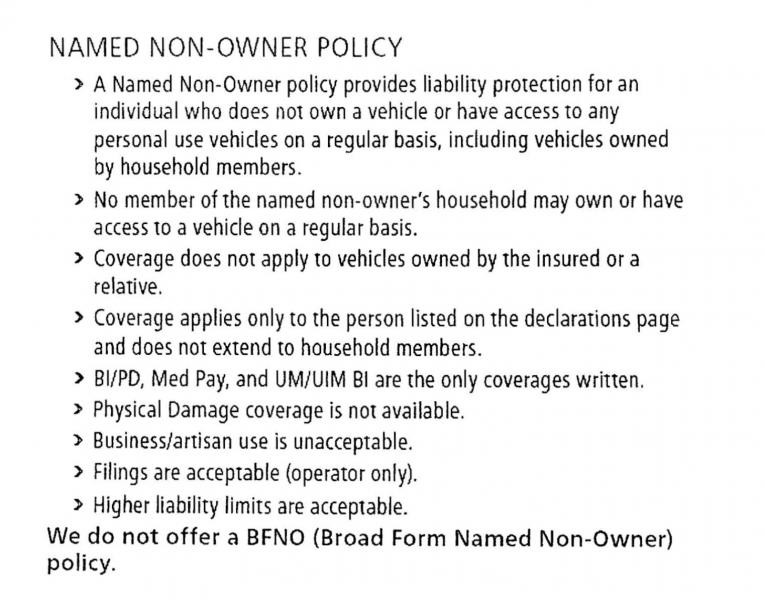

A non-owner policy, also known as a non-owner's liability insurance policy, is a type of auto insurance coverage that provides liability coverage for individuals who do not own a car. In other words, it covers individuals who don’t own a vehicle, but still drive someone else’s car. This type of policy is especially useful for people who rent vehicles or borrow cars on a frequent basis. Non-owner policies are becoming increasingly popular in Georgia, as they offer a low-cost way of protecting yourself against any potential legal problems that may arise from an accident.

What Does a Non-Owner Policy Cover?

As with any other type of auto insurance, non-owner policies provide coverage for any damages or injuries that you may cause in an accident. This includes both property damage and bodily injury. If you are found to be at-fault for an accident, the non-owner policy will provide coverage for the costs associated with the other driver’s medical bills, vehicle repairs, and other costs. In addition, a non-owner policy can also provide coverage for any passengers in the vehicle that you are driving, as well as any pedestrians involved in the accident.

What Doesn't a Non-Owner Policy Cover?

Non-owner policies are limited in what they cover. They do not provide any coverage for the vehicle you are driving, which means they are unable to cover any damage that may be caused to the vehicle, as well as any theft or vandalism. In addition, non-owner policies do not provide coverage for any medical bills or other costs you may have as a result of an accident. They also do not provide coverage for any damages that you may have caused to another vehicle or property.

Do I Need a Non-Owner Policy in Georgia?

Whether or not you need a non-owner policy in Georgia depends on your individual situation. If you are someone who borrows or rents vehicles on a regular basis, a non-owner policy can be a good way to protect yourself in the event of an accident. However, if you are someone who only drives a vehicle occasionally, a non-owner policy might not be necessary. In addition, if you have a personal auto insurance policy, your coverage may extend to any vehicles you are driving, so a non-owner policy may not be needed.

How Much Does a Non-Owner Policy Cost in Georgia?

The cost of a non-owner policy in Georgia will vary depending on a variety of factors, such as your driving record, the type of coverage you are looking for, and the amount of coverage you need. Generally speaking, non-owner policies in Georgia tend to be less expensive than traditional auto insurance policies, as they do not provide coverage for the vehicle itself. The best way to find out how much a non-owner policy will cost in Georgia is to contact an insurance agent and get a quote.

Conclusion

A non-owner policy in Georgia can be a great option for those who don’t own a vehicle, but still need to drive one on occasion. Non-owner policies provide liability coverage, which will cover any damages or injuries that you may cause in an accident. However, they do not provide coverage for the vehicle itself. The cost of a non-owner policy in Georgia will depend on your individual situation, so it’s best to contact an insurance agent to get an accurate quote.

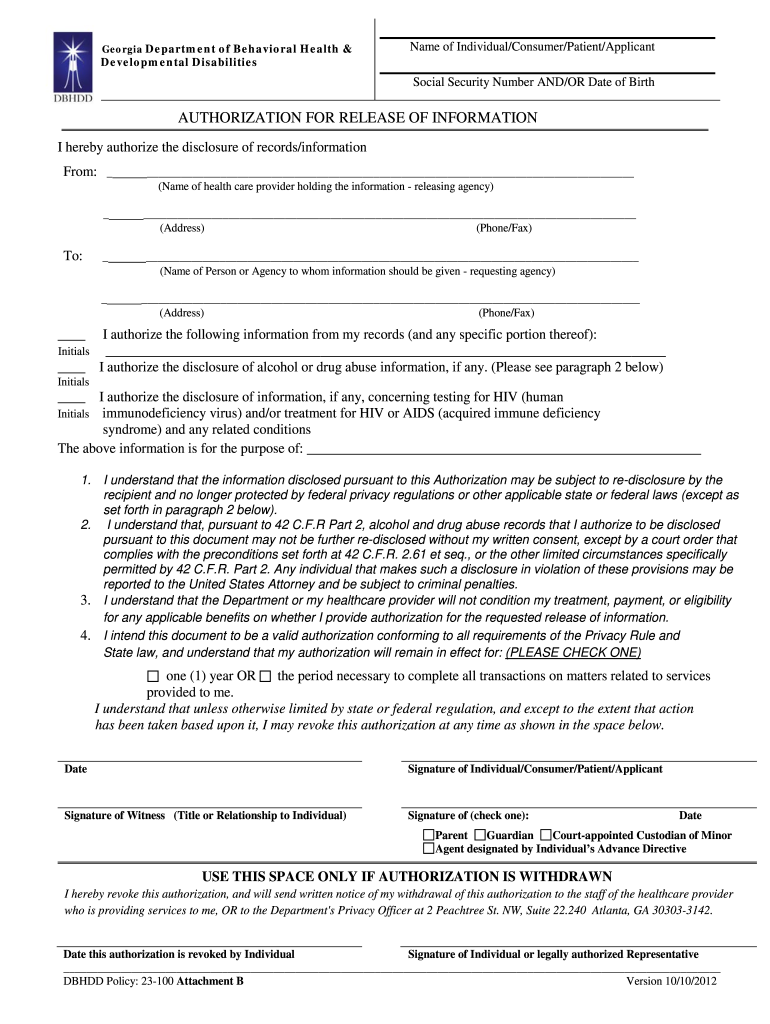

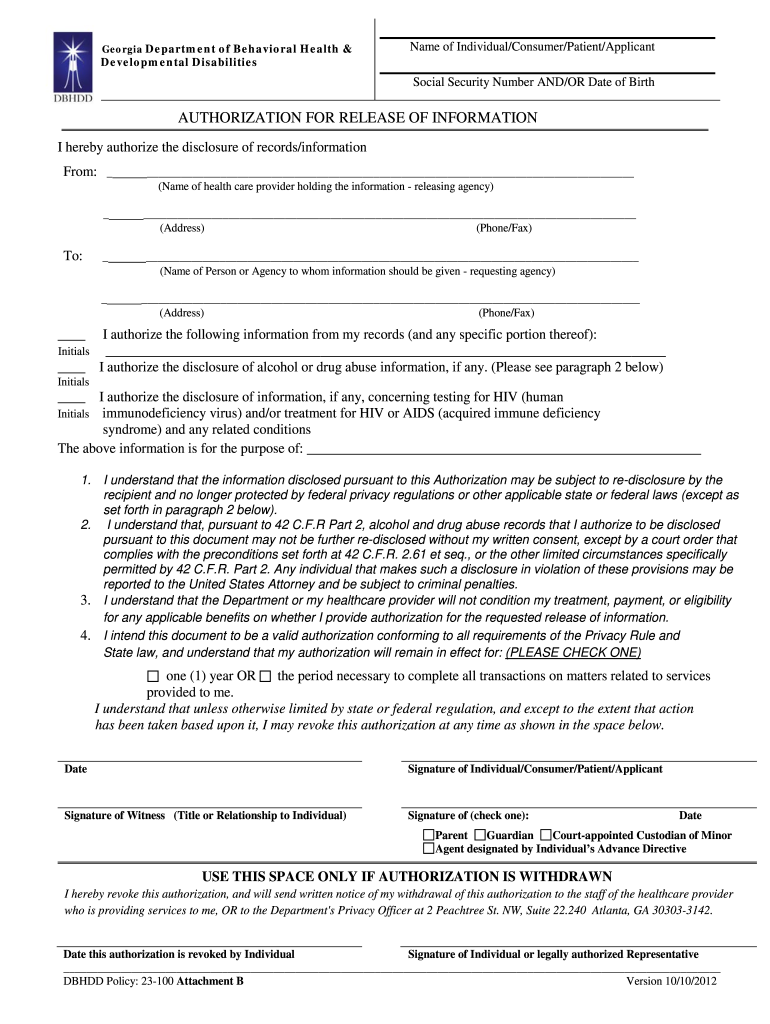

GA DBHDD Policy 23-100 2012-2022 - Fill and Sign Printable Template

[Get 28+] Sample Letter From Landlord To Tenant For Nonpayment Of Rent

![Name Non Owner Policy Georgia [Get 28+] Sample Letter From Landlord To Tenant For Nonpayment Of Rent](https://eforms.com/images/2016/01/georgia-immediate-notice-to-quit-nonpayment-of-rent.png)

Fill - Free fillable Georgia.gov PDF forms

Fascination About Cost Of Non-owner Sr-22 Insurance - Valuepenguin

Non Owner Auto Insurance | Compare quotes wih Good to Go