Kemper Senior Solutions Home Health Care Insurance Plan

Kemper Senior Solutions Home Health Care Insurance Plan

Introduction

Kemper Senior Solutions provides Home Health Care Insurance Plans that are tailored to meet the individual needs of seniors. The plans provide coverage for medical expenses for long-term care, home care, and medical equipment. The plans are designed to help seniors maintain their independence and live comfortably in their own homes. The plans are available to those who are 65 years or older, and those who are disabled or have a chronic illness.

Benefits of Kemper Senior Solutions Home Health Care Insurance Plans

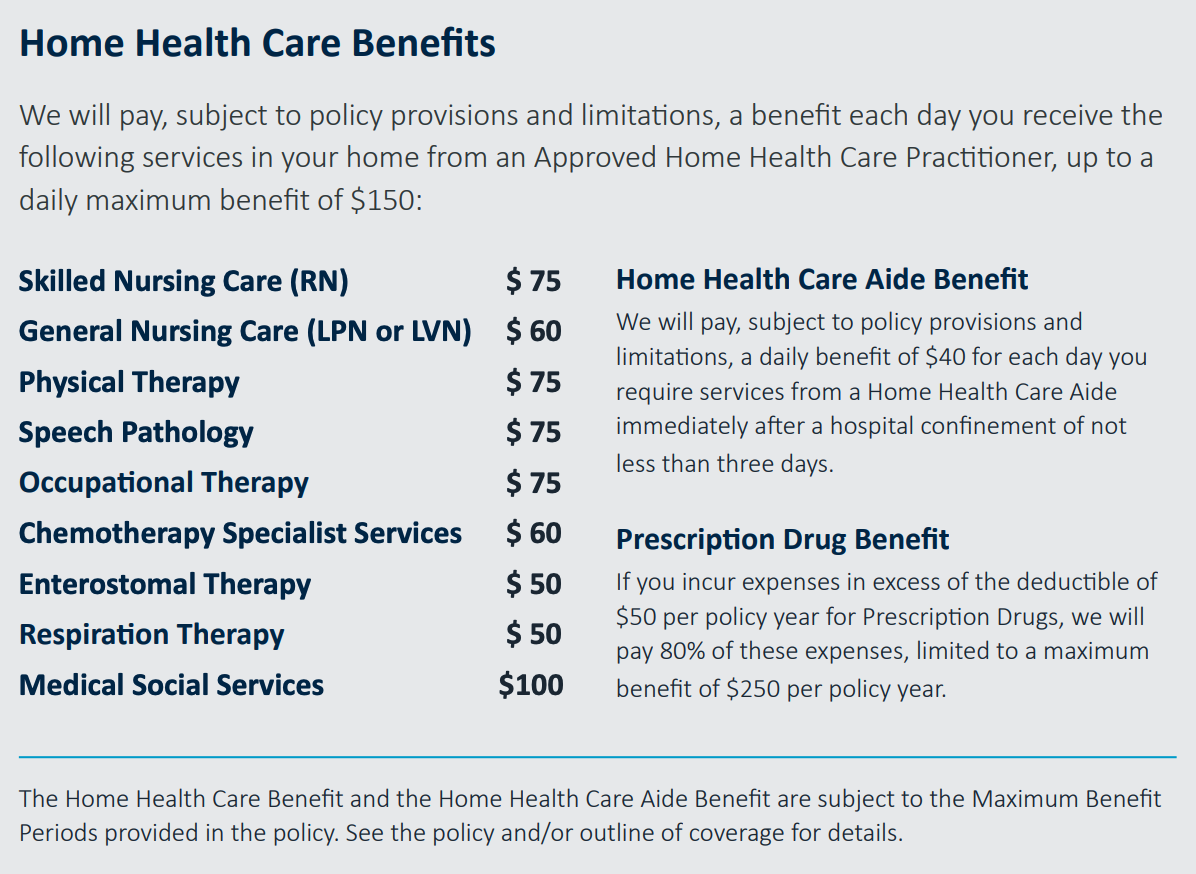

Kemper Senior Solutions Home Health Care Insurance Plans provide coverage for a variety of medical expenses related to long-term care, home care, and medical equipment. The plans cover costs associated with nursing home care, home health aides, and prescription drugs. The plans also provide coverage for durable medical equipment such as wheelchairs, walkers, and crutches. Additionally, the plans cover services such as physical and occupational therapy, mental health services, and home health aides. The plans are designed to help seniors maintain their independence and stay in their own home.

Types of Plans

Kemper Senior Solutions offers a variety of plans for seniors. The plans are designed to meet the individual needs of each senior. The plans are available in different levels of coverage and can be customized to meet the needs of each individual. The plans include Medicare Supplement Plans, Medicare Advantage Plans, and Long-Term Care Insurance Plans. Additionally, Kemper Senior Solutions offers a variety of discounts and incentives for seniors who purchase their plans.

Eligibility

Kemper Senior Solutions Home Health Care Insurance Plans are available to those who are 65 years or older, and those who are disabled or have a chronic illness. In order to be eligible, seniors must meet certain criteria, such as having a valid Social Security number and being enrolled in Medicare Part B. Additionally, seniors must be enrolled in a Medicare-approved health plan and be able to provide proof of residence.

Cost and Coverage

Kemper Senior Solutions Home Health Care Insurance Plans are available at a variety of prices and levels of coverage. The plans are customized to meet the individual needs of each senior. The plans typically include a deductible, coinsurance, and copayments. The amount of coverage and the cost of the plan will depend on the type of plan chosen and the individual needs of the senior.

Conclusion

Kemper Senior Solutions Home Health Care Insurance Plans are designed to meet the individual needs of seniors. The plans provide coverage for medical expenses related to long-term care, home care, and medical equipment. The plans are available to those who are 65 years or older, and those who are disabled or have a chronic illness. The plans are customized to meet the individual needs of each senior and are available at a variety of prices and levels of coverage.

N&F - Kemper Senior Solutions Home Health Care Plan - YouTube

WinCorp Marketing - Kemper Senior Solutions

Short Term Home Health Care Insurance - Using Financial Therapy to Deal

Free social work case management software - worldoftop

A Home Health Care insurance plan is an affordable solution that gives