How To Estimate Auto Insurance

How to Estimate Auto Insurance

What is Auto Insurance?

Auto insurance is a type of insurance policy that covers financial losses that may occur due to an accident or theft of a vehicle. It can also provide protection against liability that may be incurred in an accident. Without auto insurance, you may be responsible for paying for any damages that are caused to another person or property in an accident. Auto insurance is a legal requirement in most states and it is important that you have the proper coverage to protect yourself and your finances.

Why Estimate Auto Insurance?

Estimating auto insurance premiums is the first step in understanding how much your policy will cost. By estimating the cost of your auto insurance, you can compare different policies and find the best coverage for your budget. It can also help you to budget for the cost of your insurance by understanding the factors that will affect the cost of your policy. Factors such as your driving record, the type of car you own, and the amount of coverage you choose can all have a significant impact on the cost of your insurance.

How to Estimate Auto Insurance?

Estimating auto insurance is not as difficult as it may seem. The first step is to contact your insurance company or an independent insurance broker. They can provide you with an estimate of what your premiums will be based on your current driving record, the type of car you own, and the amount of coverage you choose. It is important to remember that these estimates may not be exact, but they can give you a good idea of the cost of your policy.

Step 1: Gather Information

Before you can start estimating your auto insurance premiums, you will need to gather information about your vehicle, driving record, and the type of coverage you need. The more information you have, the more accurate your estimate will be. This information can include the make, model, and year of your vehicle, the type of coverage you need, the number of miles you drive each year, any traffic violations you have had in the past, and any additional discounts you may qualify for. All of this information will help your insurance company to accurately calculate your premiums.

Step 2: Compare Rates

Once you have gathered all of the necessary information, you can start comparing rates between different insurance companies. You can use online tools to compare rates and policies, or you can contact each insurance company directly. When comparing rates, make sure to read through each policy carefully and understand the coverage provided. It is also important to look for discounts and other special offers that may lower the cost of your premiums.

Step 3: Choose the Right Policy

Once you have compared the rates and policies of different insurance companies, you can choose the right policy for you. Make sure to read through the policy carefully so that you understand the coverage provided and any limitations or restrictions. Once you have chosen the right policy for you, you can purchase the policy and start enjoying the protection that auto insurance provides.

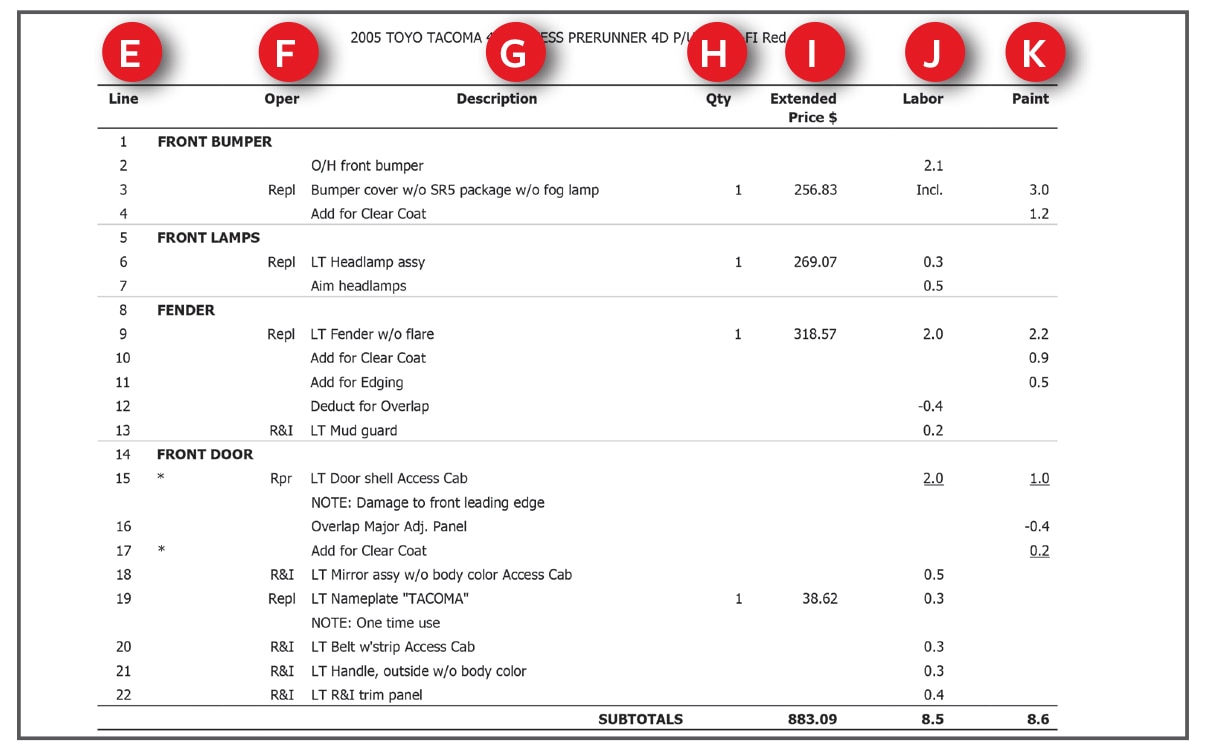

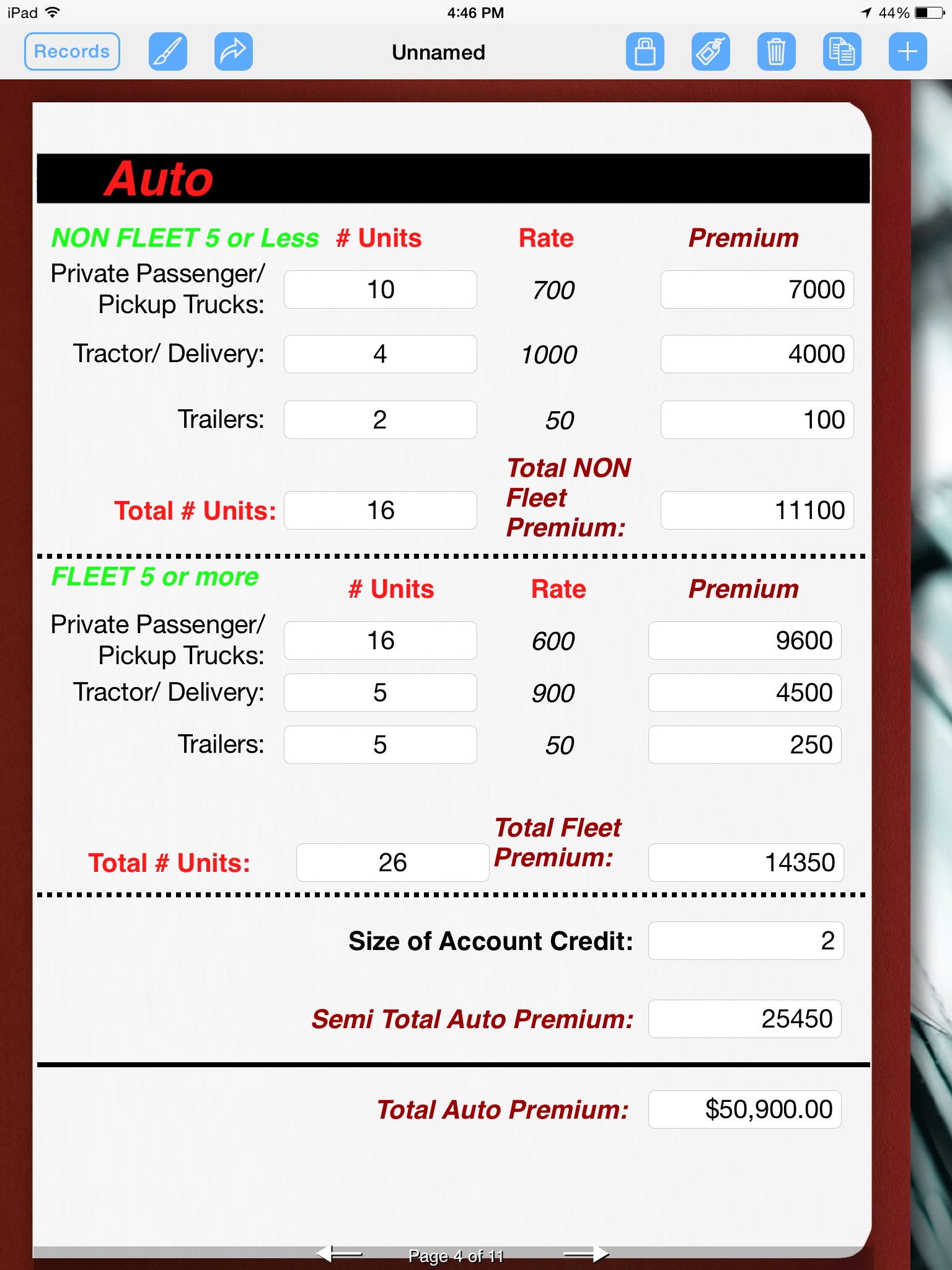

Understanding Auto Estimates | Travelers Insurance

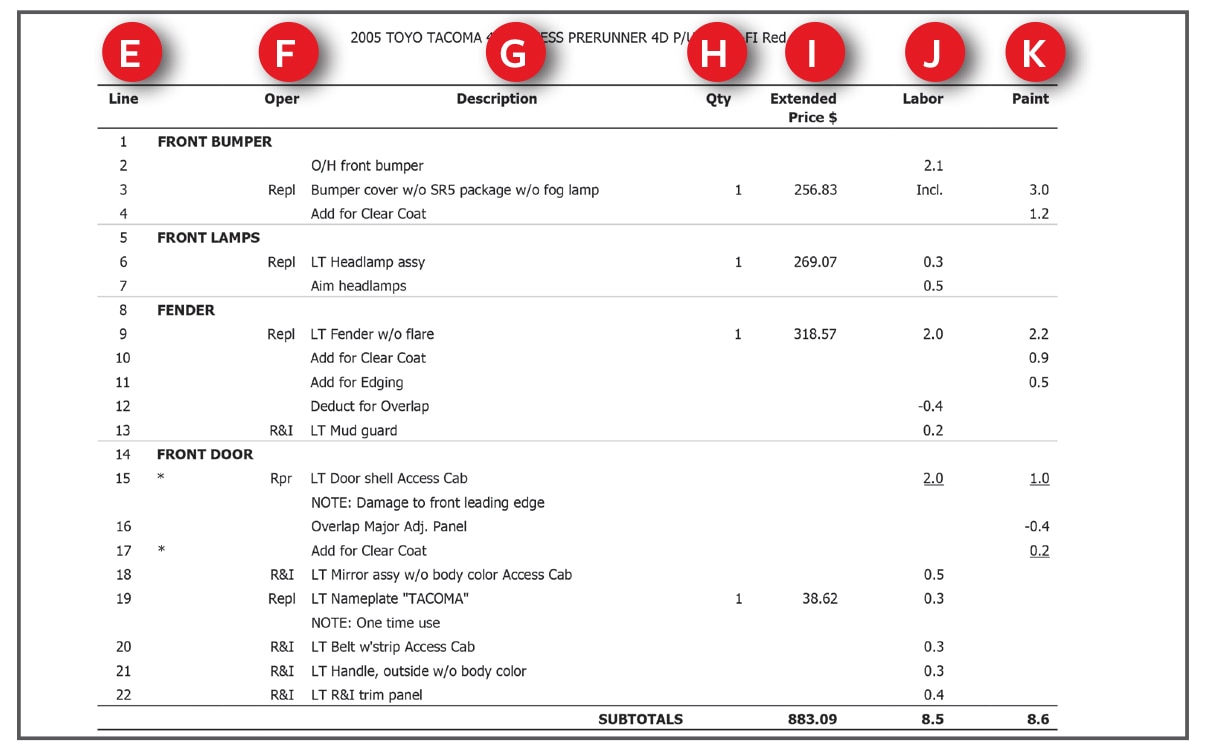

How To Calculate Car Insurance Premium Formula : How Car Insurance

Understanding Auto Estimates | Travelers Insurance

Insurance Estimate For New Car - All Information about Quality Life

Pin by Hurul comiccostum on comiccostum | Auto insurance quotes