How Does Insurance Work With A Leased Car

Sunday, July 6, 2025

Edit

How Does Insurance Work With A Leased Car?

Leasing Basics

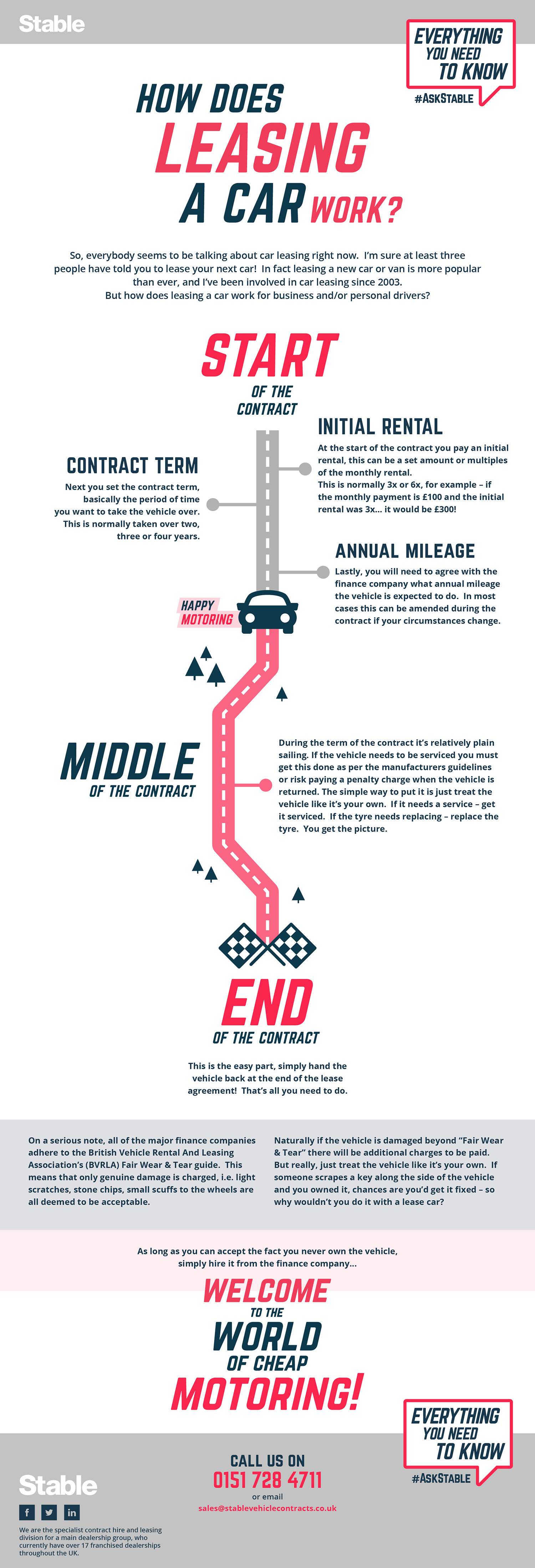

Leasing a car is becoming a more popular option for people who want to get behind the wheel of a new car without having to commit to buying it. When you lease a car, you are essentially renting it from the lender. You will make monthly payments until the lease is up and then you can either turn the car in or buy it from the lender. With a lease, you are required to get insurance to protect the lender’s interest in the car.

Insurance Requirements

When you lease a car, you will be required to carry liability insurance coverage, which protects other people and their property in the event of an accident for which you are at fault. This coverage is required by law in most states. You will also need to carry comprehensive coverage, which is designed to protect you if your car is damaged or stolen. The lender will also require you to carry collision coverage, which pays for damage to your car if you are involved in an accident.

Insurance Costs

The cost of the insurance for your leased car will depend on a number of factors, including the type of car you are leasing, your driving record, and the type and amount of coverage you choose. Generally, however, the cost of insurance for a leased car will be more than it would be for a car you own and insure yourself. This is because the lender will require you to carry more coverage than you might choose to purchase on your own.

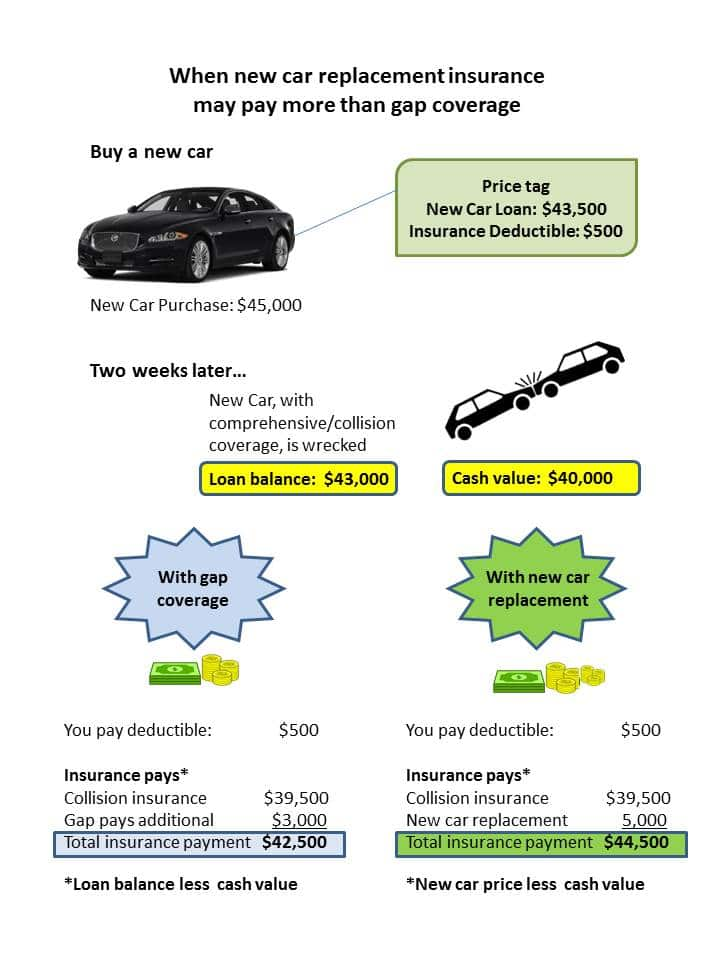

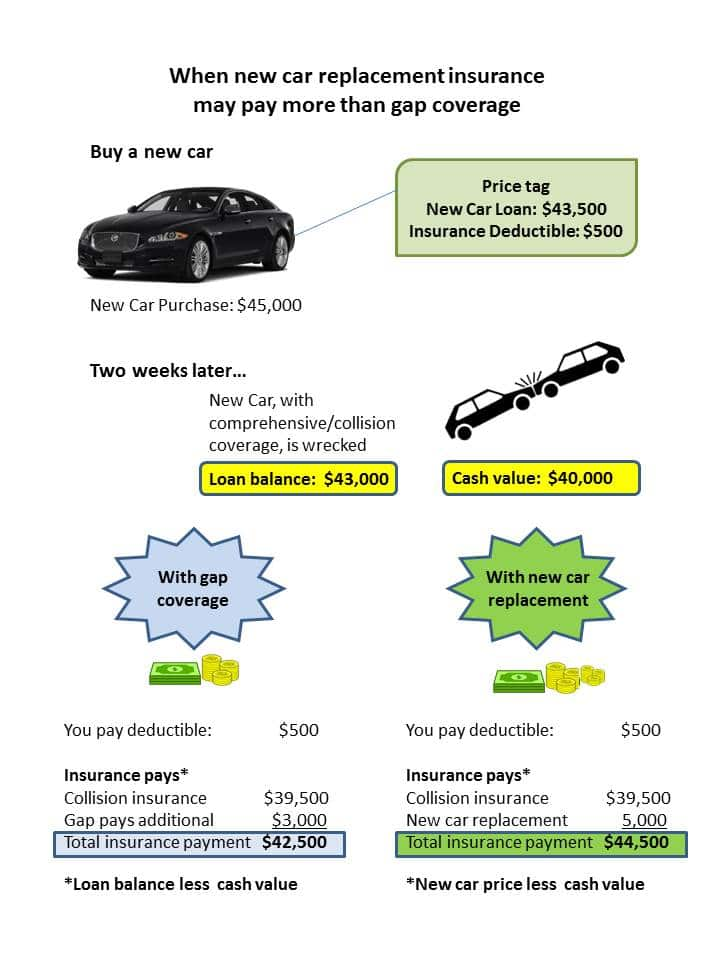

Gap Coverage

When you lease a car, you may also be required to purchase gap coverage. This type of coverage pays the difference between the amount of money you owe on the lease and the actual cash value of the car if it is totaled in an accident. Without this coverage, you could be left with a large bill from the lender if the car is totaled before the lease is up.

Insurance Discounts

When you are shopping for insurance for your leased car, you should ask your insurer about any discounts that may be available. Many insurers offer discounts for customers who purchase multiple policies, for people who have a good driving record, and for cars that have certain safety features. You may also be able to get a discount if you have taken a defensive driving course.

Conclusion

Insuring a leased car is a must. You will need to make sure you are carrying the coverage the lender requires, as well as any additional coverage you feel is necessary. Be sure to shop around and ask about discounts to get the best rate on your insurance. With the right policy, you can be sure that you and your leased car are protected.

Gap Insurance for your New or Leased Cars

Infographic: How does leasing a car work?

Lease a Car vs Buying a Car - Pros and Cons of Leasing and Buying a Car

Auto Liability Insurance - What It Is and How to Buy

Does Leasing Include Insurance : Rental Agreement California - What to