How Do I Get A Traders Car Insurance Policy

Everything You Need to Know About Getting a Traders Car Insurance Policy

What is a Traders Car Insurance Policy?

A traders car insurance policy is a type of motor insurance that is specifically tailored to cover the needs of people who use their vehicle to conduct their business, such as delivery drivers, taxi drivers and other self-employed professionals who use their car to carry out their work. It is designed to provide the same level of protection, but with some additional benefits that can help to protect your business in the event of an accident.

Traders car insurance policies are usually more expensive than standard car insurance policies, as they provide more cover and are designed to protect the business owner in the event of an accident. They may also provide additional benefits such as legal expenses cover and personal accident cover.

What Does a Traders Car Insurance Policy Cover?

A traders car insurance policy typically covers the same as a standard motor insurance policy, but with some additional benefits. These can include cover for the business use of the vehicle, cover for any goods that are carried in the vehicle and cover for any loss of income due to the vehicle being off the road.

Traders car insurance policies also often include additional benefits such as breakdown cover, legal expenses cover and personal accident cover. These additional benefits can help to protect your business in the event of an accident, and can help to ensure that you are not out of pocket if something happens to your vehicle.

How Do I Get a Traders Car Insurance Policy?

The best way to get a traders car insurance policy is to contact an insurance provider and request a quote. It is important to provide the insurance provider with as much information as possible about the business use of the vehicle, as this will help to ensure that you get the most appropriate policy for your needs.

It is also important to shop around and compare quotes from different insurance providers, as this can help to ensure that you get the best deal possible. You should also read the terms and conditions carefully before signing up for a policy, as this can help to ensure that you are fully aware of what is included in the policy.

What Should I Consider When Getting a Traders Car Insurance Policy?

When getting a traders car insurance policy, it is important to consider the type of cover that is included in the policy. As well as the standard cover, it is important to consider if any additional benefits are included, such as breakdown cover, legal expenses cover and personal accident cover.

It is also important to consider the cost of the policy, as traders car insurance policies can be more expensive than standard car insurance policies. It is important to compare quotes from different insurance providers to ensure that you get the best deal possible.

Conclusion

Traders car insurance policies are designed to provide the same level of protection as standard car insurance policies, but with some additional benefits that can help to protect your business in the event of an accident. It is important to shop around and compare quotes from different insurance providers to ensure that you get the best deal possible, and to consider the type of cover that is included in the policy before signing up.

Motor Insurance Policy – Buy Now Pertaining To Auto Insurance Id Card

7 Useful Tips on How to Read Your Car Insurance Policy Wordings

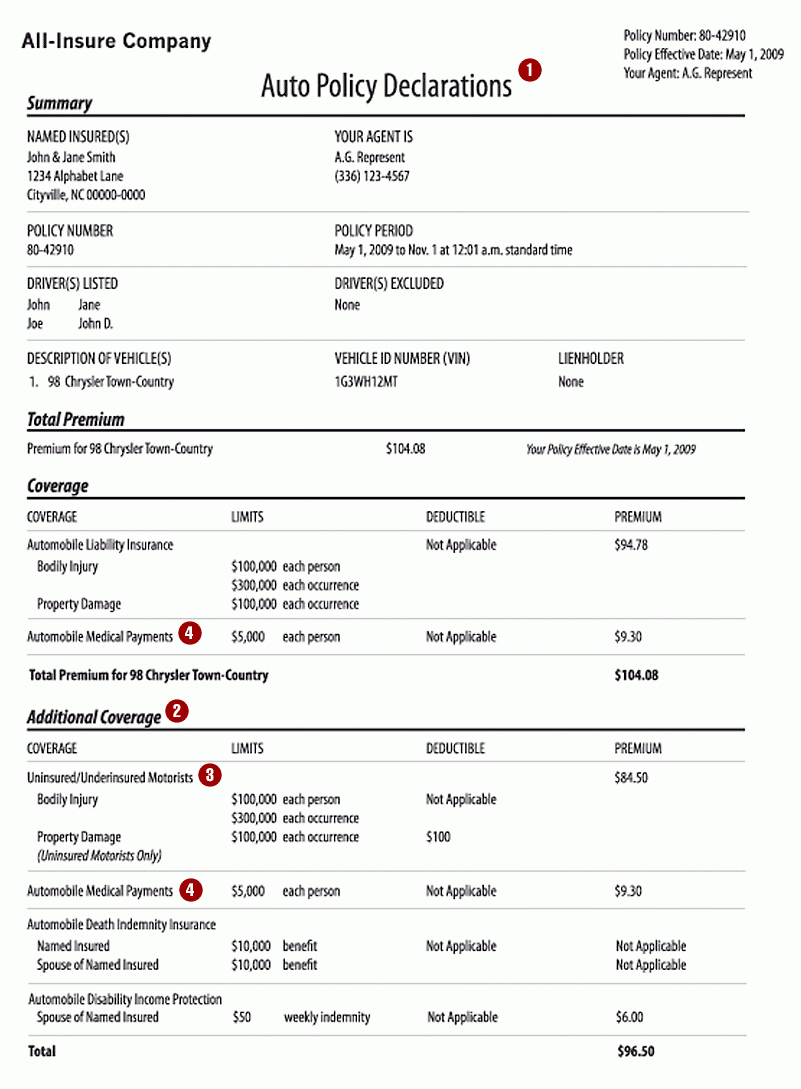

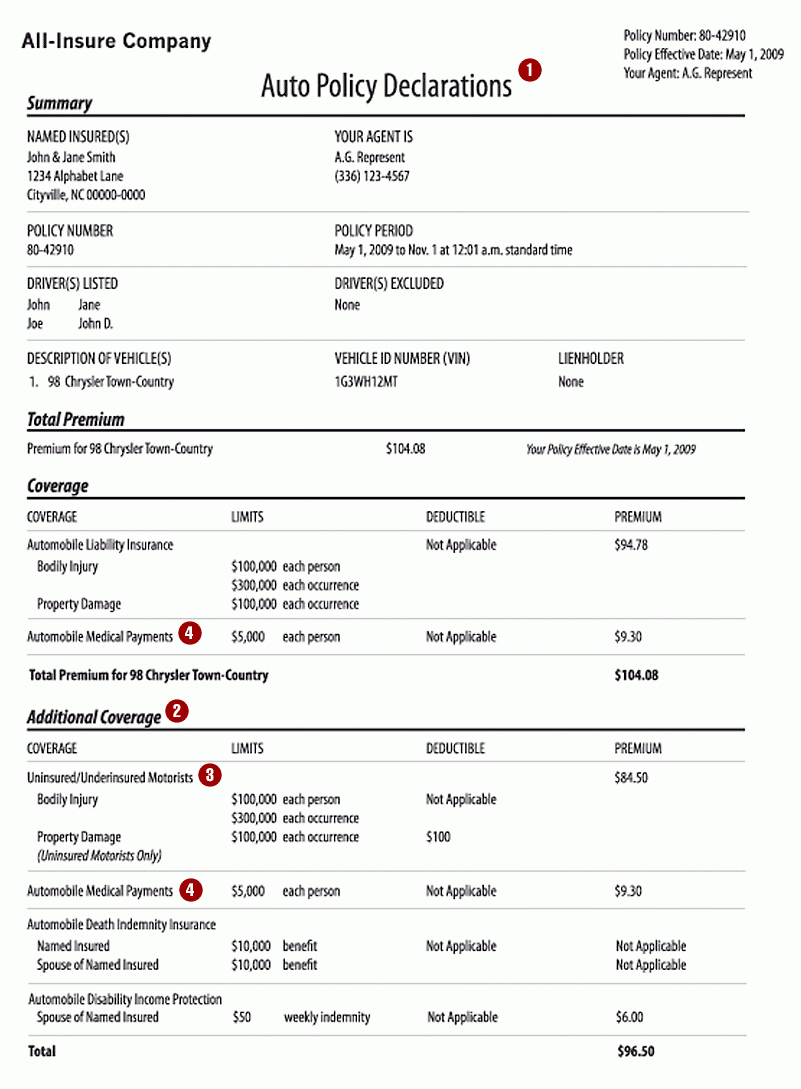

Understanding Your Car Insurance Declarations Page | Policygenius

What is an Auto Insurance Policy Declaration Page?

What Is Comprehensive Insurance Coverage? | Allstate