Geico Mechanical Breakdown Insurance Worth It

Is Geico Mechanical Breakdown Insurance Worth It?

As a car owner, you know that mechanical breakdowns can be extremely expensive to repair. You also know that car insurance is essential if you want to protect yourself financially against the costs of repairs. Geico mechanical breakdown insurance might be worth considering for those who want to make sure that their vehicle is covered for mechanical breakdowns.

Overview of Geico Mechanical Breakdown Insurance

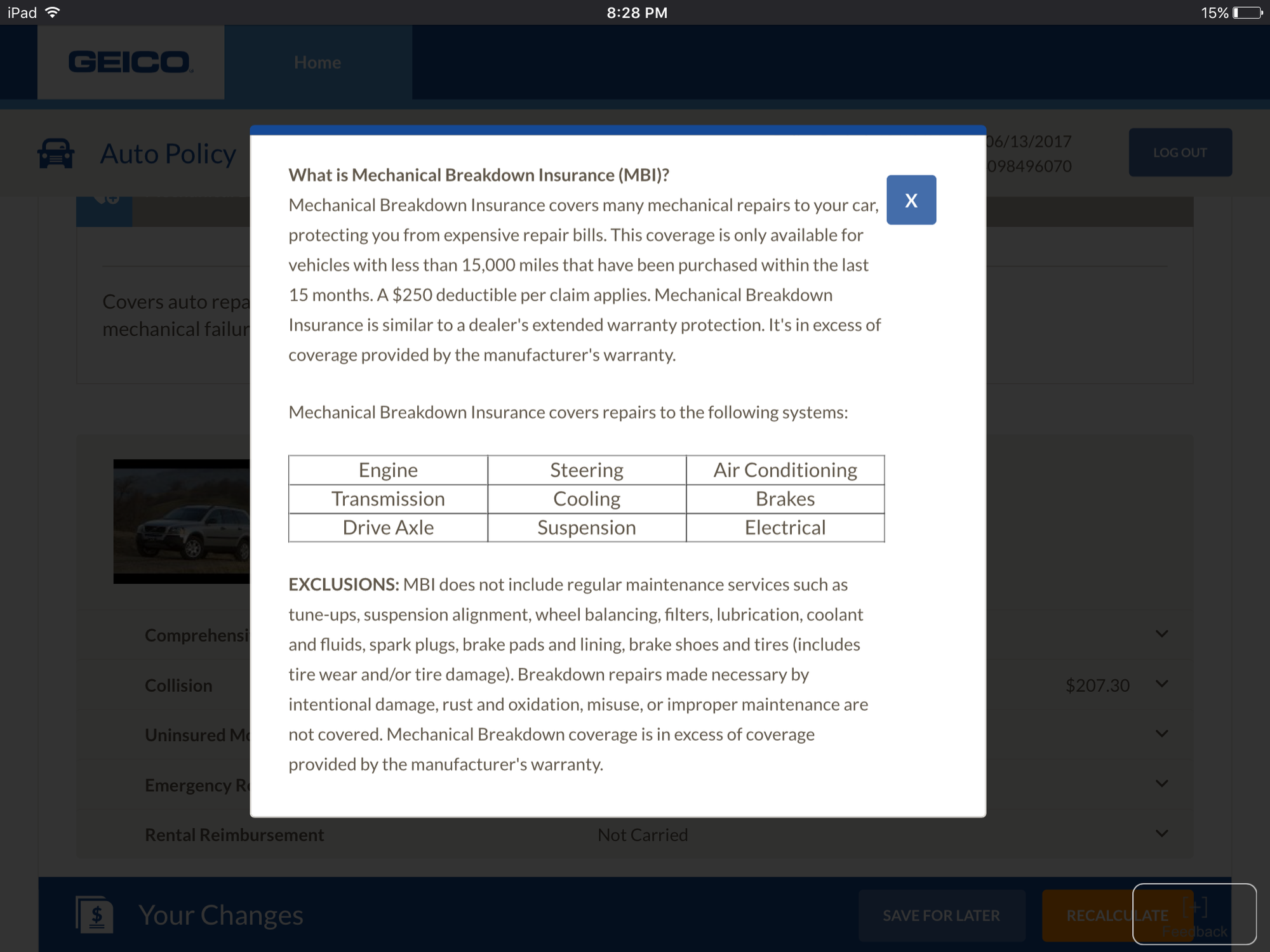

Geico mechanical breakdown insurance (MBI) is a type of coverage that can help you pay for repairs to your car if it experiences a mechanical breakdown. The coverage is similar to an extended warranty, in that it covers the cost of certain repairs to the vehicle. However, unlike an extended warranty, Geico MBI is not limited to certain types of repairs and can cover any mechanical breakdown that occurs to your vehicle. Geico MBI also has no deductible and pays for parts and labor.

What Does MBI Cover?

Geico MBI covers repairs to the engine, transmission, drive axle, and other mechanical parts of your vehicle. It also covers the cost of parts and labor, so you don’t have to pay for the repair out of pocket. MBI does not cover routine maintenance, such as oil changes and tire rotations, or repairs caused by an accident or collision.

How Much Does Geico MBI Cost?

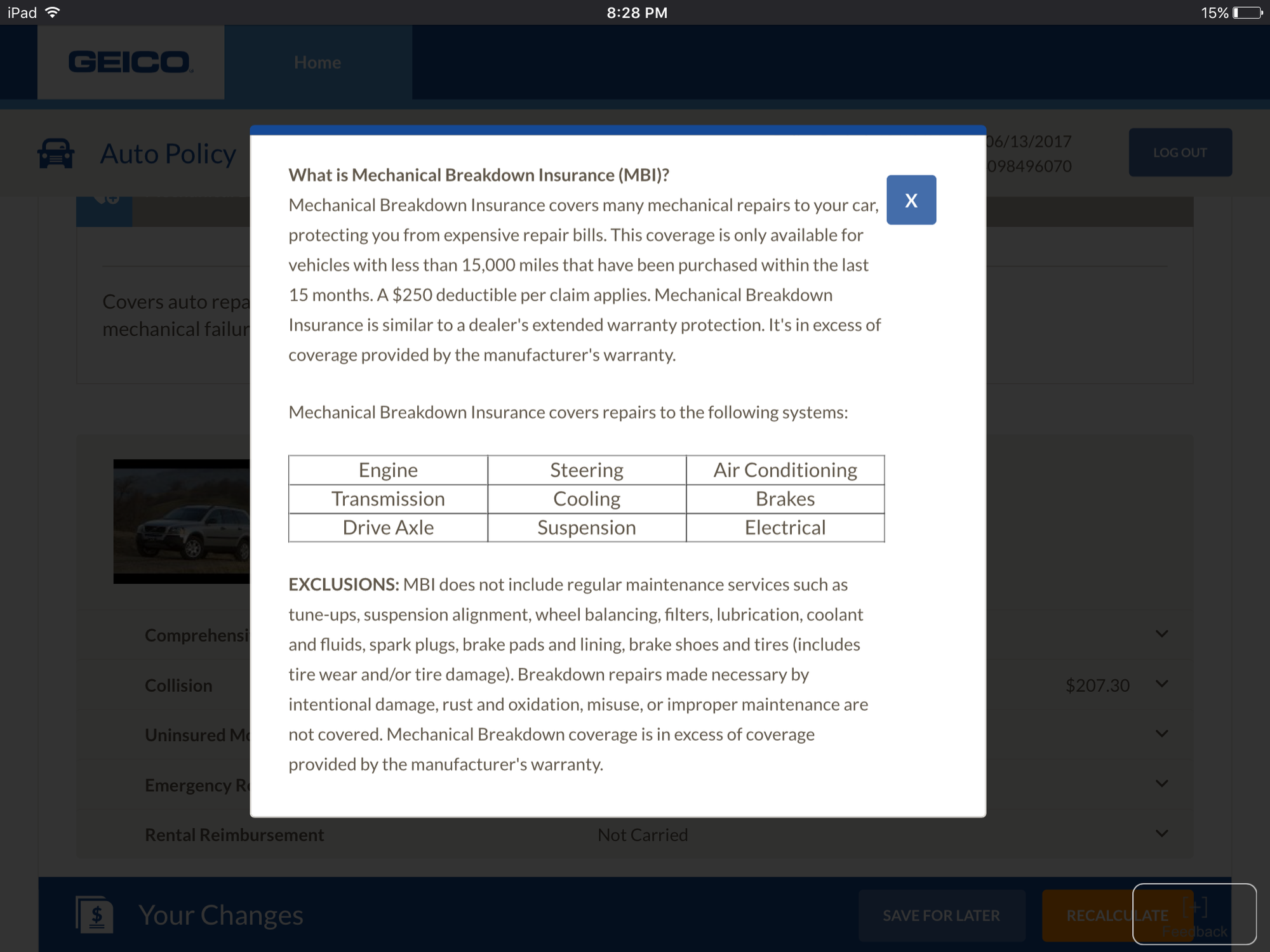

The cost of Geico MBI depends on the type of coverage you choose. Geico offers several levels of coverage, ranging from basic to comprehensive. The cost of MBI also depends on the make and model of your vehicle, as well as the age of your vehicle. Generally, the older and more expensive the vehicle, the higher the cost of MBI.

Is Geico MBI Worth It?

Whether or not Geico MBI is worth it depends on your individual circumstances. If you have an older vehicle or one that has a history of mechanical breakdowns, then Geico MBI could be worth the cost. However, if you have a newer vehicle, then Geico MBI may not be necessary. Ultimately, it’s up to you to decide if the cost of Geico MBI is worth the peace of mind of knowing your vehicle is covered in the event of a breakdown.

Conclusion

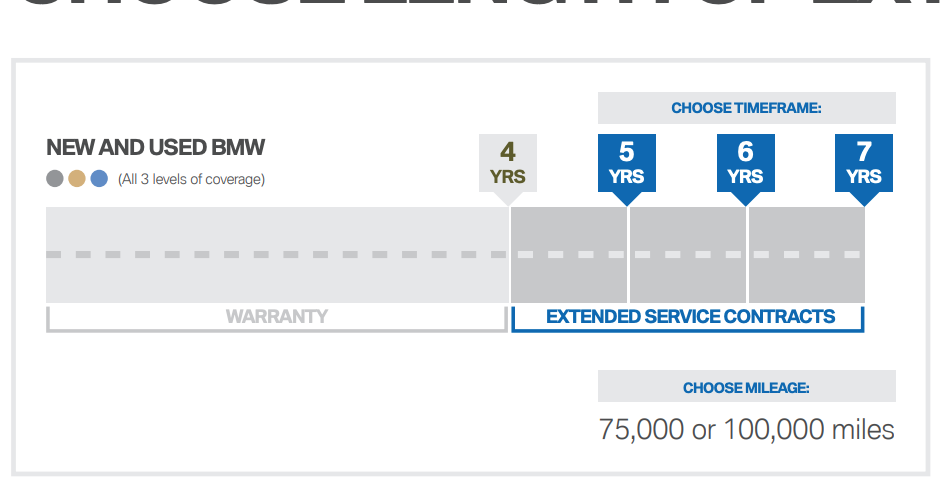

Geico mechanical breakdown insurance can be a great way to protect yourself financially if your vehicle experiences a mechanical breakdown. It pays for parts and labor, so you don’t have to worry about the cost of repairs. However, whether or not Geico MBI is worth it depends on your individual circumstances. Consider the cost and your vehicle’s age and condition before making a decision. In the end, it’s up to you to decide if Geico MBI is the right choice for you.

Thoughts on Geico's Mechanical Breakdown insurance? - CorvetteForum

Geico Mechanical Breakdown Insurance Reviews / Car Repair Insurance Is

GEICO Insurance Review: My Experience Using GEICO

Geico Insurance Warranty Coverage - Financial Report

Geico Motor Insurance - Financial Report