Full Coverage Insurance Quotes Cheap

Full Coverage Insurance Quotes Cheap: Get the Best Deals Now

What is Full Coverage Insurance?

Full coverage insurance is a type of policy that provides extensive protection for your car, home, and other assets. It covers the costs of repairs or replacements for your vehicle in the event of an accident, fire, theft, or other incidents. This type of insurance also covers the cost of medical bills if you or someone else is injured in an accident. Additionally, it can also provide coverage for legal costs if you are involved in a lawsuit. Full coverage policies are usually more expensive than basic policies, but they provide much greater protection for your assets.

How to Get Cheap Full Coverage Insurance Quotes

The first step to getting affordable full coverage insurance quotes is to compare rates from different providers. Shopping around and comparing rates can help you find the best price for the coverage you need. You can also look for discounts, such as loyalty discounts, good driver discounts, or multi-policy discounts. Some companies may also offer discounts if you have a good credit score or if you have taken a defensive driving course. Additionally, you may be able to save money by increasing your deductible amount.

Tips for Finding the Best Full Coverage Insurance Quote

When searching for full coverage insurance quotes, it is important to consider the coverage limits, deductibles, and other factors. Make sure that the coverage you choose is sufficient to protect your assets in case of an accident or other incident. Additionally, you should make sure that the deductible you choose is affordable. Finally, you should make sure that the policy you purchase is from a reputable company with a good track record of customer service.

What to Look for in a Full Coverage Insurance Policy

When buying full coverage insurance, it is important to make sure that the policy you choose includes all of the coverage you need, such as liability, comprehensive, collision, and medical payments. Additionally, you should make sure that the policy covers all of your assets, including your car, home, and any other property you own. You should also make sure that the policy includes coverage for legal costs if you are involved in a lawsuit. Finally, you should make sure that the policy includes a reasonable deductible that is affordable for you.

How to Get the Best Full Coverage Insurance Quote

The best way to get the best full coverage insurance quote is to shop around and compare rates from different providers. You can also look for discounts, such as loyalty discounts, good driver discounts, or multi-policy discounts. Additionally, you can save money by increasing your deductible amount. Finally, make sure that the policy you choose is from a reputable company with a good track record of customer service.

Conclusion

Full coverage insurance is a great way to protect your car, home, and other assets. However, it can be expensive if you don’t shop around and compare rates from different providers. To get the best deal, make sure to look for discounts and compare rates from different companies. Additionally, make sure that the policy you choose includes all of the coverage you need and has a reasonable deductible amount.

cheap full coverage car insurance companies | Life insurance quotes

Quotes For Full Coverage Insurance With In Pennsylvania | TechWink

Cheap full coverage auto insurance quotes top 3 things

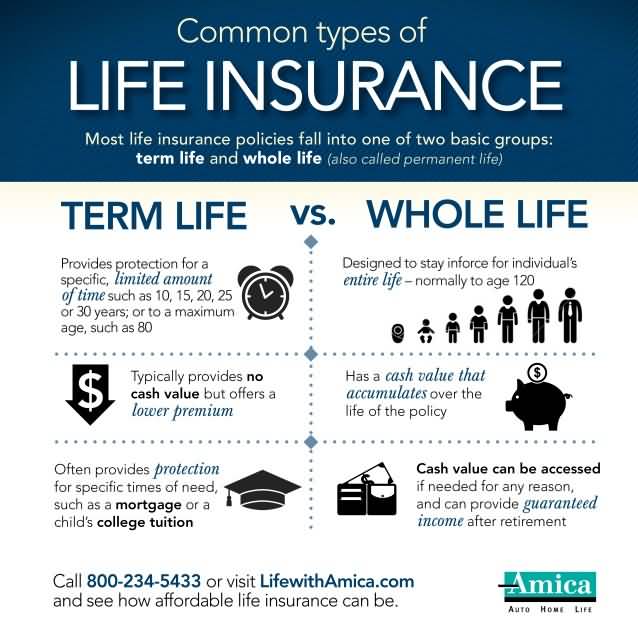

20 Cheap Whole Life Insurance Quotes & Images | QuotesBae

How To Get Cheap Full Coverage Auto Insurance Quotes - YouTube