Does Searching For Car Insurance Affect Credit

Does Searching For Car Insurance Affect Credit

What is Credit

Credit is a term that is used to describe the ability to borrow money or to access goods or services with the promise to pay for them in the future. Credit is a form of financial capital that is extended to individuals, businesses and organizations by credit providers, such as banks and other financial institutions. Credit is an important part of the economy and it is used to help fund investments, purchases and other transactions.

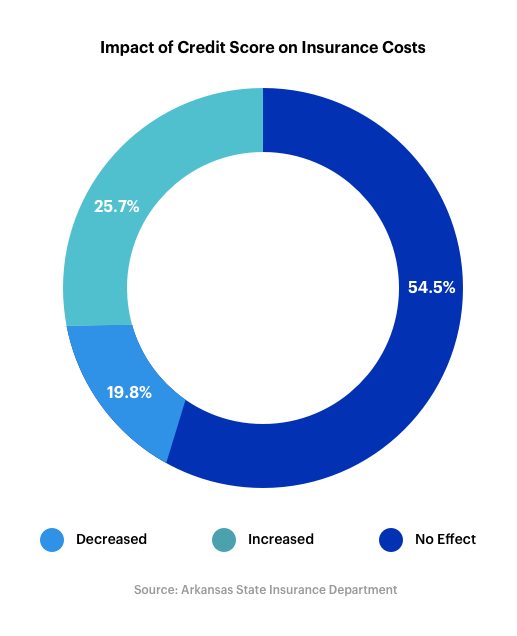

How Does Credit Affect Car Insurance

The way that credit affects car insurance is that insurance companies use credit scores to evaluate a customer's risk. Insurance companies use credit scores to determine how likely a customer is to make a claim. The better the credit score, the less likely a customer is to make a claim and the lower the risk the insurance company assumes. Because of this, insurance companies typically offer lower rates to customers with good credit scores.

How Does Searching For Car Insurance Affect Credit Scores

When a customer searches for car insurance, their credit score is typically pulled by the insurance company. This is done to assess the customer's risk and to determine the customer's eligibility for the insurance product. However, it is important to note that this type of credit check is known as a "soft inquiry" and does not impact the customer's credit score.

Does Shopping Around For Car Insurance Affect Credit Scores

Shopping around for car insurance does not affect a customer's credit score. When a customer searches for car insurance, the insurance company only pulls the customer's credit report to determine their eligibility for the product. The customer's credit score is not affected by the search, as it only serves as a way for the insurance company to evaluate the customer's risk.

How Can Customers Find The Best Deals On Car Insurance

The best way for customers to find the best deals on car insurance is to shop around and compare rates from different companies. Customers should make sure to compare not only the cost of the insurance, but also the coverage and customer service ratings. It is also important to review the policy details, such as deductible amounts and limits, to make sure that the customer is getting the coverage they need.

Conclusion

Searching for car insurance does not affect a customer's credit score. However, customers should keep in mind that insurance companies use credit scores to determine the customer's eligibility for the product and to assess the customer's risk. To find the best deals on car insurance, customers should shop around and compare rates from different companies.

Does Car Insurance Affect Your Credit? | Credit score infographic, Good

Does Car Insurance Affect Your Credit? | Car insurance, Insurance

How Do Credit Scores Affect Car Insurance? - Lexington Law

How Credit Scores Affect Your Car Insurance Rate - Cover

Does Your Credit Score Affect Your Car Insurance? | Lexington Law