Cheapest Home And Auto Insurance In British Columbia

Cheapest Home And Auto Insurance In British Columbia

Introduction

Are you looking for the cheapest home and auto insurance in British Columbia? With so many different insurance companies and policies available, it can be a challenge to find the right coverage at the right price. Fortunately, there are some ways to save money on your insurance and make sure you’re getting the best coverage possible. In this article, we’ll look at some of the best ways to get the cheapest home and auto insurance in British Columbia. Read on to learn more.

Choose The Right Company

The first step in getting the cheapest home and auto insurance in British Columbia is to choose the right company. Different companies have different rates, so it’s important to shop around and compare quotes. You can do this by getting quotes from multiple insurers and comparing them side-by-side. Make sure to check the company’s reputation and financial strength before making a purchase. This will help ensure that you’re getting the best coverage for your money.

Raise Your Deductible

Raising your deductible is one of the best ways to get the cheapest home and auto insurance in British Columbia. A higher deductible means you’ll be responsible for paying a higher amount out of pocket in the event of an accident or other claim. However, it also means that you’ll be paying lower premiums every month. Make sure you’re comfortable with the amount you’ll be responsible for in the event of a claim before raising your deductible.

Bundle Your Policies

Another great way to get the cheapest home and auto insurance in British Columbia is to bundle your policies. Many insurance companies offer discounts for customers who purchase multiple policies, such as home, auto, and life insurance. Bundling your policies can save you money on each of your premiums, so it’s definitely worth considering. Make sure to check with multiple insurers to find the best rate.

Look For Discounts

There are also many discounts available for home and auto insurance in British Columbia. For example, many insurers offer discounts for customers who have good driving records, have a home security system installed, or have multiple cars insured with the same company. You should also ask about discounts for customers who pay their premiums in full or in installments. By taking advantage of these discounts, you can significantly reduce your insurance costs.

Consider All Your Options

Finally, it’s important to consider all your options when looking for the cheapest home and auto insurance in British Columbia. Don’t just assume that the policy you find first is the best one for you. Compare quotes from multiple companies and make sure you understand the coverage offered by each policy. You may find that one policy is cheaper, but offers less coverage. Take the time to shop around and compare policies to make sure you’re getting the best coverage at the best price.

Home and Auto savings | First Insurance Agency Of The Hill Country, Inc.

Topiclocal.com | Find the cheapest auto insurance quotes

Let's Drop Your Rate Today | Cheapest-Auto-Insurance.com

5 Keys to Cheap Car Insurance - NerdWallet

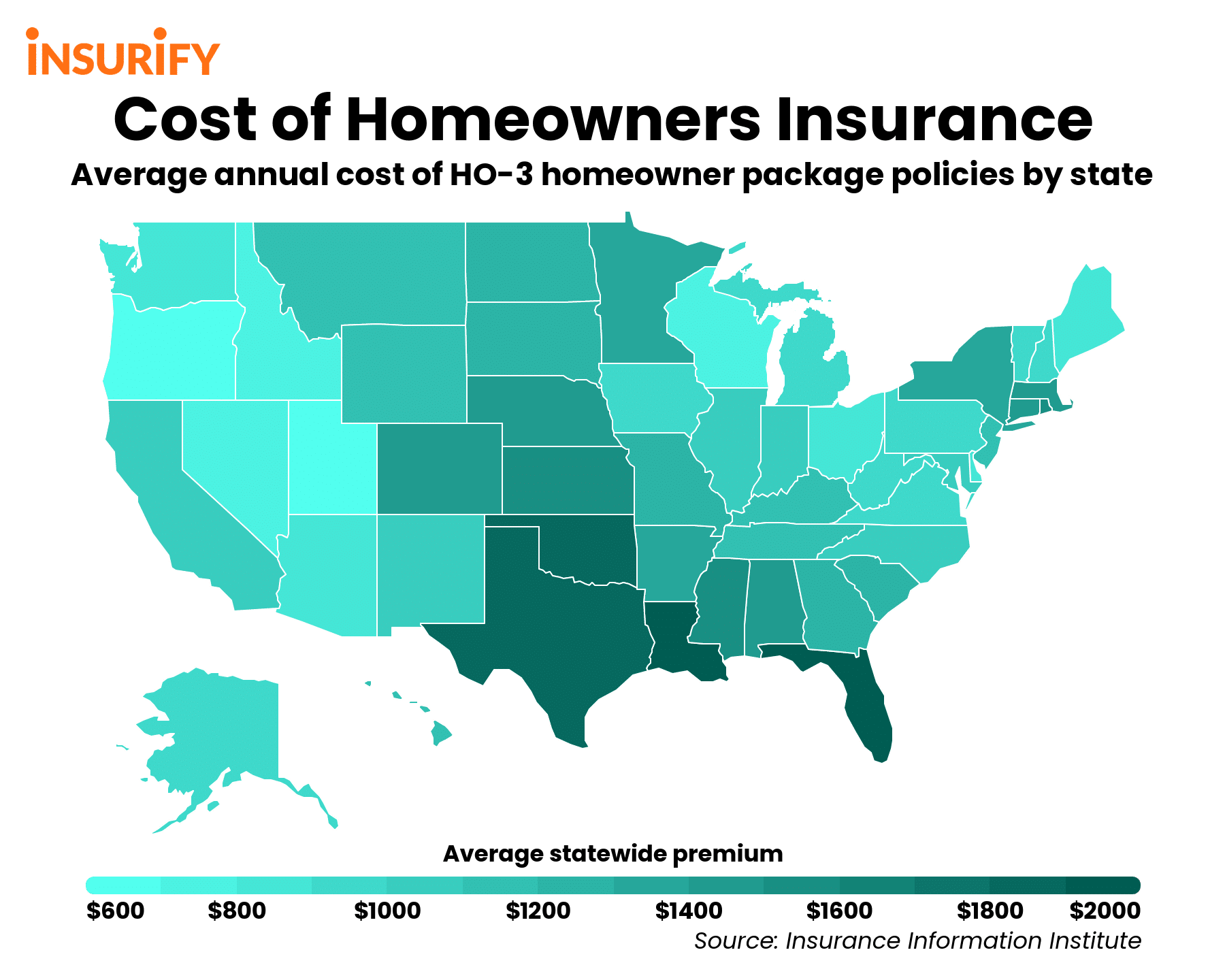

These States Have the Cheapest Home Insurance Premiums