Cgu Car Insurance Claim Review

CGU Car Insurance Claim Review

CGU is one of the most popular car insurance providers in Australia. They offer a wide range of cover types to meet the needs of different drivers. Their policies provide comprehensive cover, protecting your car and your finances in the event of an accident. In this article, we'll take a look at the claims process to help you understand what to expect if you need to make a claim with CGU.

Steps Involved in the Claims Process

Making a car insurance claim with CGU is a simple process. First, you'll need to contact the insurer and provide them with all the necessary information about your claim. This includes details about the accident, your vehicle, and the other driver. You'll also need to provide the insurer with any evidence you have, such as photos or witness statements.

Once you've submitted the required information, the insurer will investigate the claim and assess the damage. Depending on the complexity of the claim, this process can take several weeks to complete. Once they've finished their investigation, they'll make an offer to cover the costs of repairs or replacement.

What to Do If You're Unhappy With the Offer

If you're unhappy with the offer made by CGU, you can appeal the decision. You'll need to provide the insurer with additional evidence to support your position. This could include quotes from repair shops or further documentation to back up your position. If you're still unsatisfied with the outcome after appealing, you can take your case to the Financial Ombudsman Service.

What to Do If You're Not Satisfied With CGU's Service

If you're not satisfied with the service you've received from CGU during your claim, you should contact their customer service team. They'll be able to answer any questions you have and help you resolve any issues. You can also make a complaint to the insurer directly if you feel they haven't handled your claim correctly.

Tips for Filing a Claim With CGU

Filing a claim with CGU can be a stressful experience, but there are some things you can do to make the process easier. First, make sure you have all the necessary information and evidence ahead of time. This will make it easier for the insurer to assess your claim. Second, make sure you keep records of all your conversations with CGU. This will help you if you need to follow up on anything later.

Finally, if you're still unsatisfied with the outcome of your claim, you should contact a lawyer to discuss your options. They'll be able to advise you on the best course of action and help you get the compensation you deserve.

Making a car insurance claim with CGU can be a difficult process, but understanding the steps involved can make it a little easier. If you follow the tips outlined in this article, you should be able to make a successful claim and get the compensation you need to cover the costs of repairs or replacement.

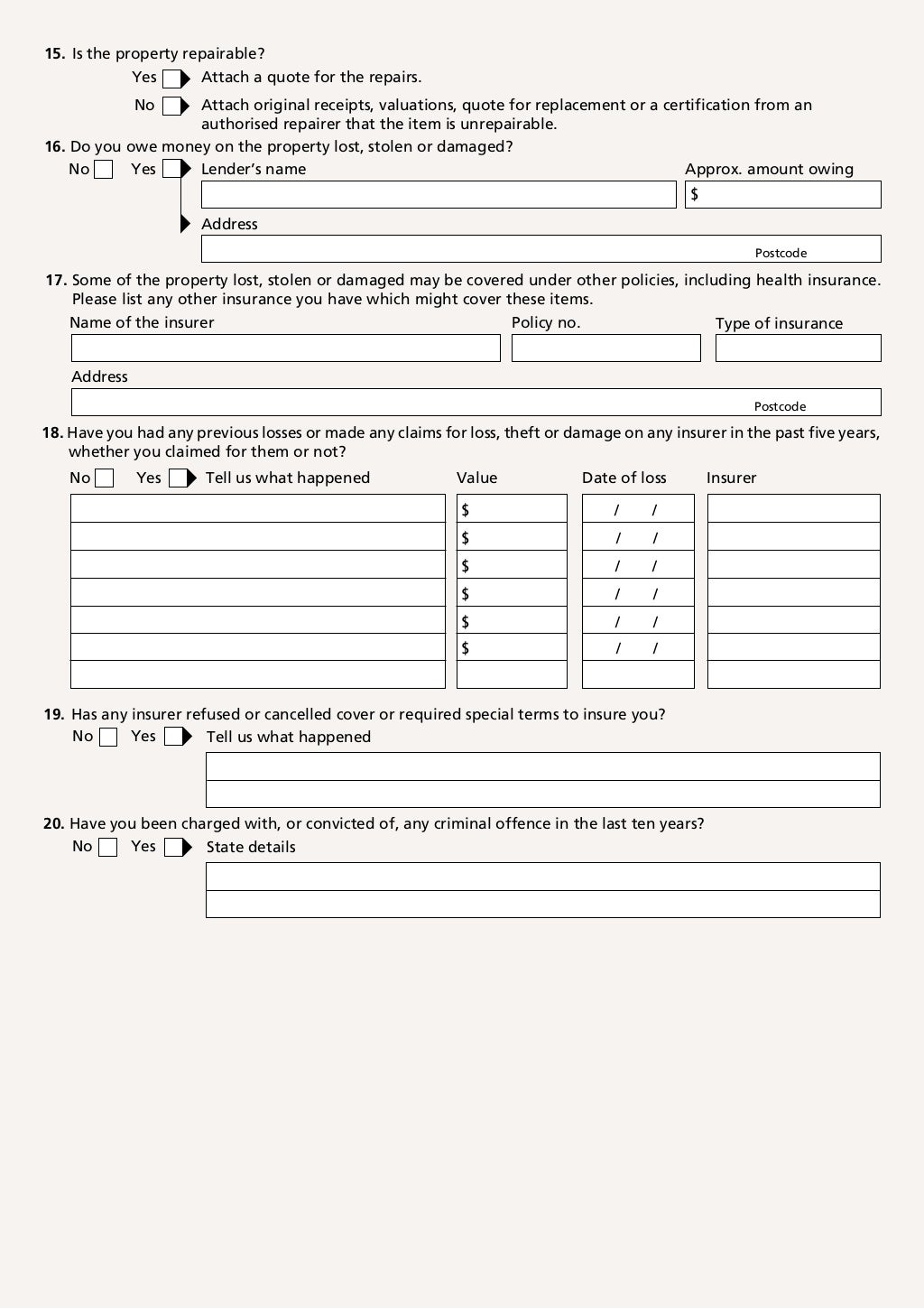

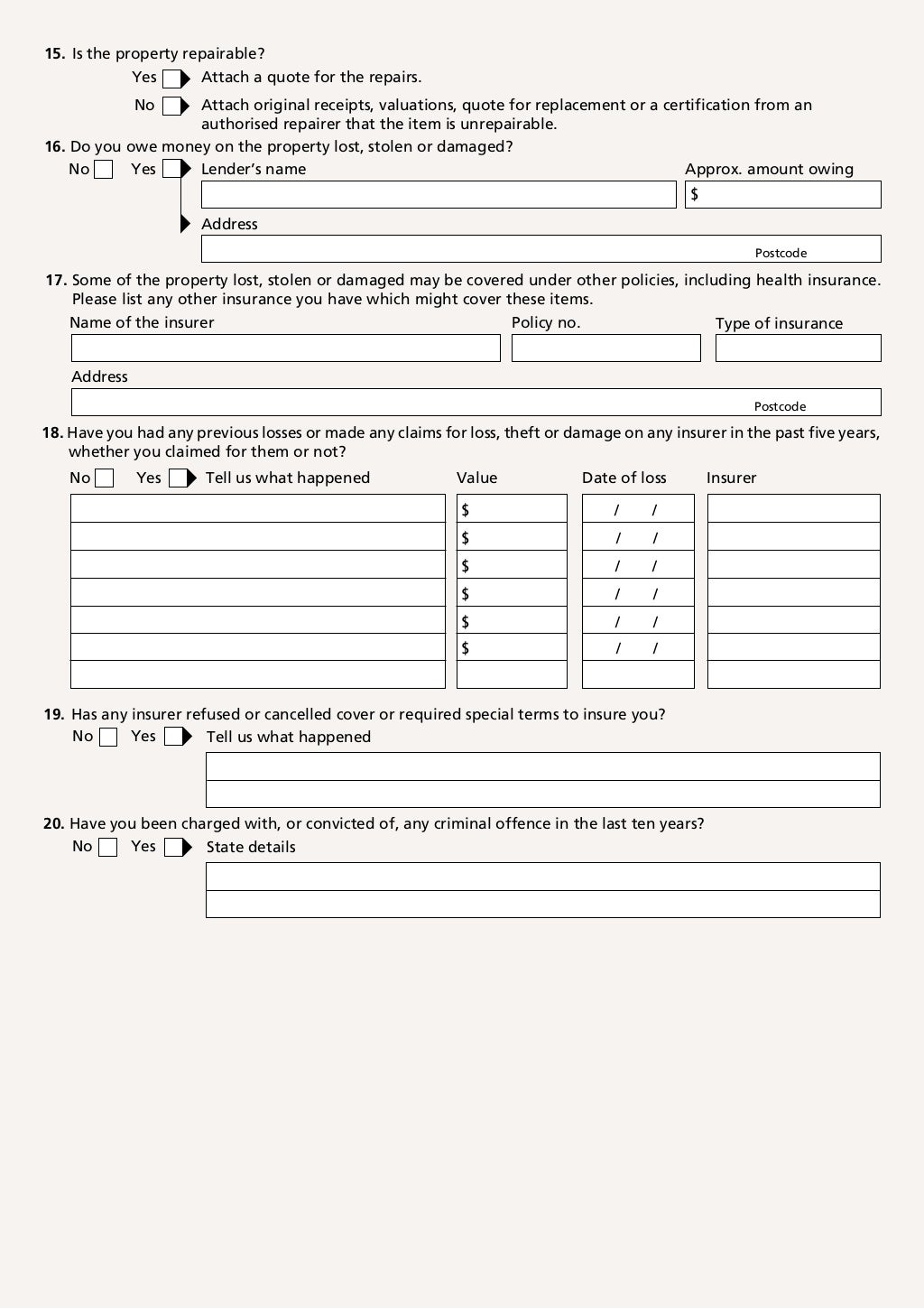

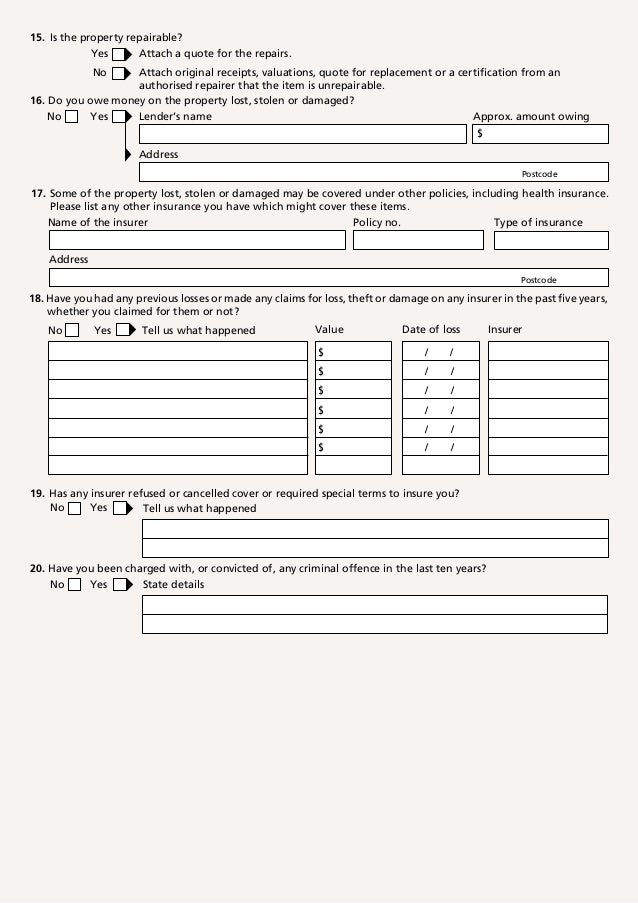

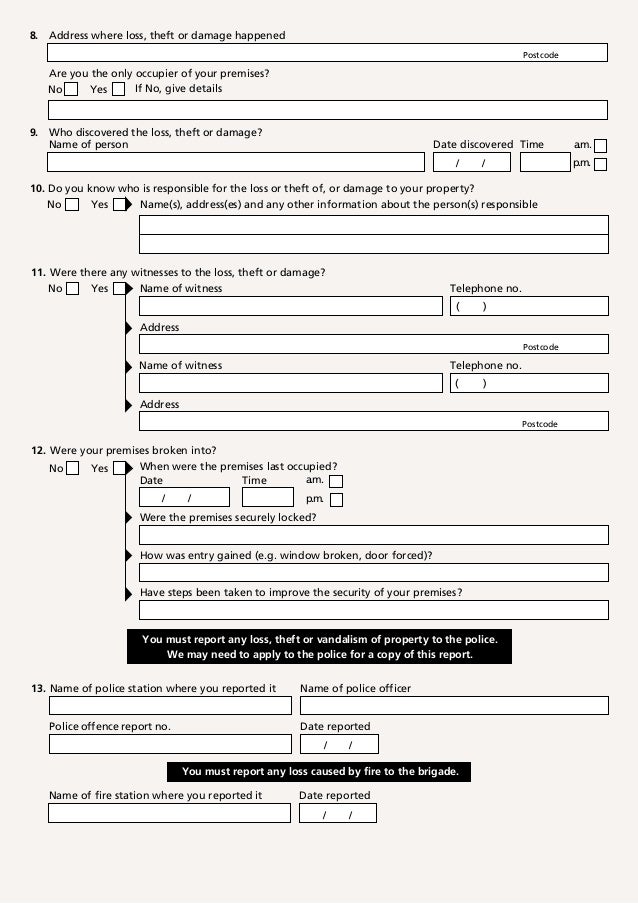

CGU General Claim Form

CGU General Claim Form

CGU General Claim Form

Cgu Miscellaneous Professional Indemnity Insurance Proposal | Insurance

cgu - Steadfast Eastern Insurance Brokers