Car Insurance Claim Own Damage Philippines

Own Damage Insurance Claims in the Philippines

What is Own Damage Insurance?

Own Damage insurance is a type of car insurance that helps cover the cost of repairs to your vehicle if it is damaged or destroyed in an accident. It also covers any damage caused by theft, vandalism, or natural disasters. In the Philippines, the law requires that all registered vehicles have at least the minimum third-party liability coverage, but it is recommended that you get a comprehensive insurance policy that includes both liability and own damage coverage. Own damage insurance will help protect you financially in the event of an accident or other unexpected event that causes damage to your car.

How Does Own Damage Insurance Work?

When you purchase an own damage insurance policy, you will be required to pay a premium, which is an amount of money you pay in exchange for the insurance coverage. Once you have a policy, you can file a claim for the cost of repairs to your vehicle when it is damaged or destroyed in an accident. Your insurance company will review the claim and decide whether or not to cover the cost of repairs. If the company determines that the damage is not covered under the policy, you will be responsible for the cost of repairs.

What Does Own Damage Insurance Cover?

Own damage insurance typically covers the cost of repairs to your vehicle if it is damaged in an accident, as well as any damage caused by theft, vandalism, or natural disasters. Depending on the insurance company and the policy you have, it may also cover the cost of a rental car while your vehicle is being repaired. Additionally, many policies provide coverage for medical expenses if you or your passengers are injured in an accident.

What Is Not Covered by Own Damage Insurance?

Own damage insurance does not typically cover the cost of repairs to another vehicle if you are responsible for the accident. It also does not cover any damage caused by reckless driving or driving under the influence. Additionally, it does not cover any damage caused by normal wear and tear or by mechanical breakdowns. It is important to understand the specific details of your own damage insurance policy, so you know exactly what is and what is not covered.

Filing an Own Damage Insurance Claim in the Philippines

If your vehicle is damaged or destroyed in an accident, you can file an own damage insurance claim with your insurance company. You will need to provide all of the necessary information, including details of the accident, a copy of the police report, and any other relevant documents. Once you have submitted the claim, your insurance company will review it and decide whether or not to cover the cost of repairs. If the claim is approved, they will pay the cost of repairs directly to the repair shop or to you, depending on the policy.

Conclusion

Own damage insurance is an important type of car insurance policy that can help protect you financially in the event of an accident or other unexpected event. It is important to understand the details of your policy, so you know exactly what is and what is not covered. If you are ever in an accident and need to file an own damage insurance claim, you can contact your insurance company for assistance.

Accident | Affidavit | Philippines

Own damage motor insurance can now be bought separately | Mint

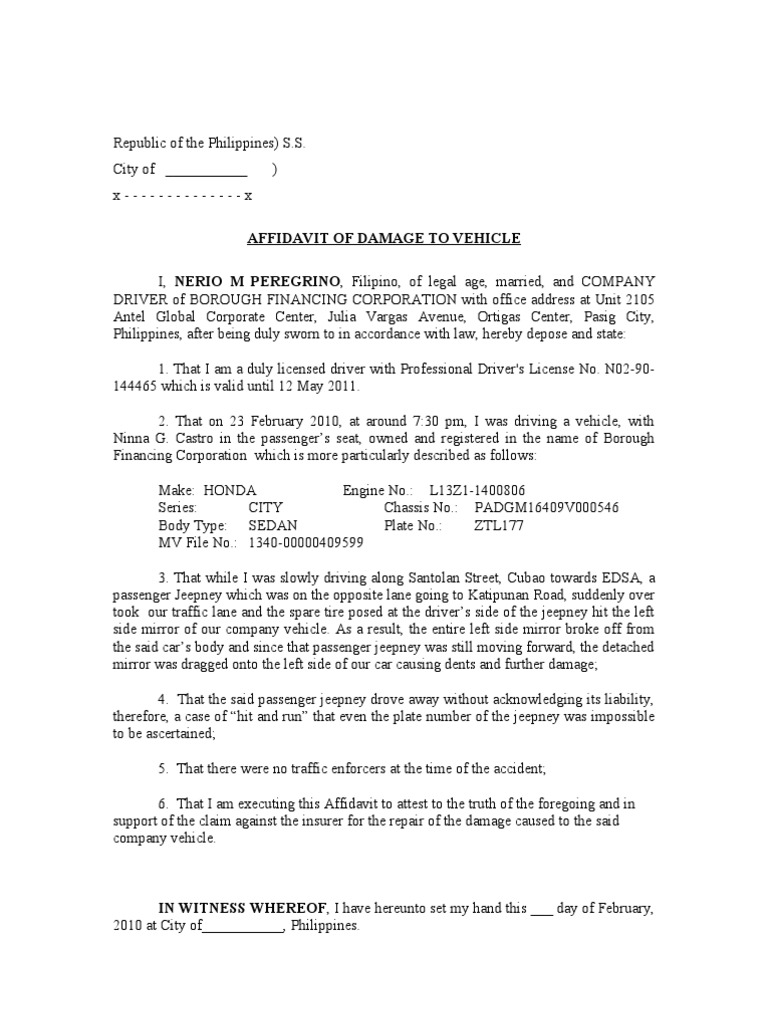

Affidavit of Damage to Vehicle

Steps to Avoid Car Insurance Claim Rejection in India

Affidavit of Damage to Vehicle | Affidavit | Land Vehicles