Can You Have Two Vehicles On One Insurance Policy

Sunday, July 27, 2025

Edit

Can You Have Two Vehicles On One Insurance Policy?

What Does It Mean To Have Two Vehicles On One Insurance Policy?

Having two vehicles on one insurance policy means that two vehicles are covered under the same insurance policy. The benefits of having two vehicles on one policy are that you can save money on insurance premiums, and also receive a discount for insuring multiple cars. Additionally, having two vehicles on one policy may make it easier to manage your coverage, as you can keep track of all your information in one place.

What Are the Benefits of Having Two Vehicles On One Insurance Policy?

Having two vehicles on one insurance policy can be beneficial for a number of reasons. First, when you have multiple vehicles insured under one policy, you can often receive a multi-car discount. This can be a great way to save money on your insurance premiums. Additionally, having two vehicles on one policy can make it easier to manage your coverage, as you can keep track of all your information in one place. Finally, if you ever need to make a claim, it can be much easier to do so if all of your vehicles are insured under the same policy.

Are There Any Disadvantages to Having Two Vehicles On One Insurance Policy?

Having two vehicles on one insurance policy can come with some drawbacks. For instance, if you have a claim on one vehicle, it could affect the premiums of both vehicles. Additionally, if one of your vehicles is destroyed or stolen, it could impact the coverage of the other vehicle. Finally, if you ever need to make a claim, it can be much more complicated to do so if all of your vehicles are insured under the same policy.

Can I Insure Multiple Vehicles On One Policy?

Yes, you can insure multiple vehicles on one policy. Most insurance companies will allow you to insure multiple vehicles on one policy, although the details of the policy may vary from provider to provider. In some cases, you may need to insure all of your vehicles on the same policy in order to qualify for certain discounts.

What Should I Consider Before Adding a Second Vehicle to My Insurance Policy?

Before adding a second vehicle to your insurance policy, you should consider a few important factors. First, you should make sure that the second vehicle is eligible for coverage under the policy. Additionally, you should check to see if the second vehicle will qualify for any discounts or special offers, such as a multi-car discount. Finally, you should make sure that the coverage on both vehicles is adequate for your needs.

Conclusion

Having two vehicles on one insurance policy can be beneficial in many ways, as it can save you money and make it easier to manage your coverage. However, there are some drawbacks to consider, such as the fact that a claim on one vehicle could affect the premiums of both vehicles. Before adding a second vehicle to your policy, make sure to weigh the pros and cons and make sure that the coverage is adequate for your needs.

Can I Have Two Car Insurance Policies - oynxdesign

Two-Wheeler Insurance: Coverage, Claim & Renewal

Can You Have Two Different Insurance Policies On One Car - Car Retro

7 Cheap Family Car Insurance Plans And Discounts (Quotes)

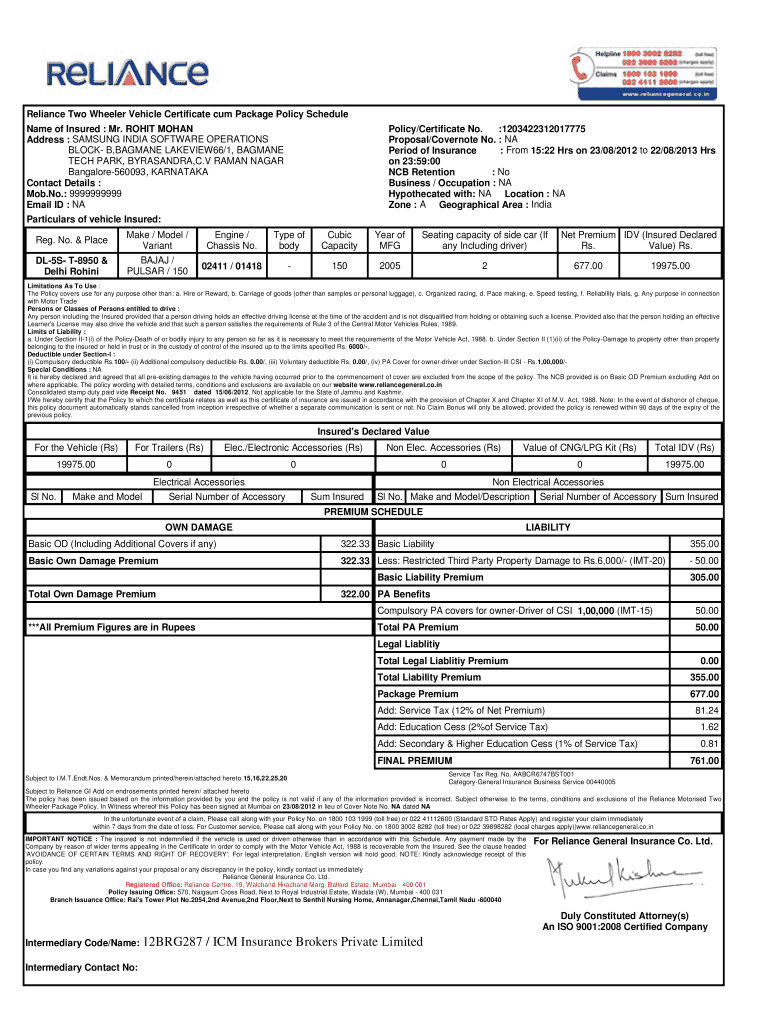

Bike Insurance Paper Form - Fill Out and Sign Printable PDF Template