Can You Buy Gap Insurance After You Buy A Car

Can You Buy Gap Insurance After You Buy A Car?

What is Gap Insurance?

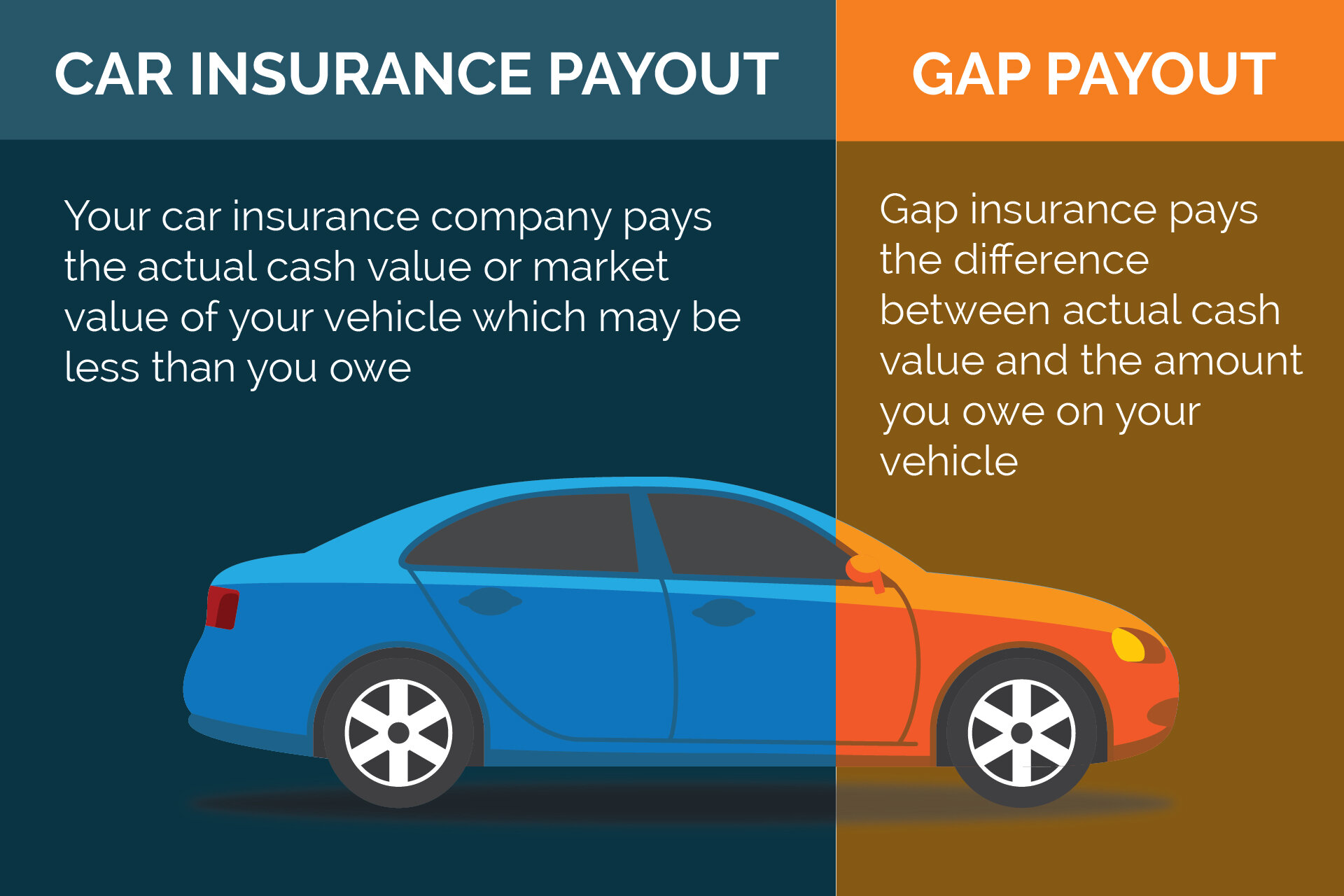

Gap insurance, also known as loan/lease payoff coverage, is an optional insurance coverage that pays the difference between the actual cash value of a vehicle and the amount that the owner owes on their loan or lease. This coverage is designed to protect the owner in the event that the car is totaled or stolen and the owner still owes money on the loan or lease. Gap insurance is often offered by dealerships at the time of purchase and can be purchased from most insurance providers.

Do I Need Gap Insurance?

If you are financing or leasing a car, gap insurance is an important consideration. Many vehicles depreciate in value quickly, and if you are in an accident and the car is totaled, you may be responsible for the difference between the actual cash value of the vehicle and the amount that you owe on the loan. Gap insurance can help protect you from this financial burden.

Can I Buy Gap Insurance After I Buy A Car?

Yes, you can purchase gap insurance after you buy a car. Most insurance providers offer gap coverage as an add-on to existing auto insurance policies. If you have purchased a car from a dealership, they may offer gap coverage as well. The cost of gap insurance will vary depending on the provider and the coverage that you choose.

What Types of Gap Insurance are Available?

There are several types of gap insurance available, including: new car replacement, return to invoice, lease/loan coverage, and total loss protection. Each type of coverage has different features and benefits and can help protect you in different ways. It is important to understand the differences between the types of coverage and how they can help protect you.

How Much Does Gap Insurance Cost?

The cost of gap insurance will vary depending on the type of coverage that you choose and the provider. Generally, gap insurance will cost between 3% and 6% of the vehicle’s value. However, if you are purchasing gap insurance from a dealership, the cost may be higher.

Conclusion

Gap insurance is a valuable form of coverage that can protect you financially in the event of an accident or theft. If you are financing or leasing a car, gap insurance is a good option to consider. You can purchase gap insurance after you buy a car from most insurance providers, and the cost will vary depending on the type of coverage that you choose.

Gap Car Insurance Tips - Can I Buy Gaping Coverage Without Paying More

Can You Buy Gap Insurance After You Purchase Car - goadesignstudio

2017 Cheap Gap Insurance | Is Your Local Car Dealer the Best Place to

Compare Gap Insurance Quotes

The Importance of Gap Insurance When Financing a Car — The Law Office