Best Cheap Car Insurance Missouri

Monday, July 7, 2025

Edit

Best Cheap Car Insurance Missouri

Looking for the Best Car Insurance in Missouri?

If you're in Missouri, you know that having the right car insurance is essential. In order to protect you and your family, you need to make sure you have the best car insurance coverage possible. But what is the best car insurance in Missouri? How do you know you're getting the best coverage for the best price?

The best way to find the best car insurance in Missouri is to shop around. You should compare prices, coverage, and discounts between different insurance companies. You may even be able to get a better deal by bundling your car insurance with other types of insurance, such as home or life insurance. By doing a little research and comparing rates, you can ensure you're getting the best car insurance in Missouri.

Missouri Car Insurance Requirements

In order to drive legally in Missouri, you need to have at least the minimum car insurance coverage required by law. The state requires that you have liability insurance, which covers the damage you cause to another person's property or vehicle. You also need to have uninsured motorist coverage, which covers damage to your car caused by an uninsured driver.

The minimum liability coverage in Missouri is $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage. The minimum uninsured motorist coverage is $25,000 for bodily injury per person and $50,000 for bodily injury per accident.

Finding Cheap Car Insurance in Missouri

If you want to save money on car insurance in Missouri, there are several ways to do so. First, you should shop around and compare rates from different insurance companies. You may be able to find a better deal by bundling your car insurance with other types of insurance, such as home or life insurance. You should also take advantage of any discounts you may be eligible for, such as good driver discounts or safe driver discounts.

You should also make sure your car is in good condition. Things like regular maintenance and repairs can help you get lower rates on your car insurance. In addition, you should consider increasing your deductible, as this can help you lower your premiums.

Finding the Right Car Insurance in Missouri

When you're looking for the best car insurance in Missouri, make sure you're getting the coverage you need. You should make sure that you have the minimum coverage required by law, as well as any additional coverage you may need. You should also consider any discounts you may be eligible for, and make sure you're getting the best rate available.

It's also important to make sure you're working with a reputable insurance company. You should read reviews and check out the company's financial ratings before committing to a policy. This will help ensure you're getting the coverage you need and the best rate possible.

Conclusion

Finding the best car insurance in Missouri doesn't have to be a difficult or time-consuming process. By doing a little research and comparing rates, you can ensure you're getting the best coverage for the best price. You should also make sure you're getting the coverage you need and the best rate available. With a little bit of effort, you can find the best car insurance in Missouri.

Best Cheap Car Insurance: Washington, D.C. (2022)

9 Best Cheap Car Insurance Companies for 2022 | Affordable car

Best Cheap Car Insurance Companies (That Give You the Best Coverage for

Best Cheap Car Insurance In Texas For 2020 + Savings Tips

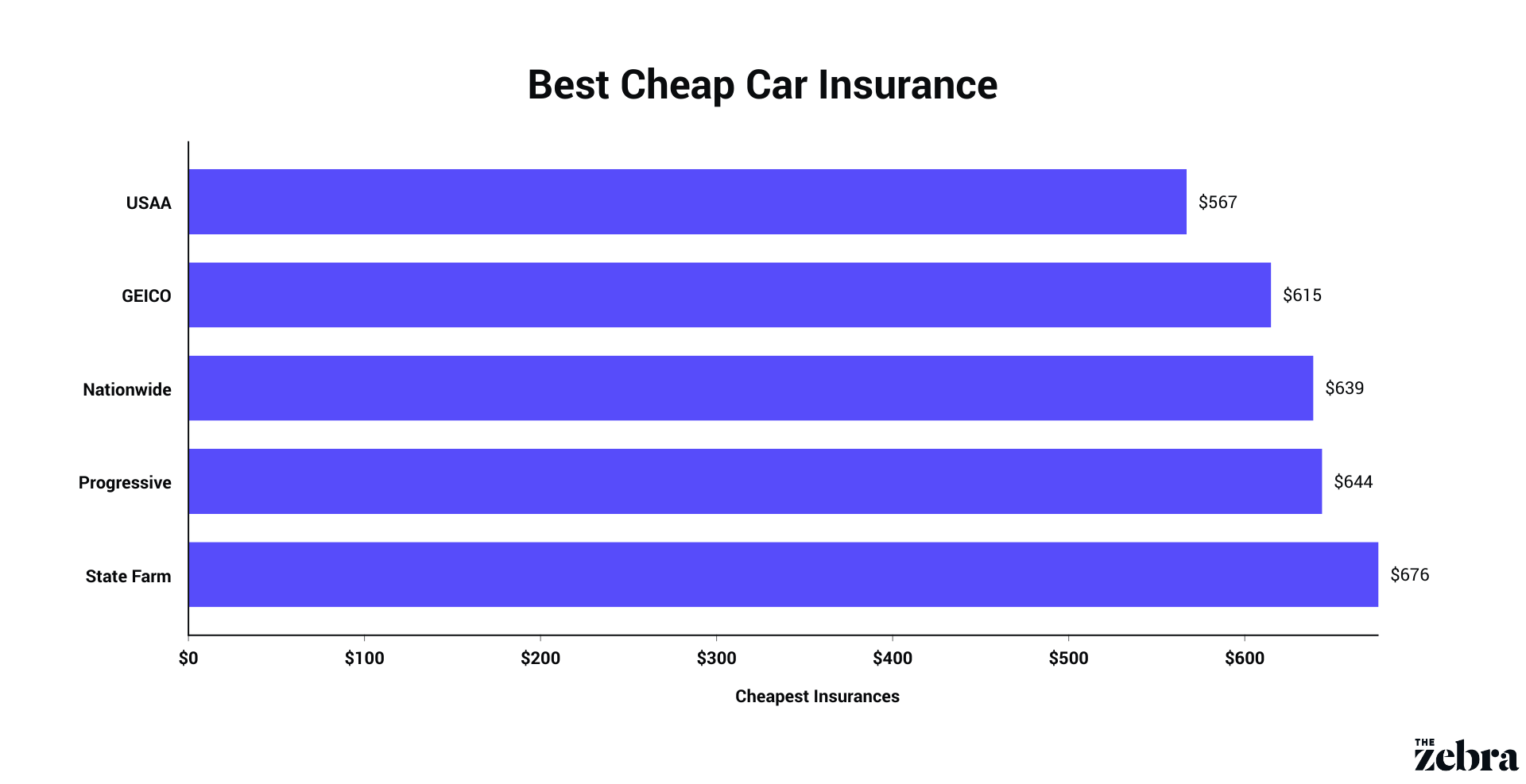

Cheapest Car Insurance Companies (September 2021) | The Zebra