Average Car Insurance Monthly Cost

Tuesday, July 15, 2025

Edit

Average Car Insurance Monthly Cost

What is the Average Cost of Car Insurance?

When it comes to determining the average cost of car insurance, there is no one-size-fits-all answer. The cost of car insurance can vary greatly depending on your specific situation. Factors like your age, driving record, car make and model, and even your credit score can affect the cost of your car insurance. Generally, the average cost of car insurance per month is around $100 to $200, with some drivers paying even more than this.

What Affects the Average Cost of Car Insurance?

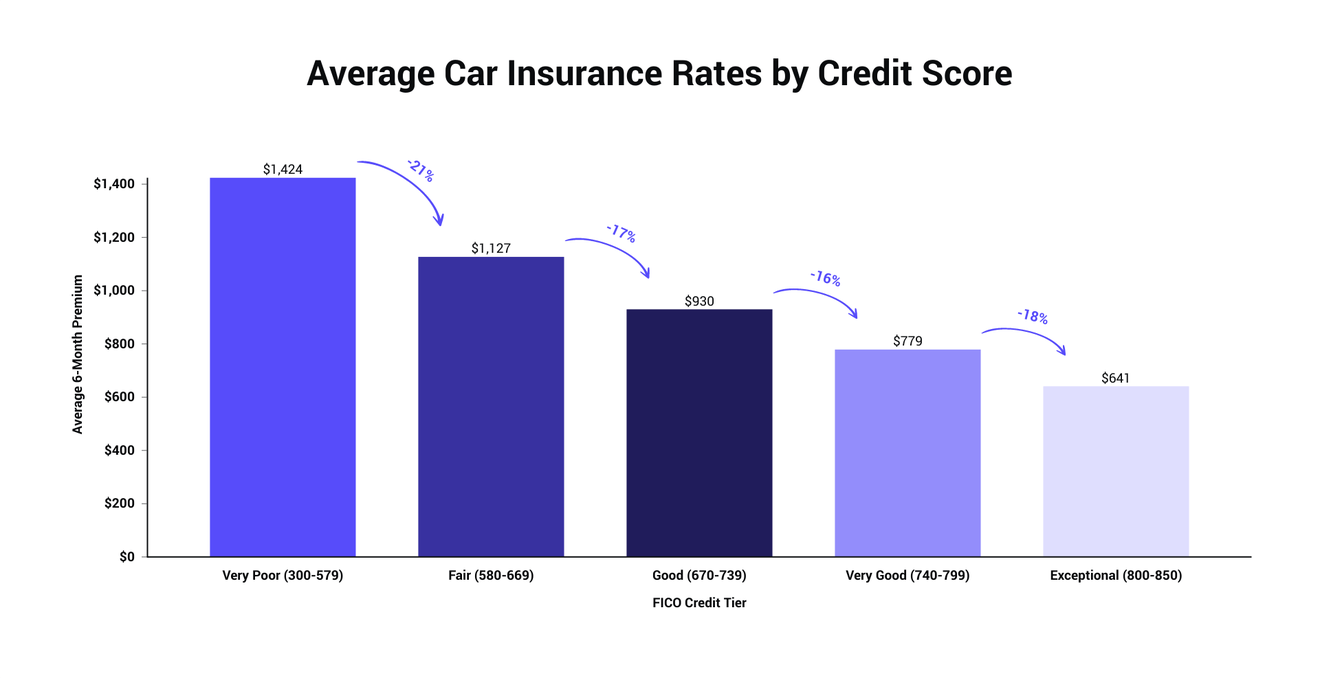

The average cost of car insurance can be affected by a variety of factors, including your age, driving record, car make and model, credit score, and more. Generally, younger drivers will pay more for car insurance than older drivers, as they are considered a higher risk. Drivers with a poor driving record may also pay more for car insurance, as they are also seen as a higher risk. The type of car you drive can also affect the cost of your car insurance, as some cars are more expensive to insure than others. Finally, your credit score can also affect the cost of car insurance, as insurance companies view drivers with good credit as less of a risk.

Tips for Lowering the Average Cost of Car Insurance

There are a few things you can do to lower the average cost of car insurance. First, consider raising your deductible. This can lower the cost of your monthly premiums. Also, consider shopping around and comparing quotes from multiple insurance companies to ensure you are getting the best rate. Additionally, consider bundling your car insurance with other types of insurance, such as home or life insurance. Finally, consider taking a defensive driving course, which could result in a discount on your car insurance.

What Are Some Alternatives to Car Insurance?

If you are looking for alternatives to car insurance, there are a few options. One option is to join a car-share program or carpool. This can reduce your overall mileage and thus lower your car insurance costs. Additionally, you can consider a pay-as-you-go insurance policy, which allows you to pay for your car insurance only when you use your car. Finally, you can consider a usage-based insurance policy, which is based on your driving behavior.

Conclusion

The average cost of car insurance per month can vary greatly depending on your specific situation. Factors like your age, driving record, car make and model, and credit score can all affect the cost of your car insurance. There are a few things you can do to lower the average cost of car insurance, such as raising your deductible, shopping around, bundling your insurance, and taking a defensive driving course. Additionally, there are alternatives to car insurance, such as car-share programs, pay-as-you-go insurance, and usage-based insurance.

The Best Average Cost Of Car Insurance 2022 - Dakwah Islami

ALL You Need to Know About the Average Car Insurance Cost

The average cost of car insurance in the US, from coast to coast

How Much Does Car Insurance Cost on Average? | The Zebra

The Average Auto Insurance Cost Per Month | The Lazy Site