Average Car Insurance Cost Colorado

Thursday, July 3, 2025

Edit

Average Car Insurance Costs in Colorado

Living in Colorado has its pros and cons, but one of the biggest advantages is the low cost of car insurance. The average car insurance cost in Colorado is much lower than in other states. In fact, Colorado has the fifth-lowest car insurance rates in the United States. In this article, we'll take a look at the average car insurance costs in Colorado, how they compare to other states, and what you can do to get the lowest rate possible.

Average Car Insurance Premiums in Colorado

According to the Insurance Information Institute, the average car insurance premium in Colorado is around $1,161 per year. This is significantly lower than the national average of $1,548. In fact, the average car insurance premium in Colorado is about 25% lower than the national average.

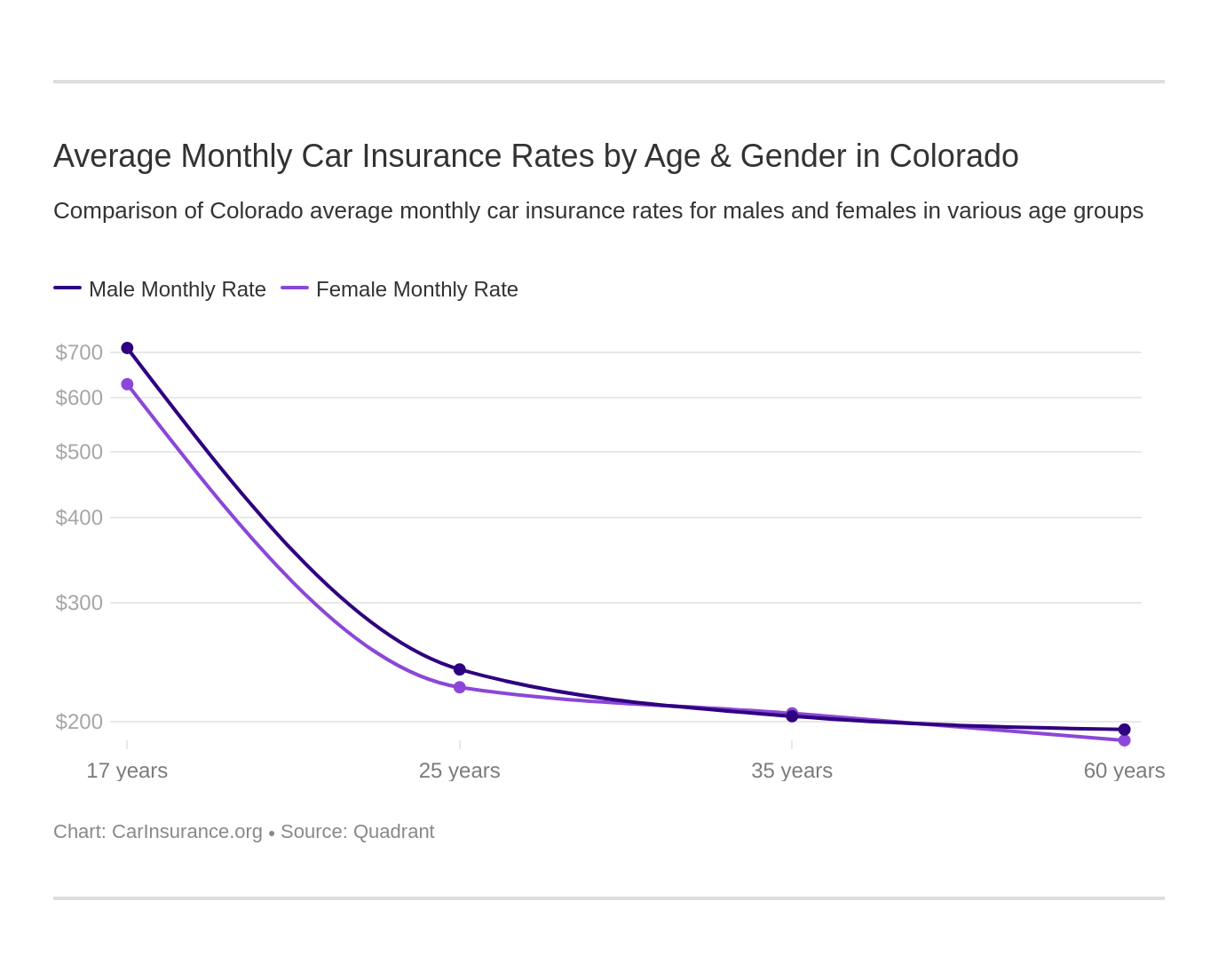

Car insurance premiums in Colorado are determined by a variety of factors, including your driving record, the type of vehicle you drive, and the amount of coverage you choose. The age and gender of the driver, as well as the driver's credit score, can also affect the cost of insurance.

Comparing Car Insurance Rates in Colorado

Colorado is one of the most affordable states for car insurance. In fact, the average car insurance premium in Colorado is about $400 lower than the national average. However, it's important to note that the cost of car insurance can vary significantly from one state to another.

In comparison to other states, Colorado's average car insurance premium is lower than the national average in all but six states. Colorado ranks fifth overall in terms of affordability, with only Utah, Idaho, Maine, and Virginia having lower rates.

Factors That Affect Car Insurance Rates in Colorado

Car insurance premiums in Colorado are determined by a variety of factors, including your driving record, the type of vehicle you drive, and the amount of coverage you choose. The age and gender of the driver, as well as the driver's credit score, can also affect the cost of insurance.

Insurance companies also use a variety of other factors to determine the cost of car insurance in Colorado. The type of car you drive, the amount of miles you drive each year, and your location can all affect the cost of car insurance. Additionally, insurance companies may also consider your driving experience and whether or not you have had any previous accidents or violations.

Tips for Finding the Lowest Car Insurance Rates in Colorado

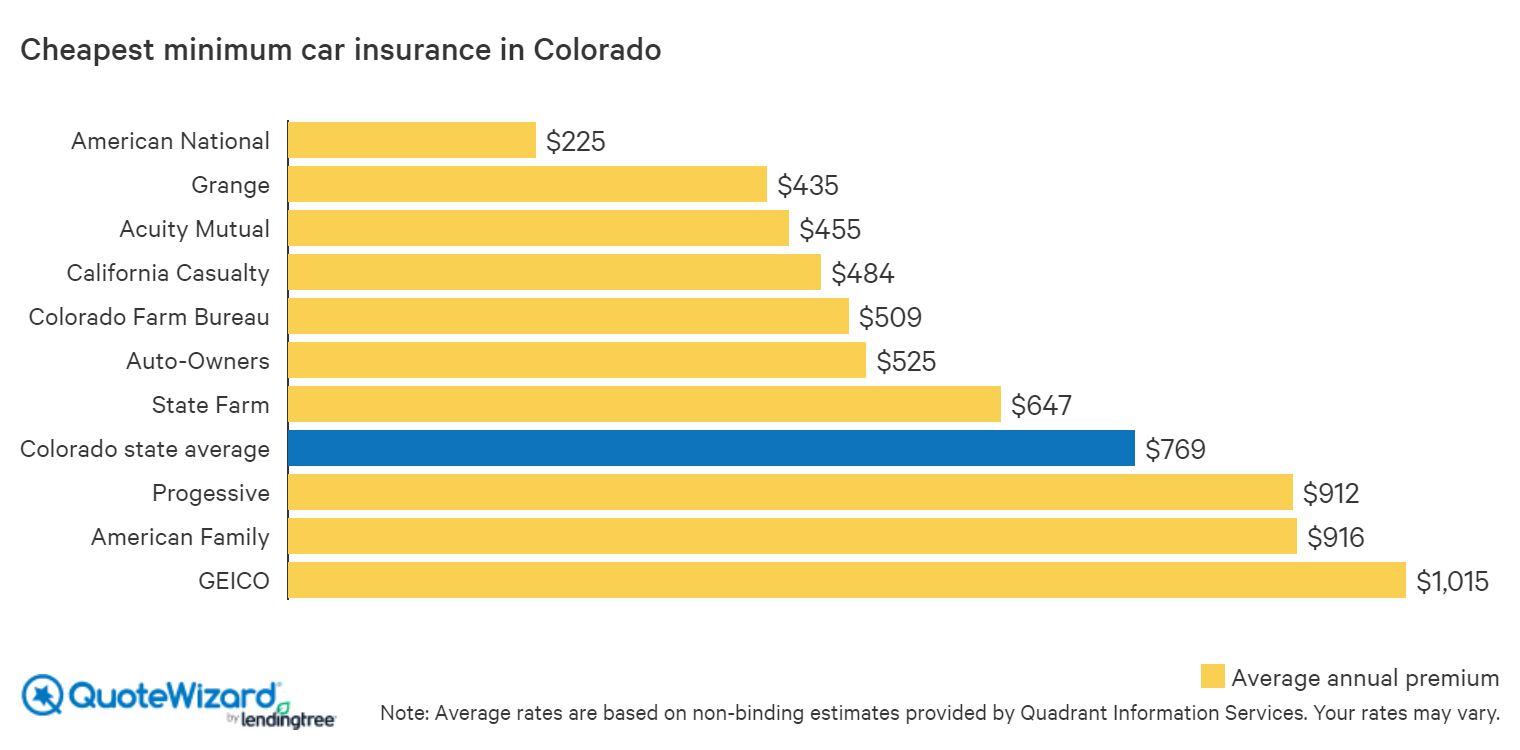

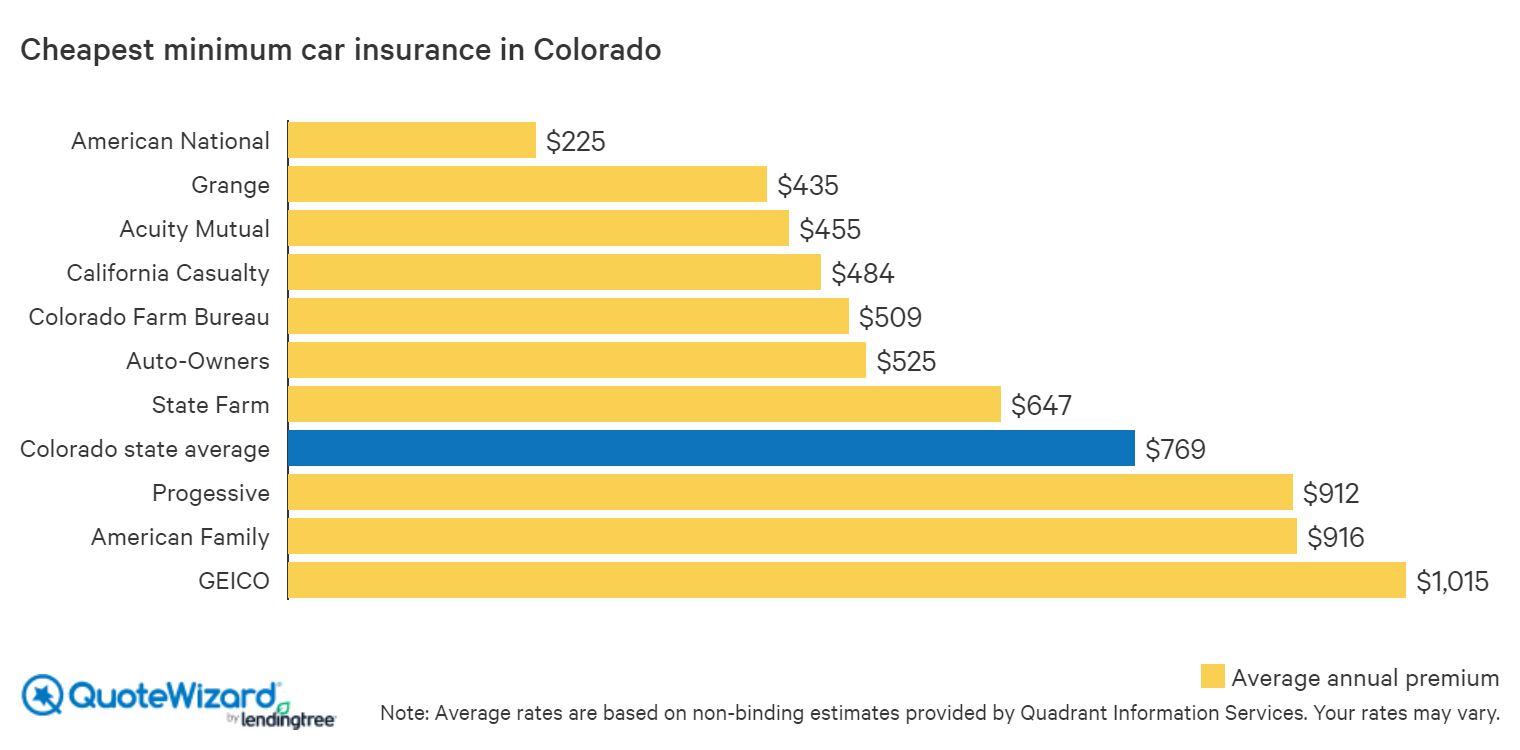

If you're looking for the lowest car insurance rates in Colorado, there are a few tips you can follow. First, make sure you're comparing rates from multiple car insurance companies. You can also consider bundling your car insurance with your home or renters insurance to get a discount. Additionally, you may be able to save money by raising your deductible or by opting for a higher deductible on certain coverages.

You can also take steps to make yourself a lower risk to insurers. This includes maintaining a clean driving record, keeping your vehicle in good condition, and taking a defensive driving course. Finally, you can shop around for the best rates by using an online comparison tool.

Conclusion

The average car insurance cost in Colorado is much lower than in other states. Colorado ranks fifth overall in terms of affordability, with only Utah, Idaho, Maine, and Virginia having lower rates. If you're looking for the lowest car insurance rates in Colorado, there are a few tips you can follow, including comparing rates from multiple companies, bundling your insurance policies, and taking steps to make yourself a lower risk to insurers. By following these tips, you can find the lowest car insurance rates in Colorado.

Cheap Auto Insurance Colorado / Car Insurance Rates By State 2020 Most

Colorado – CarInsurance.org

The Average Cost of Car Insurance in Lakewood, CO, is $1,126

What's the Average Auto Insurance Cost Per Month? | The Lazy Site

Who Has The Cheapest Auto Insurance Quotes in California? (2018