Average Auto Insurance Cost Per Month Texas

Average Auto Insurance Cost Per Month in Texas

When it comes to auto insurance, Texas drivers have a lot of options. With so many different companies, policies, and coverage options, it can be difficult to determine the average auto insurance cost per month in Texas. Fortunately, there are a few factors you can consider that will help you get a better idea of the average cost of auto insurance in the Lone Star State.

Factors That Affect Auto Insurance Costs in Texas

The average cost of auto insurance in Texas will depend on several factors, including the type of vehicle you drive, your age, your driving history, and the coverage you choose. Other factors that can affect the cost of auto insurance in Texas include the area where you live, the type of insurance you purchase, and the deductible you choose.

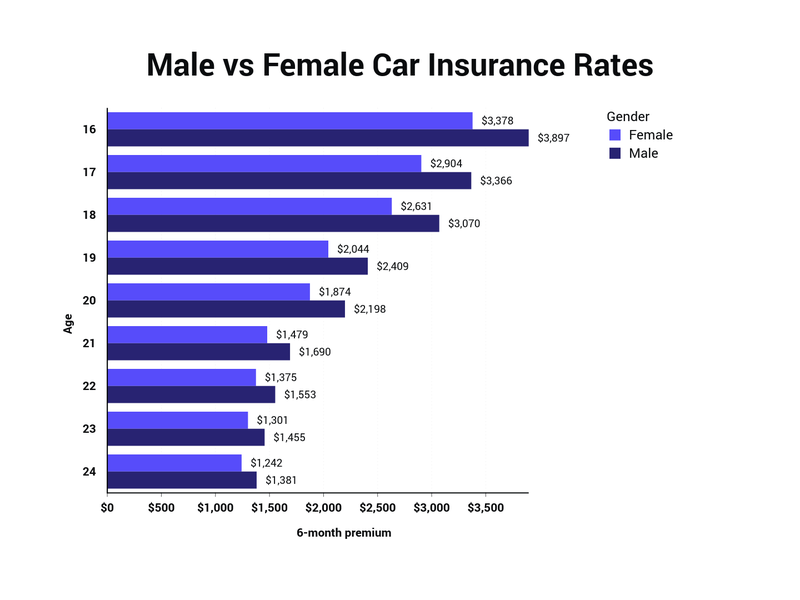

The type of vehicle you drive is an important factor in determining the average cost of auto insurance. Generally, vehicles with higher safety ratings will be cheaper to insure than those with lower ratings. Your age is also an important factor in determining the cost of auto insurance. Generally, young drivers will pay more for auto insurance than older drivers.

Your driving history is also a factor in determining the cost of auto insurance. Drivers with a history of speeding tickets or other moving violations will often pay more for auto insurance than those with a clean driving record. The coverage you choose will also affect the cost of your auto insurance. Liability coverage is typically the most affordable type of coverage, while comprehensive coverage is more expensive.

Average Auto Insurance Cost Per Month in Texas

The average cost of auto insurance per month in Texas is $117. This is based on a full coverage policy with a $500 deductible. However, the exact cost of auto insurance in Texas will vary depending on the factors mentioned above. For example, young drivers and those with a history of moving violations will typically pay more for auto insurance than older drivers and those with a clean driving record.

Tips for Finding the Best Auto Insurance Rates in Texas

If you are looking for the best auto insurance rates in Texas, there are a few tips that can help. First, make sure you shop around for the best rates. Different insurance companies may offer different rates for the same coverage, so it’s important to compare quotes from several companies to ensure you get the best rate. Second, consider raising your deductible. Increasing your deductible can help lower your monthly premium payments.

Finally, consider purchasing additional coverage. Adding additional coverage such as comprehensive or collision coverage can help protect you in the event of an accident. Although it may cost more upfront, the added protection may be worth the extra cost in the long run. By following these tips, you can help ensure you get the best auto insurance rates in Texas.

Average Cost Of Car Insurance For 19 Year Old Female - Car Retro

Average Monthly Car Insurance Payment / Texas Car Insurance

Average Monthly Car Insurance Payment / Texas Car Insurance

Average Cost of Car Insurance (2019) | Average Cost of Insurance

Average Car Insurance Rates by Age and Gender Per Month