20 Good To Go Auto Insurance

20 Good To Go Auto Insurance Companies

What is Good To Go Auto Insurance?

Good To Go Auto Insurance is a special type of insurance that provides coverage to drivers who have been labeled a high-risk driver, either due to their age, their driving record, or other factors. Good To Go Auto Insurance is a great way for high-risk drivers to still get the protection they need when they’re behind the wheel. It’s also a great way for drivers to get the coverage they need at a price they can afford.

Which Companies Offer Good To Go Auto Insurance?

There are a number of companies that offer Good To Go Auto Insurance, and each company has its own set of rules and regulations. Some of the most popular companies that offer Good To Go Auto Insurance include Progressive, Geico, State Farm, and Allstate. Each of these companies has a variety of different coverage options, so it’s important to compare them to find the best deal. Additionally, some of these companies offer discounts to drivers who have clean driving records.

How Much Does Good To Go Auto Insurance Cost?

The cost of Good To Go Auto Insurance varies depending on the company. Generally, high-risk drivers can expect to pay more than drivers with clean driving records. However, there are a number of discounts available to drivers who have clean driving records. Additionally, some companies offer discounts to drivers who bundle their auto insurance with other policies such as homeowners or renters insurance.

What Does Good To Go Auto Insurance Cover?

Good To Go Auto Insurance provides coverage for both bodily injury and property damage. This means that if you were to cause an accident, your insurance would cover the costs associated with any injuries or damage to property. Additionally, Good To Go Auto Insurance provides coverage for medical payments, which covers the cost of medical bills for you and your passengers.

Do I Need Good To Go Auto Insurance?

If you’re considered a high-risk driver, then it’s important to have Good To Go Auto Insurance. This type of insurance provides the protection you need while you’re behind the wheel, and it can also help you get the coverage you need at a price you can afford. However, if you have a clean driving record and don’t consider yourself a high-risk driver, then you may be able to get a better deal on traditional auto insurance.

Conclusion

Good To Go Auto Insurance is a great way for high-risk drivers to get the protection they need while they’re behind the wheel. There are a number of companies that offer this type of insurance, and each company has its own set of rules and regulations. Additionally, the cost of Good To Go Auto Insurance varies depending on the company, but there are a number of discounts available. Ultimately, Good To Go Auto Insurance is a great way for high-risk drivers to still get the coverage they need at a price they can afford.

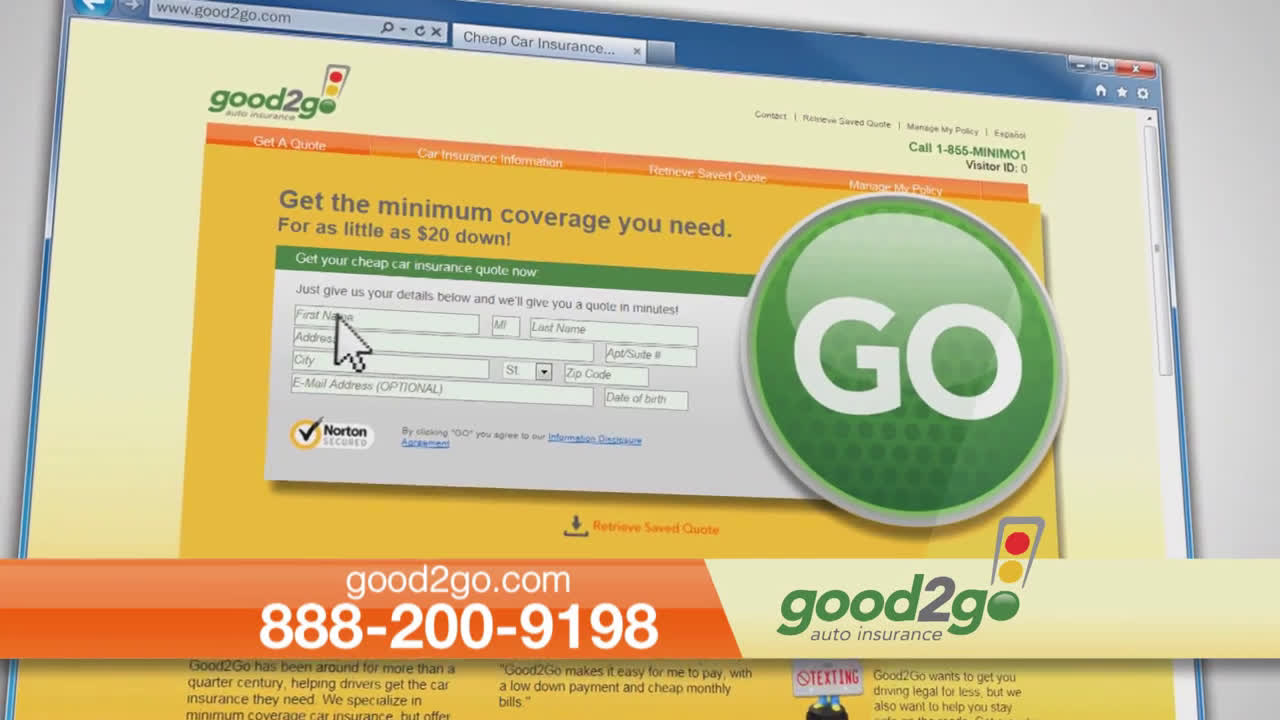

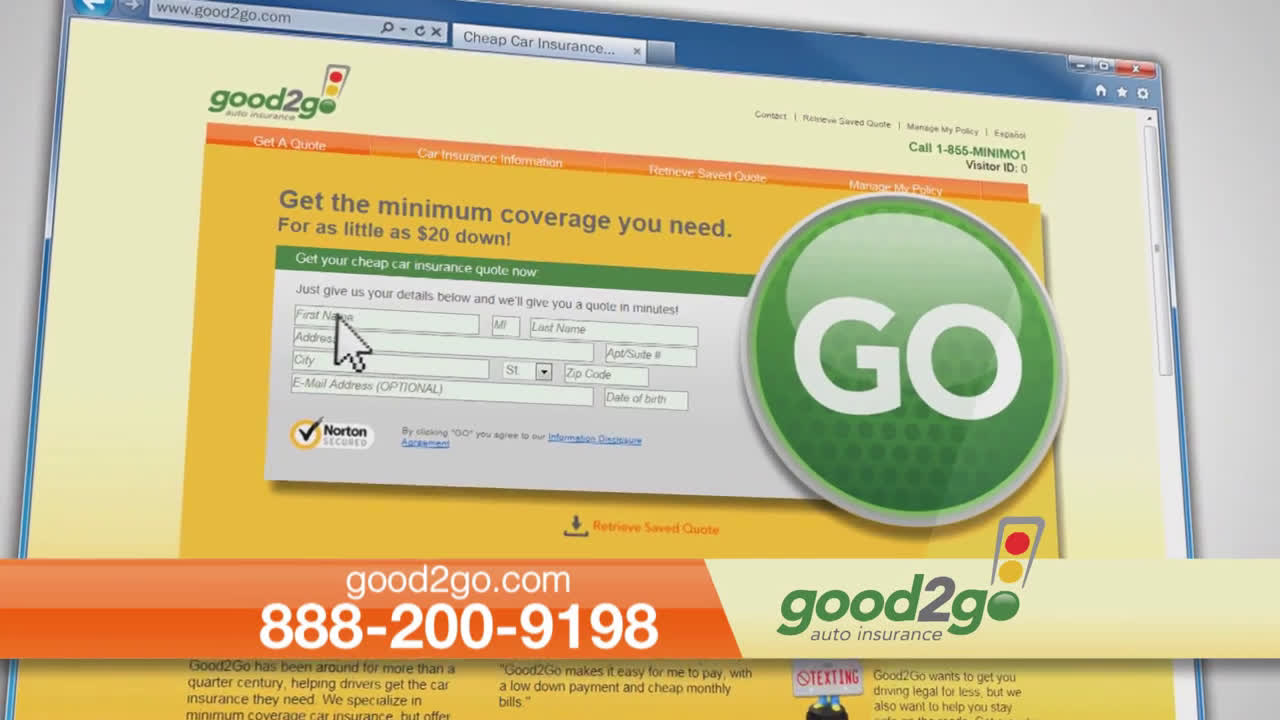

Good2go Need Car Insurance Get It From As Little As $20 Down Ad

Good2Go Auto Insurance - Minimum Coverage As Little As $20 Down - YouTube

Good2Go Car Insurance Review [The Complete Guide]

![20 Good To Go Auto Insurance Good2Go Car Insurance Review [The Complete Guide]](https://res.cloudinary.com/quotellc/image/upload/insurance-site-images/aiorg-live/727b22f0-good2go-homepage.png)

Good To Go Auto Insurance Number in 2021 | Car insurance, Insurance