Which Long Term Care Insurance Statement Is True

Sunday, June 29, 2025

Edit

Long Term Care Insurance: What You Need to Know

Long term care insurance is becoming an increasingly popular option for people who want to secure their financial future when it comes to their health and wellbeing. But with so much conflicting information out there, it’s hard to know what’s true and what’s not. In this article, we will look at some key points you need to know about long term care insurance to help you decide if it’s the right option for you.

What is Long Term Care Insurance?

Long term care insurance is a type of insurance policy that provides financial coverage for individuals who need long-term care services. These services can include skilled nursing care, home health care, personal care, and other related services. Long term care insurance allows individuals to receive care without depleting their savings, allowing them to maintain their independence and quality of life for as long as possible.

Who Should Consider Long Term Care Insurance?

Long term care insurance is a good option for anyone who wants to secure their financial future and make sure they have the resources to pay for long-term care services. While it’s true that Medicare and Medicaid can provide coverage for some services, they don’t cover all of the services that may be needed. Long term care insurance can provide the coverage needed to ensure that all necessary services are covered.

What Does Long Term Care Insurance Cover?

Long term care insurance policies vary, but most cover a variety of services. These can include skilled nursing care, home health care, personal care, and other related services. Some policies may also cover the cost of medical equipment, such as wheelchairs and walkers, as well as respite care and adult day care. The coverage provided by the policy will depend on the policy itself, so it’s important to read the policy carefully to make sure it covers the services that may be needed.

How Much Does Long Term Care Insurance Cost?

The cost of long term care insurance will vary depending on the policy, but it is typically based on the age and health of the individual. Generally, the younger and healthier an individual is, the lower the cost of the policy. It’s also important to remember that the cost of long term care insurance may increase over time as the individual gets older.

How Can I Get Long Term Care Insurance?

Long term care insurance is typically available through private insurance companies. It is important to shop around and compare policies to make sure you are getting the best coverage for your needs. It is also important to make sure you understand the terms and conditions of the policy before signing up. Some policies may have restrictions on the type of care that is covered, so it’s important to read the policy carefully to make sure it covers the services that may be needed.

The Bottom Line

Long term care insurance is an important option for anyone who wants to secure their financial future and make sure they have the resources to pay for long-term care services. It is important to shop around and compare policies to make sure you are getting the best coverage for your needs, and it’s important to read the policy carefully to make sure it covers the services that may be needed. With the right policy, long term care insurance can provide the coverage needed to ensure that all necessary services are covered.

Unum Long Term Care Claim Form - Fill Online, Printable, Fillable

Compare Long-Term Care Insurance Policies

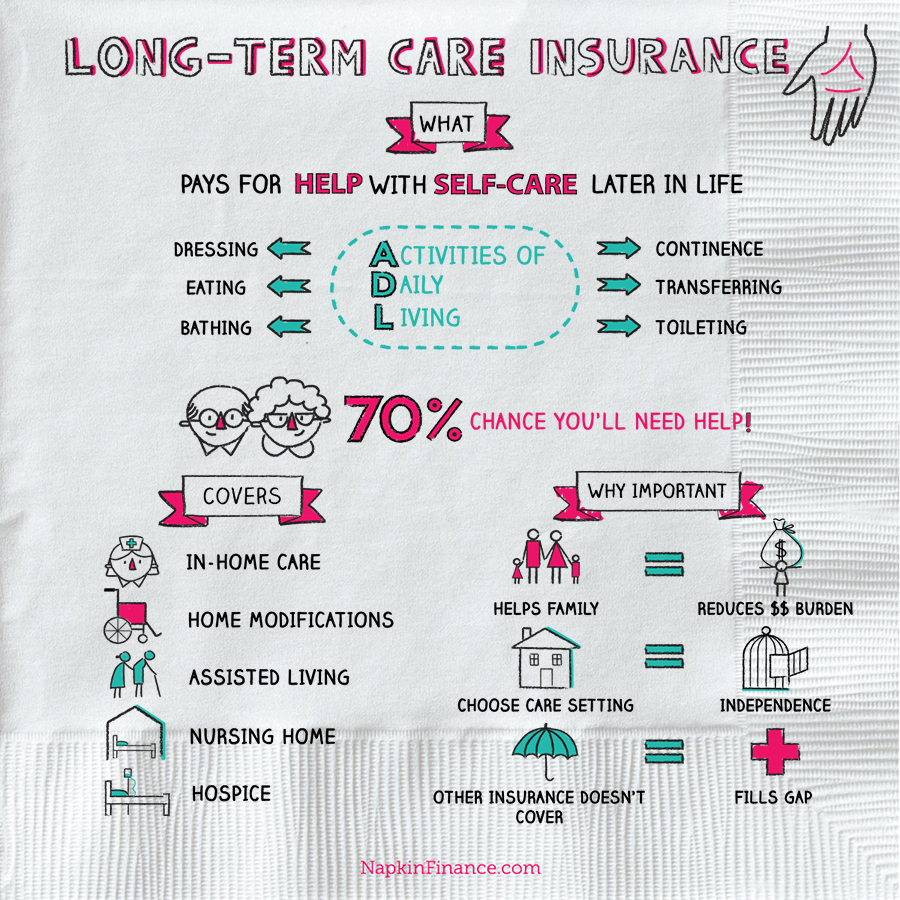

Pin on Best Infographics

Long Term Care Insurance - Napkin Finance

PPT - LONG TERM CARE INSURANCE PowerPoint Presentation, free download