What Is The Average Cost For Full Coverage Car Insurance

What Is The Average Cost For Full Coverage Car Insurance?

Understanding The Different Types of Insurance Coverage

When it comes to car insurance, there are many different types of coverage available. Knowing the different types of coverage and understanding what is included in each will help you to determine what is the average cost for full coverage car insurance. In general, most states require drivers to have at least liability coverage, which covers you if you cause an accident. Liability coverage pays for the other person’s medical bills, property damage, and other costs associated with the accident. It does not pay for the damage to your own vehicle.

In addition to liability coverage, there are other types of coverage you can purchase. Comprehensive coverage provides protection for your vehicle in cases of theft, fire, and other types of damage. Collision coverage pays for damage to your vehicle that is caused by an accident with another vehicle. Uninsured/underinsured motorist coverage covers you in the event that another driver does not have enough insurance to cover your costs.

Factors That Affect The Cost of Full Coverage Car Insurance

The average cost for full coverage car insurance is dependent on several factors including your age, driving record, the type of vehicle you drive, the amount of coverage you need, and the state where you live. Generally, younger drivers pay more for insurance than older drivers because they are considered to be a higher risk. Drivers with a poor driving record will also pay more for insurance than those with a clean record. The type of vehicle you drive can also affect the cost of insurance; luxury vehicles, SUVs, and sports cars tend to be more expensive to insure than regular passenger cars.

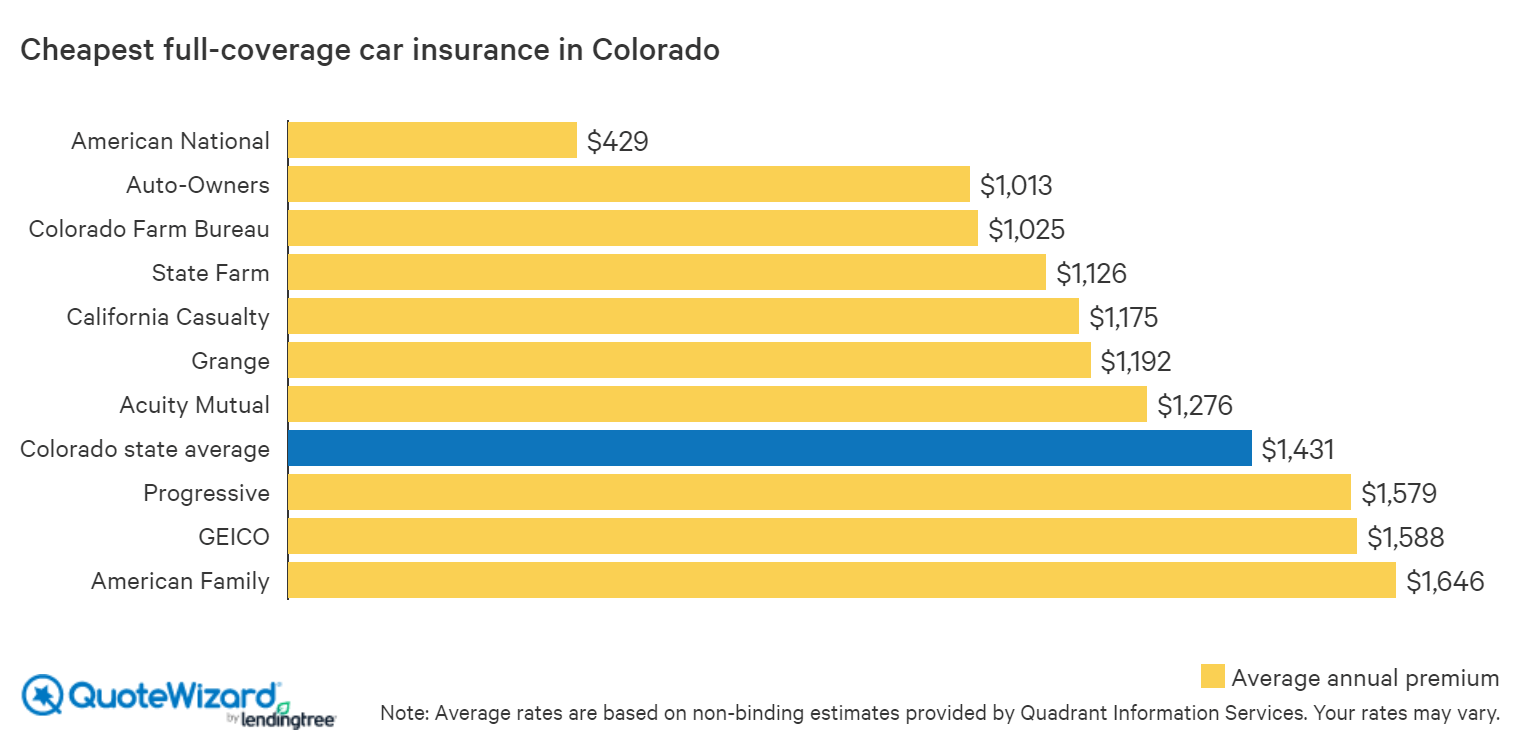

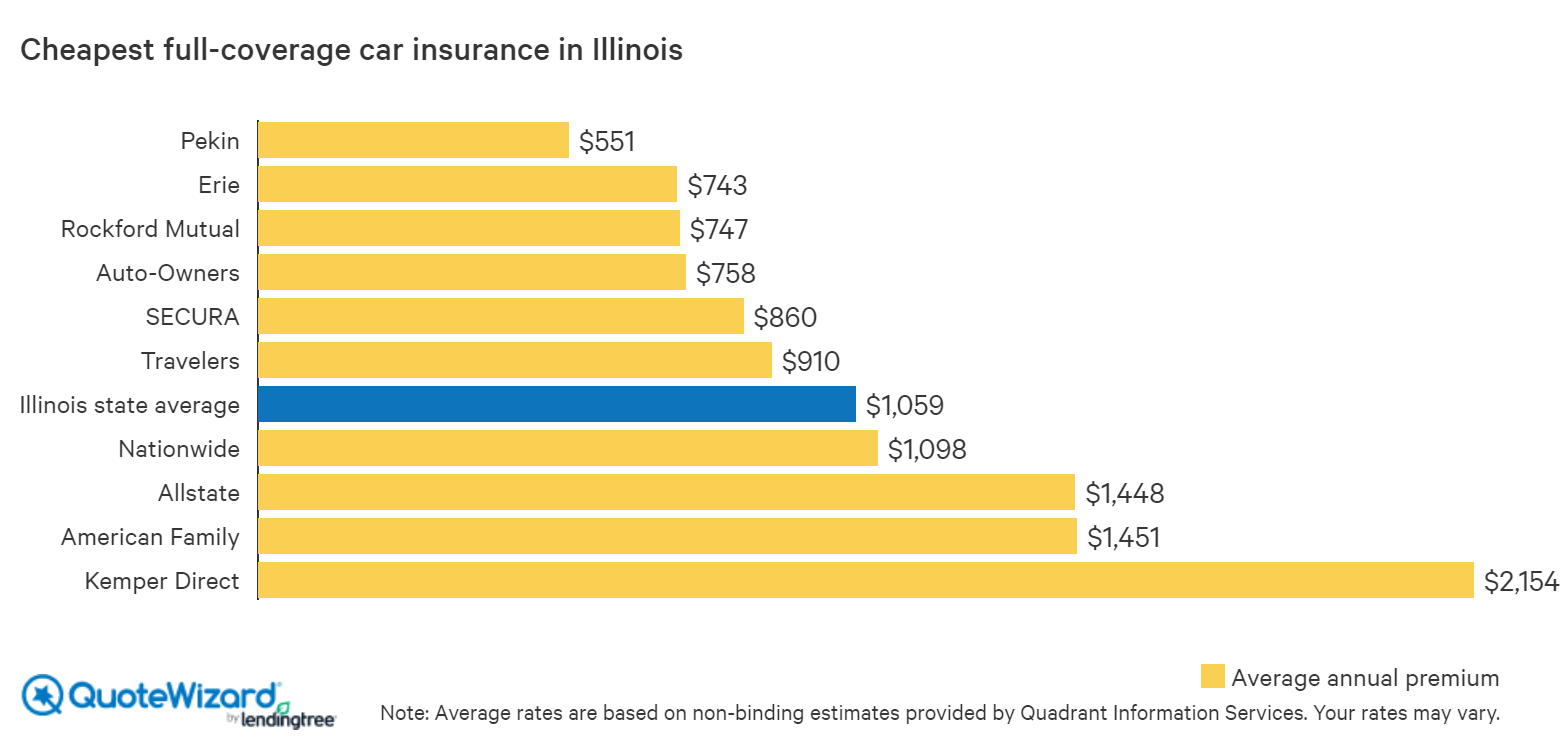

The amount of coverage you need will also affect the cost of your insurance. The more coverage you have, the more you will pay for your insurance. The state where you live can also affect the cost of insurance, as some states have higher premiums than others. In addition, the insurer you choose can affect the cost of your coverage, as some insurers offer discounts for certain types of drivers.

How To Get The Best Price For Full Coverage Car Insurance

When shopping for full coverage car insurance, it is important to compare quotes from several different companies. Different insurers may offer different rates for the same coverage, so it is important to compare quotes to ensure you are getting the best rate. Additionally, many insurance companies offer discounts for certain types of drivers, such as those who drive fewer miles or maintain a good driving record. It is also important to consider the deductibles you choose. Higher deductibles mean lower premiums, but they also mean more out-of-pocket costs if you are in an accident.

It is also important to consider the customer service of the insurance company you choose. Read customer reviews to find out how responsive and helpful the insurer is in the event of a claim. Lastly, make sure you understand the terms and conditions of your policy before signing any contracts.

Conclusion

The average cost for full coverage car insurance can vary greatly depending on several factors, including your age, driving record, the type of vehicle you drive, the amount of coverage you need, and the state where you live. It is important to compare quotes from multiple companies to ensure you are getting the best rate for your coverage. Additionally, consider the customer service of the insurer, the deductibles you choose, and the terms and conditions of your policy before signing any contracts.

Cheap Car Insurance in North Carolina | QuoteWizard

What is No-Fault Insurance and How Does it Work? | QuoteWizard

The average cost of car insurance in the US, from coast to coast

Find Cheap Car Insurance in Illinois | QuoteWizard

What Is The Average Price Of Full Coverage Car Insurance