Rsa Car Insurance Claim Form

RSA Car Insurance Claim Form

What is an RSA Car Insurance Claim Form?

RSA car insurance claim forms are documents that are used to file an insurance claim with the Royal & Sun Alliance (RSA) insurance company. The form must be completed and submitted to RSA in order to process the claim. The form is usually completed online, but can also be completed and submitted in hard copy. The form covers all the necessary details regarding the incident, including the date, time, and place of the incident, as well as the specifics of the vehicle involved and the personal details of the claimant.

What Information is Required for an RSA Car Insurance Claim Form?

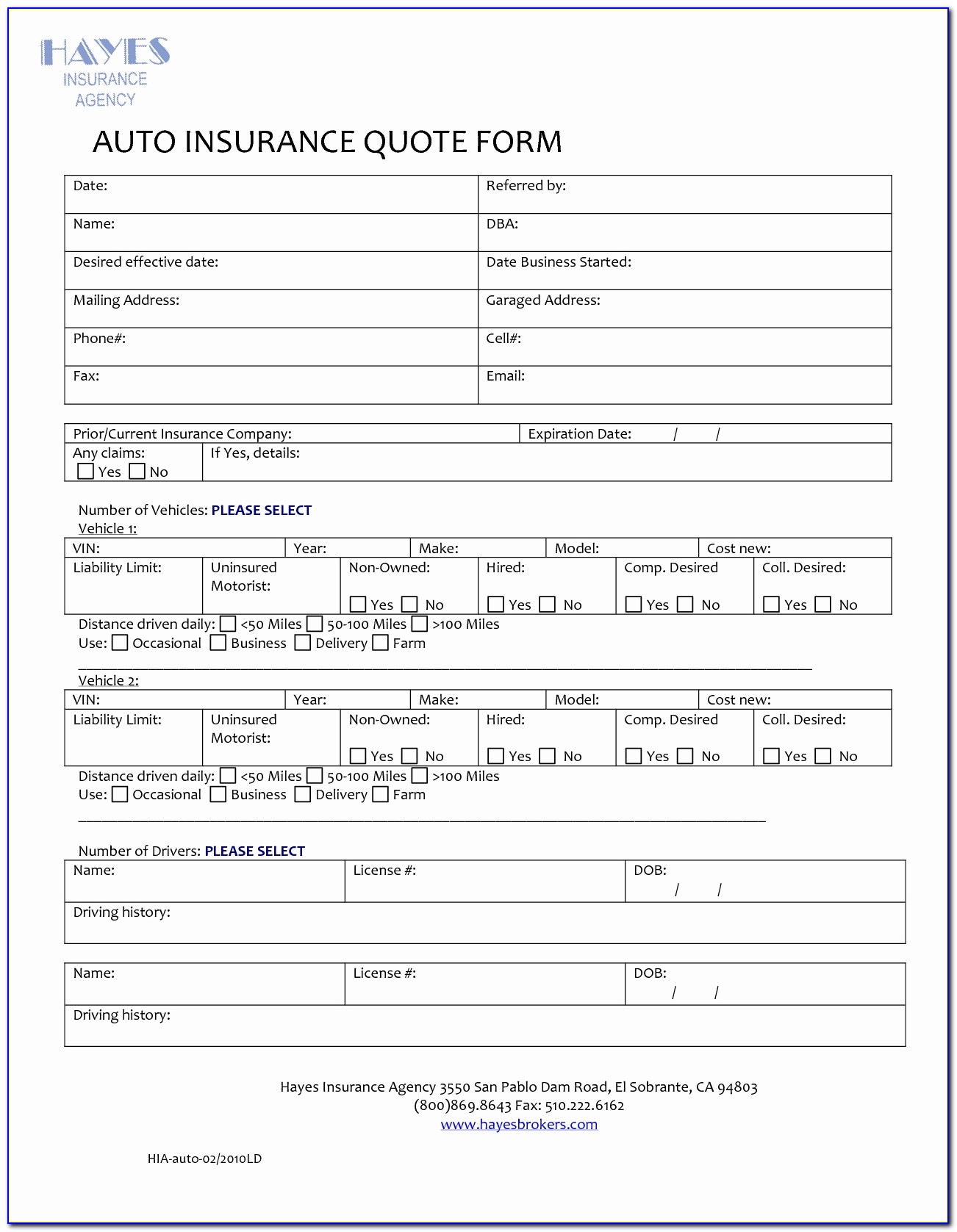

RSA car insurance claim forms require a wide range of information from the claimant in order to process the claim. The information required includes personal details of the claimant, such as their name, address, and contact information. Additionally, the claimant must also provide details regarding the incident, such as the time and place of the incident, as well as the specifics of the vehicle involved. The claimant must also provide details on the type of claim they are making, such as whether it is a collision or a comprehensive claim.

What is the Process for Submitting an RSA Car Insurance Claim Form?

The process for submitting an RSA car insurance claim form is relatively straightforward. The claimant must first complete the form, ensuring that all details are accurate and complete. Once the form has been completed, it must be submitted to RSA either online or through the post. RSA will then assess the claim and determine whether or not it will be approved. If the claim is approved, RSA will contact the claimant with further instructions on how to proceed and what documentation is required.

What is the Timeframe for Processing an RSA Car Insurance Claim Form?

The timeframe for processing an RSA car insurance claim form varies depending on the complexity of the claim and the amount of information that is required. Generally, RSA aims to process claims within 10-14 days of receipt of the claim form. However, if the claim is particularly complex or requires additional information, this timeframe may be extended. In such instances, RSA will contact the claimant with an update on the timeframe for processing the claim.

What Should a Claimant Do If They Need Assistance With Completing an RSA Car Insurance Claim Form?

If a claimant needs assistance with completing an RSA car insurance claim form, they can contact RSA directly for assistance. RSA has a dedicated customer service team that is available to answer any questions that the claimant may have regarding the completion of the form. Additionally, RSA also provides a range of online resources that can help claimants to understand the process and complete the form accurately.

What Happens After an RSA Car Insurance Claim Form is Submitted?

Once an RSA car insurance claim form is submitted, RSA will begin to assess the claim and determine whether or not it will be approved. If the claim is approved, RSA will contact the claimant with further instructions on how to proceed and what documentation is required. If the claim is not approved, RSA will also contact the claimant with an explanation as to why the claim was not approved.

Rsa online claim form v1 16 03 2016 by Your Homes Newcastle - Issuu

DHFL CLAIM FORM | Vehicle Insurance | Insurance

Car Accident Claim Release Form - Form : Resume Examples #JxDNMqXkN6

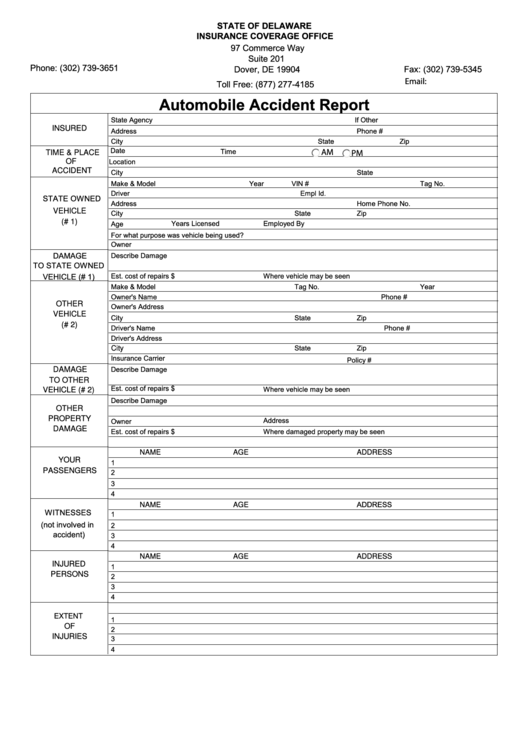

Fillable Automobile Accident Report Form - Insurance Coverage Office

Car Insurance Claim Form Pdf - Insurance Forms