Malaysia Car Insurance Price Third Party

Malaysia Car Insurance Price Third Party

Car insurance is one of the most important investments you can make for your vehicle. In Malaysia, third party car insurance is mandatory for all vehicles on the road. Third party insurance covers you against any legal liabilities that may arise from an accident which causes loss or damage to other people's property or injury/death to other persons. In addition, it also covers any legal costs incurred by you if you are sued for any legal issues related to an accident.

In Malaysia, the third party car insurance is handled by the Insurance Commission of Malaysia (ICM). This government body is responsible for overseeing the insurance industry and making sure that insurance companies comply with the regulations set by the government. The ICM works with the insurance companies to ensure that the premiums charged for third party car insurance are fair and reasonable.

When it comes to third party car insurance, the premiums may vary depending on the make and model of the car, the age of the driver, the coverage chosen and the area in which the car is driven. Generally, the premiums for third party car insurance tend to be higher than those for other types of insurance, such as comprehensive insurance. However, it is important to compare the different premiums offered by different insurance companies in order to get the best deal.

How to Calculate Third Party Car Insurance Premium in Malaysia

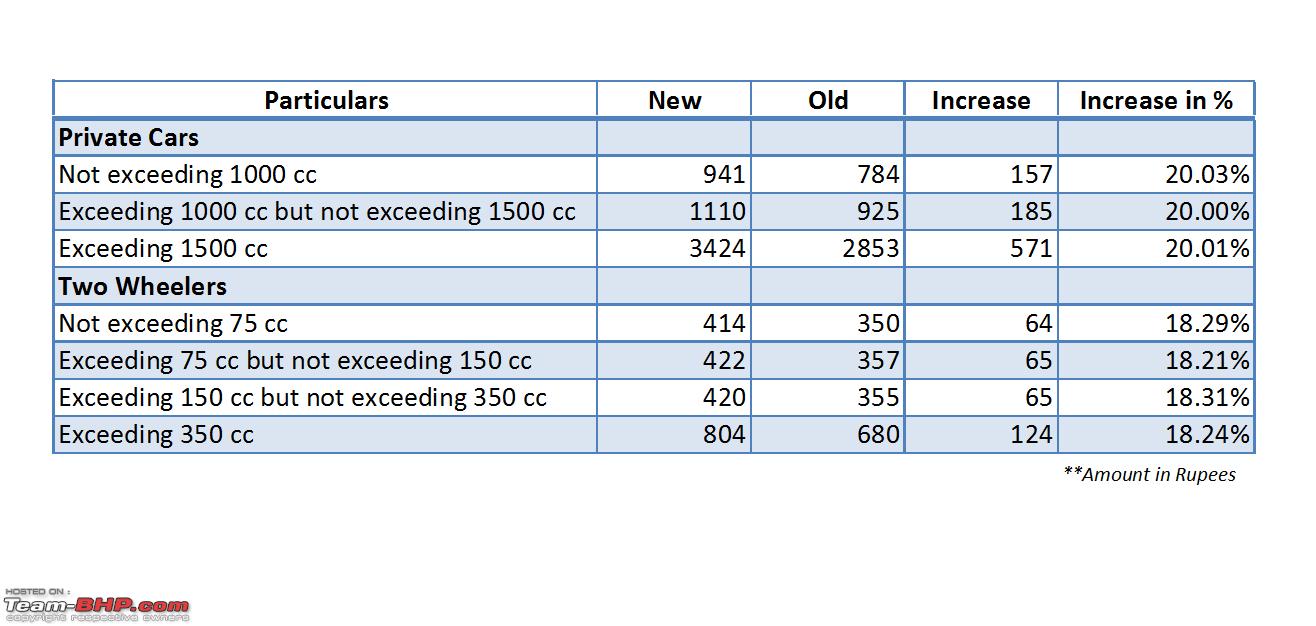

The premium for third party car insurance is determined by the ICM and can be calculated based on the type of coverage chosen, the make and model of the car and the age of the driver. The premium can also vary depending on the area in which the car is driven, as the risk of an accident is higher in certain areas. Generally, the younger the driver, the higher the premium. This is because younger drivers are seen as more likely to be involved in an accident.

There are also certain discounts that may be available for drivers, such as those who have taken a defensive driving course or those who have a good driving record. These discounts can help to reduce the overall premium for third party car insurance.

Conclusion

Third party car insurance is an important investment for any vehicle in Malaysia and is mandatory by law. The premiums for third party car insurance can vary depending on the type of coverage chosen, the make and model of the car, the age of the driver and the area in which the car is driven. It is important to compare the different premiums offered by different insurance companies in order to get the best deal.

Car Insurance Online Malaysia - Asuransi Terjamin 2022

Third Party Insurance Premium to go up W.e.f 1st April 2013 - Team-BHP

FAQs

Third Party Insurance: Online Car & Bike Insurance -COCO by DHFL GI

What Is Third-party Insurance?