Liability Insurance Vs Full Coverage

Liability Insurance vs. Full Coverage – What’s Right for You?

What is Liability Insurance?

Liability insurance is a type of insurance policy that provides coverage for legal expenses related to injuries or property damage caused by you or your employees. It is an important type of insurance that people often purchase as part of their auto, home, or business insurance policy. Liability insurance helps protect you financially if someone else makes a claim against you, such as in the case of an auto accident. In most cases, liability insurance will pay for legal costs associated with defending against a claim, as well as any damages or settlements that may be assessed.

What is Full Coverage?

Full coverage is an insurance term used to describe a package of coverage that includes liability insurance as well as other types of coverage, such as collision, comprehensive, and personal injury protection. A full coverage policy is typically more expensive than a liability-only policy, but it provides you with more protection against potential losses. For example, if you are involved in an accident that is your fault, a full coverage policy may help to pay for repairs to your vehicle, as well as any medical expenses incurred by the other party.

Which One is Right for You?

Whether you choose a liability-only policy or a full coverage policy will depend on your individual needs and risk tolerance. If you have a newer car and can afford to carry more coverage, a full coverage policy may be the right choice for you. However, if you are looking for an affordable option that will cover the basics, a liability-only policy may be the way to go. Ultimately, it’s important to consider all of your options and make an informed decision that works for you and your budget.

What are the Benefits of Full Coverage?

Full coverage policies tend to be more expensive than liability-only policies, but they also provide more protection. A full coverage policy will provide you with protection against a wider range of risks, including damage to your vehicle, theft, and injury to yourself or other parties involved in an accident. Additionally, full coverage policies typically include additional benefits, such as roadside assistance, rental car reimbursement, and towing coverage.

What are the Drawbacks of Full Coverage?

The biggest drawback of full coverage policies is the cost. Full coverage policies tend to be more expensive than liability-only policies, so if you’re on a tight budget, you may want to consider a liability-only policy. Additionally, full coverage policies may not provide adequate protection for certain types of losses. For example, if you are involved in an accident with an uninsured or underinsured driver, you may be responsible for some of the costs.

Conclusion

Liability insurance and full coverage are both important types of insurance coverage, and the right choice for you will depend on your individual needs and risk tolerance. Liability insurance provides basic protection against legal expenses related to injuries or property damage caused by you, while full coverage policies provide additional protection against a wider range of risks. Before making a decision, it’s important to consider all of your options and make an informed decision that works for you and your budget.

Liability insurance vs full coverage - insurance

Page for individual images - QuoteInspector.com

Liability vs. Full Coverage: Which Auto Insurance Do You Need? - Clark

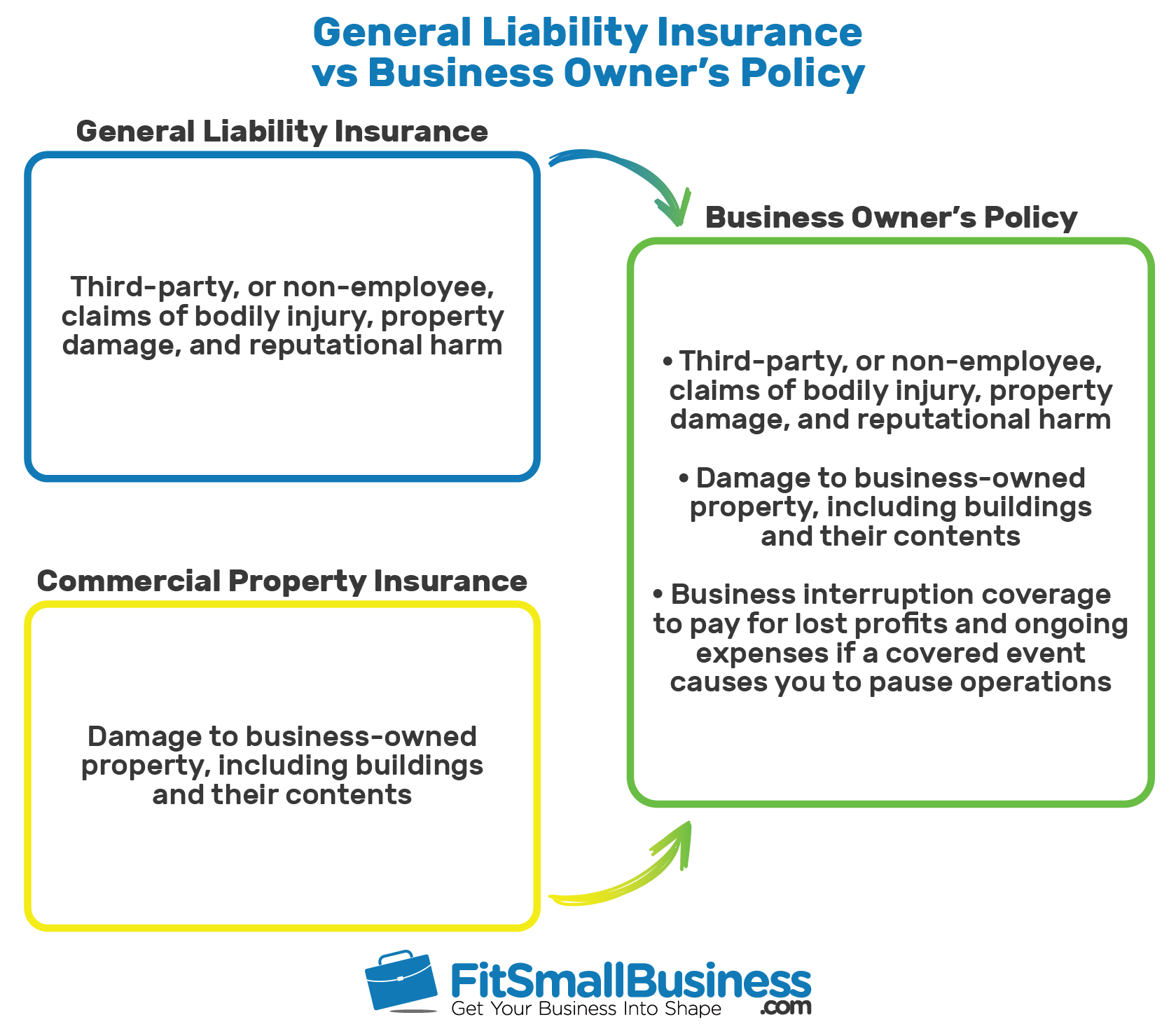

General Liability Insurance vs Business Owner’s Policy