Is A Rebuilt Title Bad For Insurance

Tuesday, June 3, 2025

Edit

Is A Rebuilt Title Bad For Insurance?

What Does Rebuilt Title Mean?

A vehicle with a rebuilt title has been in a severe accident, declared a total loss by an insurance company, and a salvaged title has been issued. In order to get the vehicle back on the road, it was repaired, inspected and issued a rebuilt title. The rebuilt title indicates that the vehicle is now safe to be driven on the roads.

When a vehicle has a rebuilt title, it means that the vehicle was previously declared as a total loss and was issued a salvaged title, indicating that it had suffered significant damage. The vehicle was then repaired and inspected and given a rebuilt title.

What Does Insurance Consider For Rebuilt Title?

Insurance companies consider several factors when determining whether to insure a vehicle with a rebuilt title. They will typically look at the amount of damage to the vehicle, the extent of the repairs, and the age and condition of the vehicle.

The amount of damage to the vehicle is important to consider. If the vehicle has sustained extensive damage, it may be difficult to insure as the repairs may not be sufficient to make it safe to drive. Additionally, if the repairs were not done properly, the vehicle may be unsafe to drive.

The extent of the repairs is also important for insurance companies to consider. If the repairs are extensive and costly, the insurance company may be reluctant to insure the vehicle. Additionally, if the repairs were not done by a qualified and experienced mechanic, the insurance company may be hesitant to insure the vehicle.

Finally, the age and condition of the vehicle will also be taken into account. If the vehicle is older, it may be more difficult to insure, as the repairs may be more costly and the vehicle may be more likely to experience mechanical problems.

Is A Rebuilt Title Bad For Insurance?

A vehicle with a rebuilt title can be more difficult to insure than a vehicle with a clean title. The insurance company may be more reluctant to insure the vehicle due to the amount of damage, the extent of the repairs, and the age and condition of the vehicle.

It is also possible that the insurance premiums for a vehicle with a rebuilt title may be higher than for a vehicle with a clean title. This is because the insurance company may view the vehicle as more of a risk and may charge higher premiums to offset this risk.

However, in some cases, it is possible to get insurance for a vehicle with a rebuilt title. Generally, if the vehicle is in good condition, the repairs were done properly, and the vehicle is not too old, it may be possible to get insurance for the vehicle.

Tips For Insuring Rebuilt Title

If you are looking for insurance for a vehicle with a rebuilt title, there are a few tips that can help you get the best rates. First, make sure that the vehicle is in good condition and that the repairs were done properly. Additionally, make sure that the vehicle is not too old, as this can have an impact on the insurance rates.

It is also important to shop around and compare rates from different insurance companies. Different companies may offer different rates and it is important to compare to make sure you are getting the best deal. Additionally, make sure to ask about any discounts that may be available, such as a multi-vehicle discount or a safe driver discount.

Finally, make sure to ask about any additional coverage options that may be available. It is important to make sure that you have the coverage you need in case of an accident or other incident.

Conclusion

A vehicle with a rebuilt title can be more difficult to insure than a vehicle with a clean title. Insurance companies may be more reluctant to insure the vehicle due to the amount of damage, the extent of the repairs, and the age and condition of the vehicle. Additionally, insurance premiums for a vehicle with a rebuilt title may be higher than for a vehicle with a clean title.

However, it is possible to get insurance for a vehicle with a rebuilt title. It is important to make sure that the vehicle is in good condition, the repairs were done properly, and the vehicle is not too old. Additionally, it is important to shop around and compare rates from different insurance companies and to ask about any discounts or additional coverage options that may be available.

美國加拿大購車注意要點及車輛歷史報告 - 璟上國際有限公司

flowerdesignersnyc: What Is A Rebuilt Car Title

What is a Rebuilt Title? | Pros & Cons Of Rebuilt Titles - WeeklyMotor

What is Title Insurance? | Carlisle Title

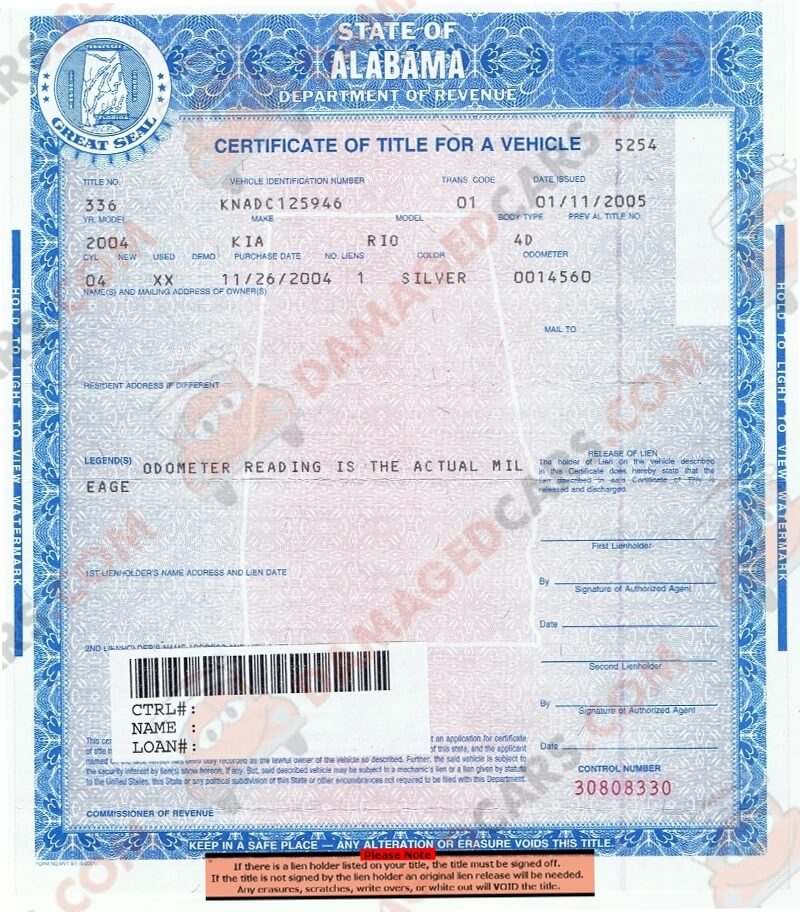

Alabama car title - How to transfer a vehicle, rebuilt or lost titles.