Is Geico Mechanical Breakdown Insurance Worth It

Tuesday, June 10, 2025

Edit

Is Geico Mechanical Breakdown Insurance Worth It?

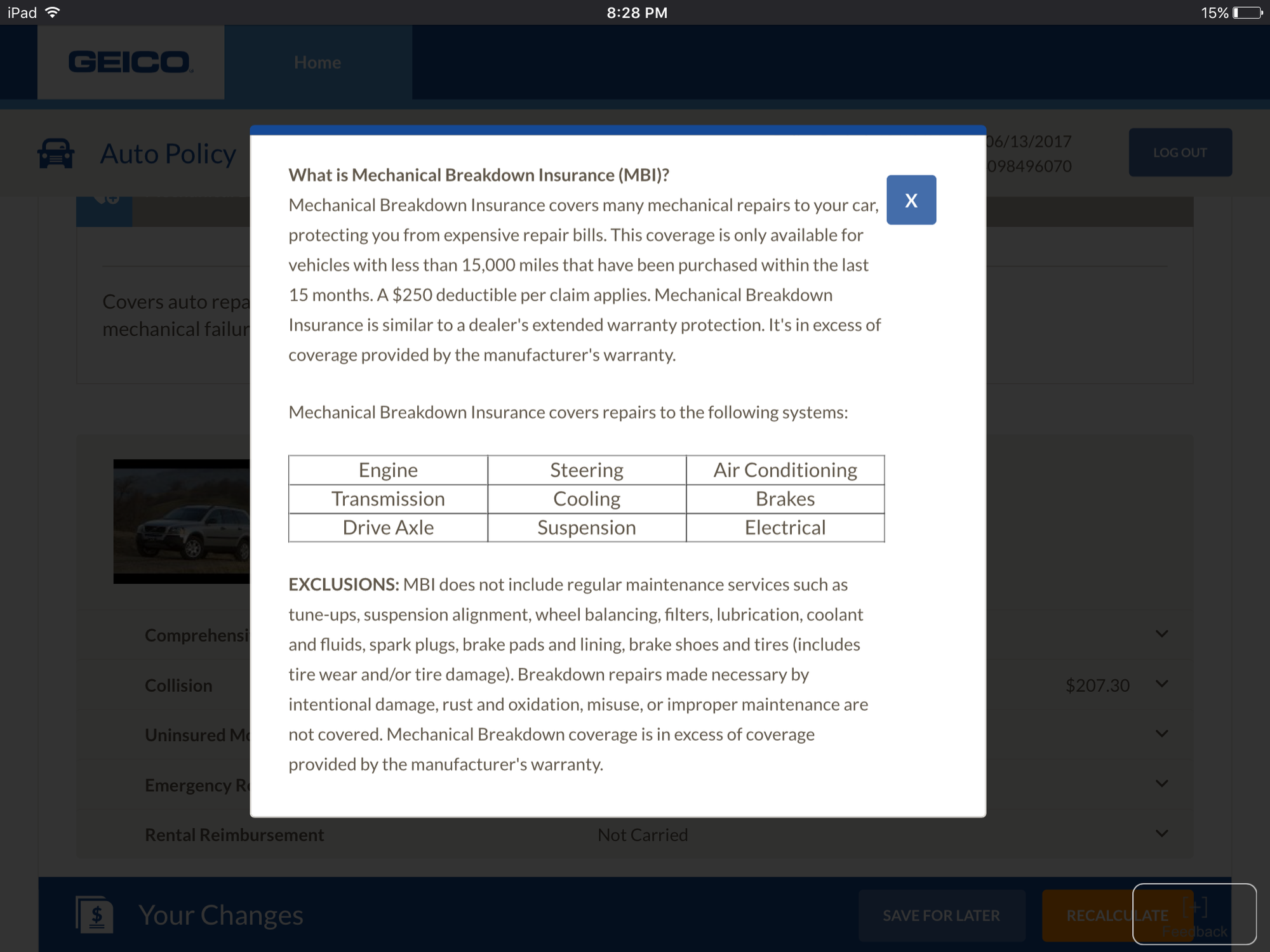

What is Mechanical Breakdown Insurance?

Mechanical Breakdown Insurance (MBI) is a type of insurance policy that covers mechanical failures related to your vehicle. It is not a type of coverage that is included in a standard auto insurance policy, but rather an additional policy that can be purchased for an additional cost. It is designed to cover the cost of repairs to your vehicle if it suffers any mechanical breakdowns or failures. This type of coverage can be very beneficial if you are driving an older car that is prone to breakdowns, or if you simply want the peace of mind of knowing that you have additional coverage in case something unexpected happens.

What Does Geico Mechanical Breakdown Insurance Cover?

Geico Mechanical Breakdown Insurance is designed to cover the cost of repairs to your vehicle if it suffers any mechanical breakdowns or failures. It covers the cost of parts, labor and taxes related to the repair of your vehicle. It also covers the cost of a rental car if your vehicle is in the shop for more than 24 hours. Additionally, it covers the cost of towing if your vehicle is disabled due to mechanical failure.

What Is the Cost of Geico Mechanical Breakdown Insurance?

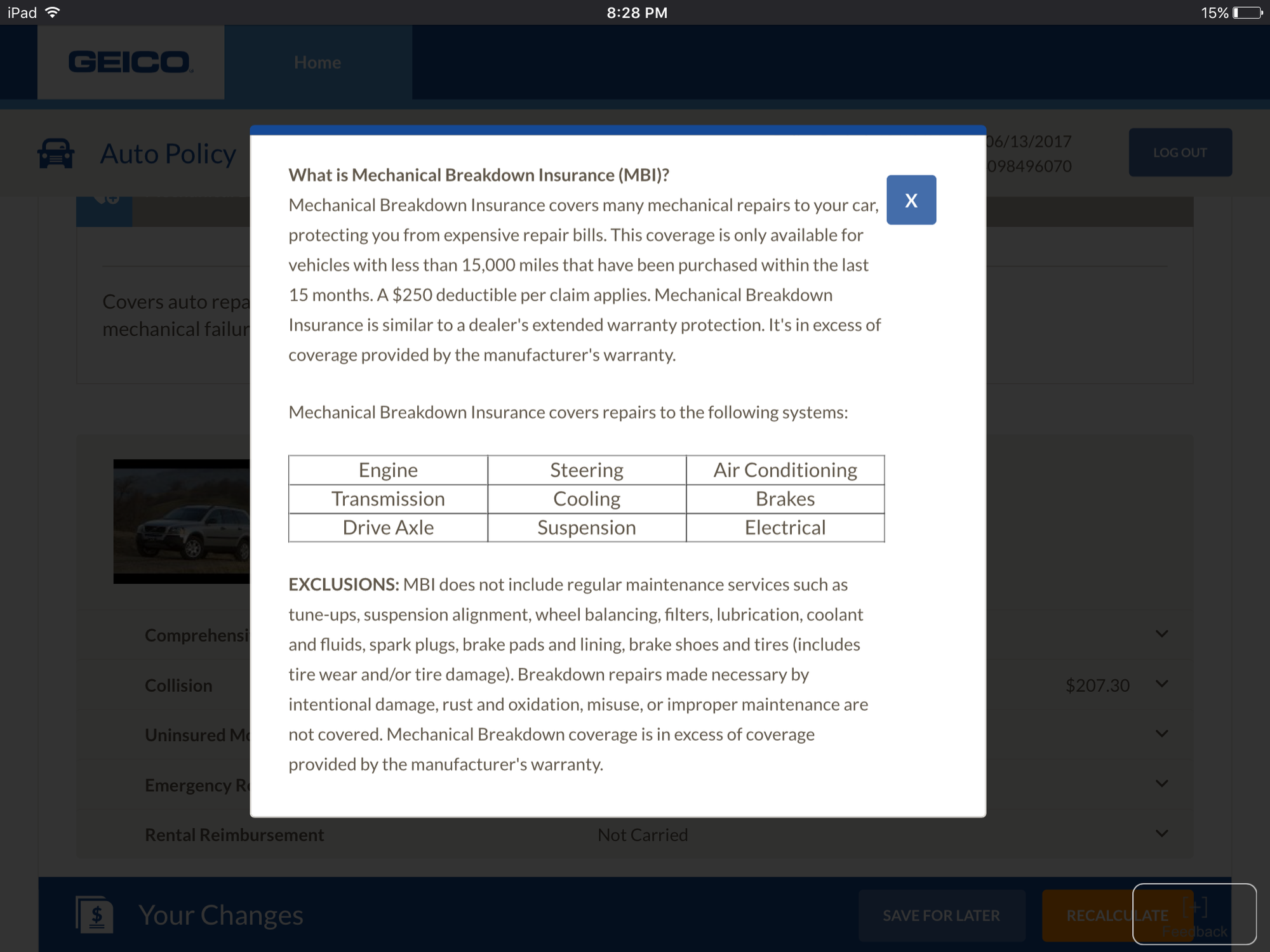

The cost of Geico Mechanical Breakdown Insurance varies depending on the type of vehicle you have and the amount of coverage you purchase. Generally speaking, the cost of coverage is based on the age of the vehicle and the type of coverage you purchase. For example, if you have an older car that is prone to breakdowns, you may elect to purchase a higher level of coverage that will cover the cost of more repairs.

What Are the Benefits of Geico Mechanical Breakdown Insurance?

The main benefit of Geico Mechanical Breakdown Insurance is the peace of mind it provides. You can rest assured that if your vehicle suffers a mechanical breakdown or failure, you will be covered for the cost of repairs. Additionally, it can help to protect you from costly repairs that you may not be able to afford on your own. And, if your vehicle is in the shop for more than 24 hours, you will be covered for the cost of a rental car.

Should You Get Geico Mechanical Breakdown Insurance?

Ultimately, the decision to purchase Geico Mechanical Breakdown Insurance is up to you. If you have an older car that is prone to breakdowns, or if you simply want the peace of mind of knowing that you have additional coverage in case something unexpected happens, then it may be worth considering. However, be sure to weigh the cost of the coverage against the potential savings if you do experience a mechanical breakdown.

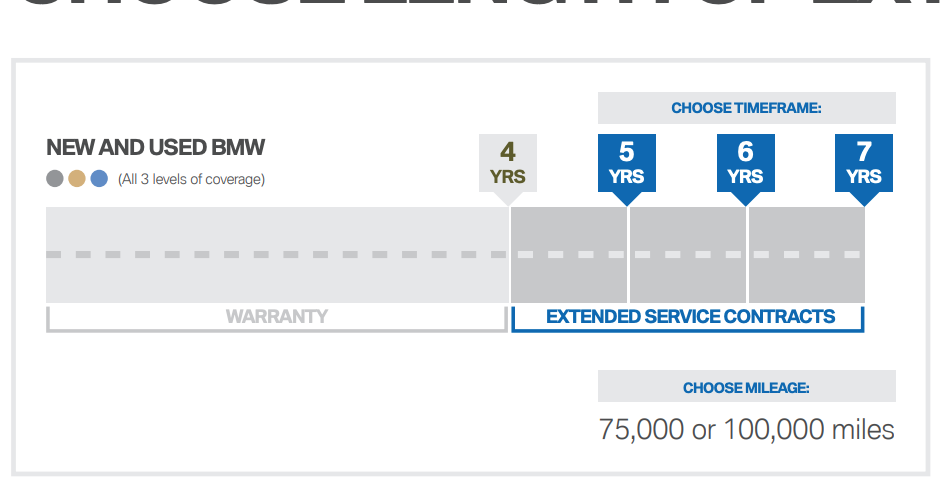

Get a Quote for Geico Mechanical Breakdown Insurance Today

If you are considering purchasing Geico Mechanical Breakdown Insurance, it is important to get a quote to determine the cost of coverage for your vehicle. You can get a quote online or by calling your local Geico office. Once you have your quote, you can decide if the coverage is worth the cost and if it is the right choice for you.

Thoughts on Geico's Mechanical Breakdown insurance? - CorvetteForum

Geico Mechanical Breakdown Insurance Reviews / Car Repair Insurance Is

GEICO Insurance Review: My Experience Using GEICO

Geico Mechanical Breakdown Insurance Reviews / Car Repair Insurance Is

Geico Auto Insurance Review: Features, Pros & Cons, and Costs