How Much Does Car Insurance Cost For Teens

Car Insurance Cost For Teens: What You Need to Know

As a teen, getting your first car can be an exciting experience. It opens up a whole new world of freedom and independence. But as with any new endeavour, there are some important things to consider. One of those considerations is the cost of car insurance for teens. The cost of car insurance for teens can vary based on a variety of factors, and it’s important to understand the different factors that can impact the cost.

Factors That Influence Car Insurance Cost for Teens

The cost of car insurance for teens depends on a variety of factors, including age, gender, driving history, and the type of car being insured. Age is one of the biggest factors in determining the cost of car insurance for teens. Generally, the younger a driver is, the higher the cost of insurance. This is because younger drivers are considered to be more likely to get into an accident, and thus, they present a higher risk to insurance companies.

Gender is another factor that can influence the cost of car insurance for teens. Generally, male drivers tend to pay more for car insurance than female drivers. This is because male drivers are typically considered more likely to engage in risky driving behaviors, such as speeding or reckless driving.

Driving history is another key factor that impacts the cost of car insurance for teens. If a teen has a history of accidents or traffic violations, the cost of their insurance may be higher than a teen with a clean driving record. Insurance companies also take into account the type of car being insured. If a teen is driving a newer, more expensive car, the cost of insurance will likely be higher than if they are driving an older, less expensive car.

Tips for Saving Money on Car Insurance for Teens

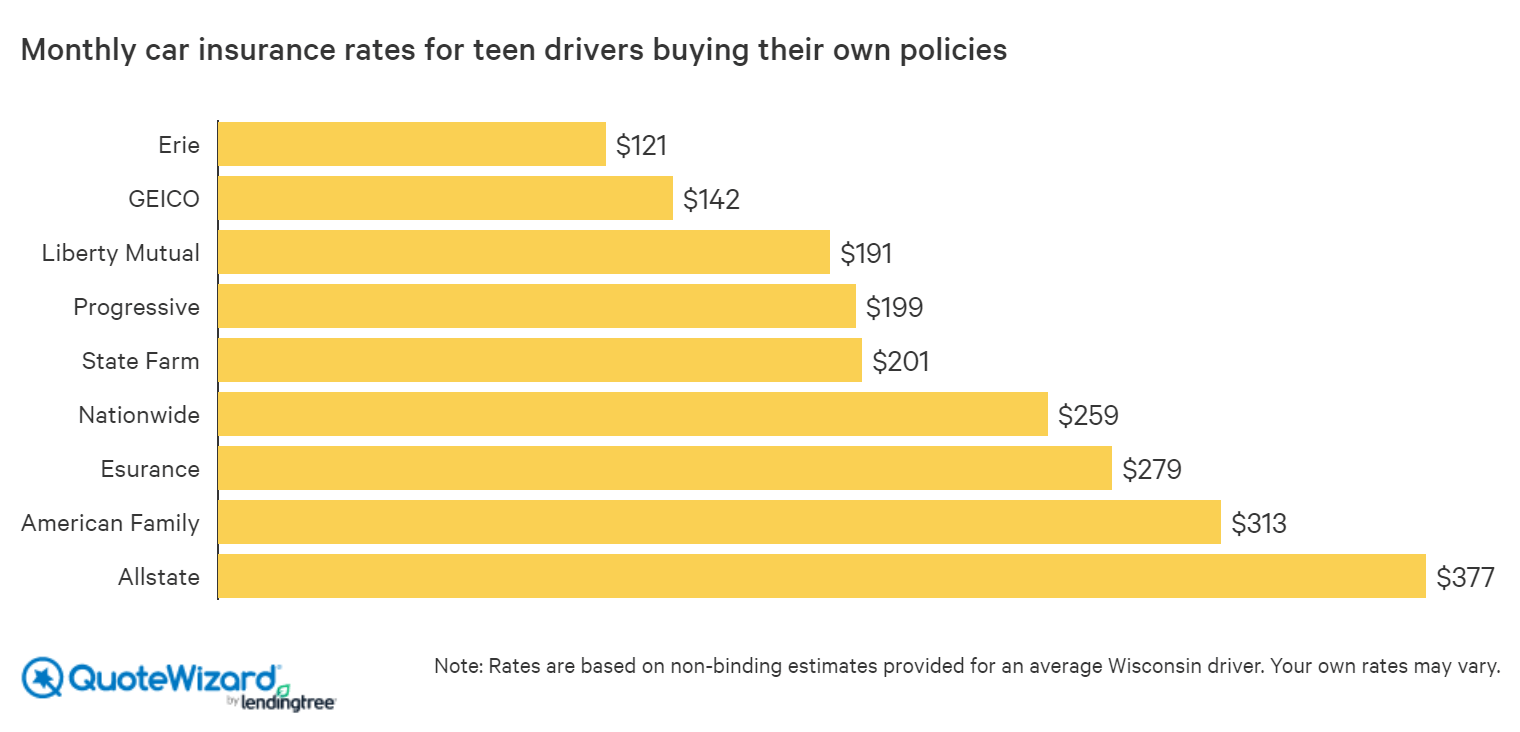

There are a few things teens can do to save money on car insurance. One of the most important things is to maintain a good driving record. Teens should always drive defensively and avoid speeding and other risky behaviors. Teens should also take a defensive driving course, as this can often result in a lower insurance rate. Additionally, teens should shop around for different insurance companies in order to get the best rate.

Finally, teens should consider raising their deductible. This means that they will have to pay more out of pocket if they get into an accident. However, it can also result in a lower insurance premium. It’s important to weigh the pros and cons of raising the deductible before making a decision.

Conclusion

Car insurance for teens can be expensive, but there are things teens can do to save money. It’s important to understand the different factors that can impact the cost of car insurance for teens, and to shop around for the best rate. Additionally, maintaining a good driving record and taking a defensive driving course can help teens save money on car insurance. Finally, teens should consider raising their deductible in order to get a lower insurance premium.

32+ Teenage Car Insurance Average Cost Per Month Pics - Escanciador Sidra

Average Cost of Car Insurance for Young Drivers 2020 | NimbleFins

Best Car Insurance for Teens | QuoteWizard

Finding the Cheapest Car Insurance for Teens

Pin on Soul Insurances