High Performance Car Insurance Under 25

High Performance Car Insurance Under 25

Overview of High Performance Car Insurance Under 25

Getting car insurance for high-performance cars can be tricky for drivers under the age of 25. High performance vehicles are typically more expensive to insure, as they are considered riskier than other types of cars. They are also more likely to be involved in an accident, as young drivers may not have the experience necessary to handle the power of the car. For this reason, it is important to find the right car insurance company that offers the best coverage for high performance vehicles.

Types of High Performance Car Insurance

When looking for car insurance for a high-performance car, there are several types of coverage to consider. The most common types of coverage are liability, collision, comprehensive, and medical payments. Liability coverage will pay for any damage caused to another party if the driver is at fault in an accident. Collision coverage will cover any damage to the insured car due to an accident. Comprehensive coverage will cover any damage caused by theft, vandalism, or natural disasters. Medical payments coverage will cover any medical bills that the driver may incur as a result of an accident.

Factors That Affect High Performance Car Insurance Rates

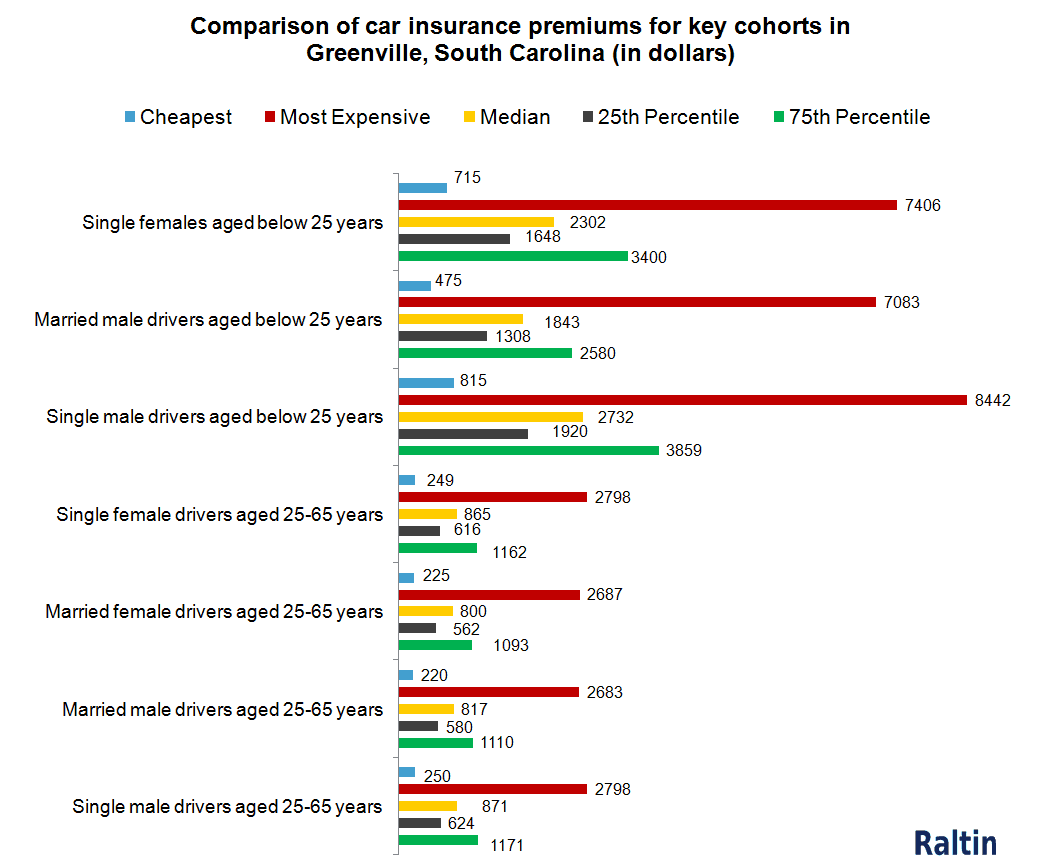

There are several factors that can affect the cost of high performance car insurance for drivers under 25. These factors include the driver's age, driving record, and the type of car. The more experience a driver has, the lower the insurance rate. Additionally, the type of car is important, as high-performance cars typically have higher insurance rates than other cars. The make and model of the car, as well as any modifications that have been made, can also affect insurance rates.

How to Find the Best High Performance Car Insurance Rates

The best way to find the best high performance car insurance rates for drivers under 25 is to shop around. It is important to compare different insurance companies and their coverage options. When comparing different policies, make sure to consider the types of coverage offered, the deductible, and the monthly premium. Additionally, it is important to read the fine print in order to understand the terms and conditions of the policy.

Ways to Reduce High Performance Car Insurance Rates

There are several ways to reduce high performance car insurance rates for drivers under 25. One way is to take a defensive driving course. Taking a defensive driving course can help drivers learn how to safely operate a high-performance car, as well as how to avoid common accidents. Additionally, drivers can also take advantage of discounts for good grades, safe driving, and low mileage. Drivers should also consider raising their deductible, as this can lower the monthly premium.

Conclusion

High performance car insurance can be expensive for drivers under 25, but there are ways to reduce the cost. Shopping around and comparing different policies is the best way to find the best rates. Additionally, drivers can take advantage of discounts, take a defensive driving course, and raise the deductible in order to lower the monthly premium. With the right coverage and the right company, drivers can get the protection they need at an affordable price.

auto insurance that doesn't check driving record with free quotes online

Under 25 Car Insurance – The Housing Forum

Under 25 Car Insurance - car insurance for females under 25 - YouTube

Best Car Insurance for Drivers under 25 with Lowest Monthly Rates | Car

25.Free Car Insurance Picture - YouTube