General Liability Insurance For Lawn Care Business

The Benefits of General Liability Insurance for Lawn Care Businesses

Lawn care businesses often face unique risks that can be difficult to navigate without the proper insurance coverage. General liability insurance is an important type of coverage that can offer a variety of benefits for lawn care businesses. This type of insurance can help protect businesses from a wide range of potential risks and liabilities.

What is General Liability Insurance?

General liability insurance is a type of business insurance designed to protect companies against a wide range of potential liabilities. This type of coverage typically covers claims of bodily injury and property damage incurred due to the business’s operations. It can also provide coverage for certain contractual liabilities, such as advertising injuries, tenant disputes, and damage to rented property.

How Does General Liability Insurance Benefit Lawn Care Businesses?

Lawn care businesses are particularly vulnerable to certain risks and liabilities, and general liability insurance can help protect these businesses from financial losses. For instance, this type of insurance can provide coverage for injuries that occur on the business’s property, such as a customer slipping and falling on a wet surface. It can also provide coverage for property damage caused by the business’s operations, such as a lawn mower damaging a neighbor’s fence. In addition, general liability insurance can provide coverage for certain contractual liabilities, such as a customer claiming that the lawn care company’s services damaged their property.

What is Covered By General Liability Insurance?

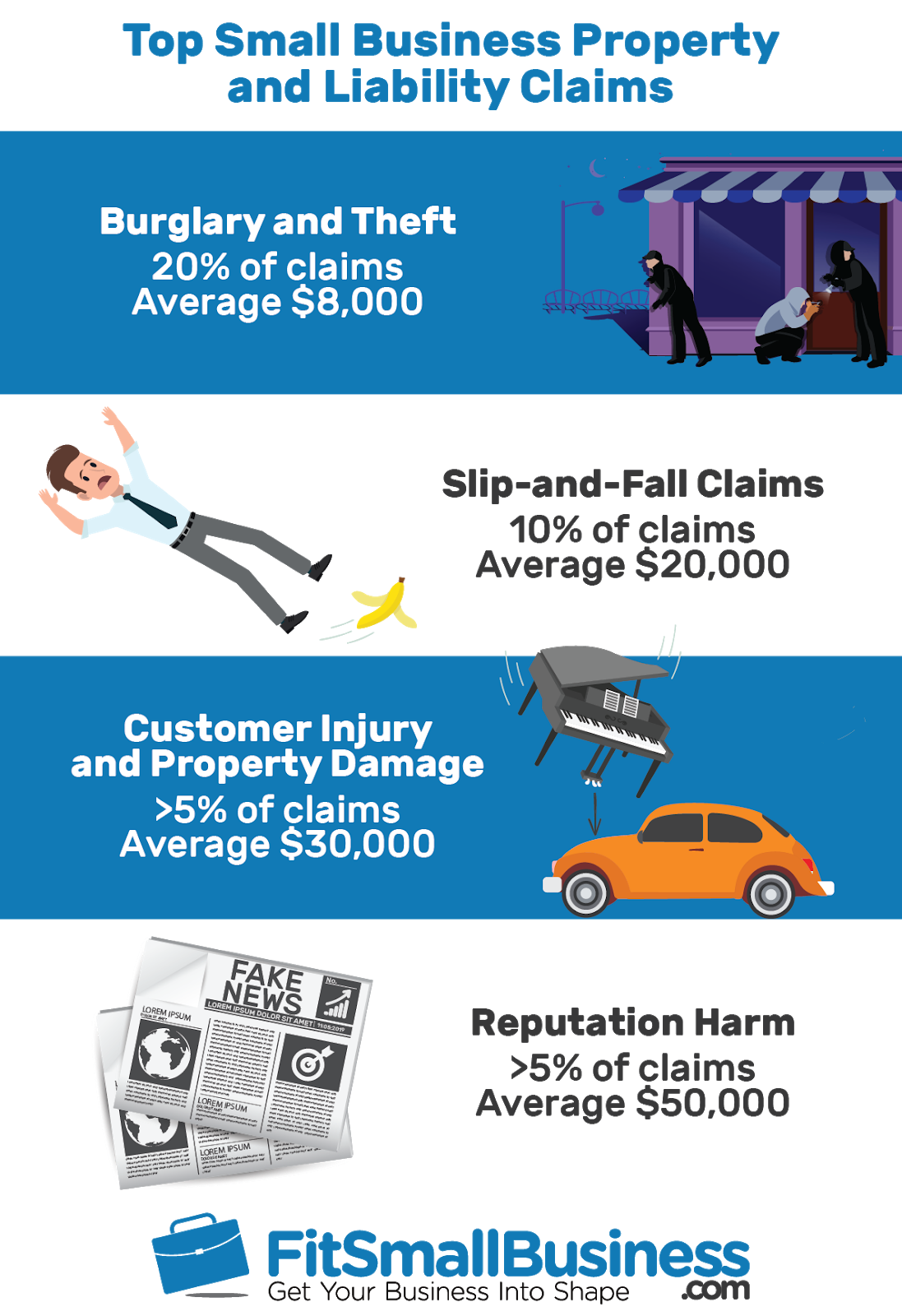

General liability insurance can provide coverage for a wide range of potential risks and liabilities. This type of coverage typically covers claims of bodily injury and property damage incurred due to the business’s operations. It can also provide coverage for certain contractual liabilities, such as advertising injuries, tenant disputes, and damage to rented property. In addition, it can provide coverage for damages resulting from libel, slander, and copyright infringement.

What Is Not Covered By General Liability Insurance?

Despite the wide range of potential risks and liabilities that general liability insurance can provide coverage for, there are certain types of losses that are not typically covered by this type of insurance. For instance, general liability insurance typically does not provide coverage for damages resulting from professional errors or omissions, product defects, or workplace injuries. In addition, it usually does not provide coverage for damages resulting from pollution or illegal activities.

Why Is General Liability Insurance Important for Lawn Care Businesses?

General liability insurance is an important type of coverage for lawn care businesses due to the unique risks that these businesses can face. This type of coverage can help protect businesses from a wide range of potential liabilities, such as bodily injury and property damage caused by the business’s operations. It can also provide coverage for certain contractual liabilities, such as advertising injuries, tenant disputes, and damage to rented property. As such, it is important for lawn care businesses to carry general liability insurance in order to protect themselves from potential liabilities.

General Liability Insurance | LawnSite.com™ - Lawn Care & Landscaping

Pin on lawn care business cards

What Kind of Insurance Do I Need For My Lawn Business? - YouTube

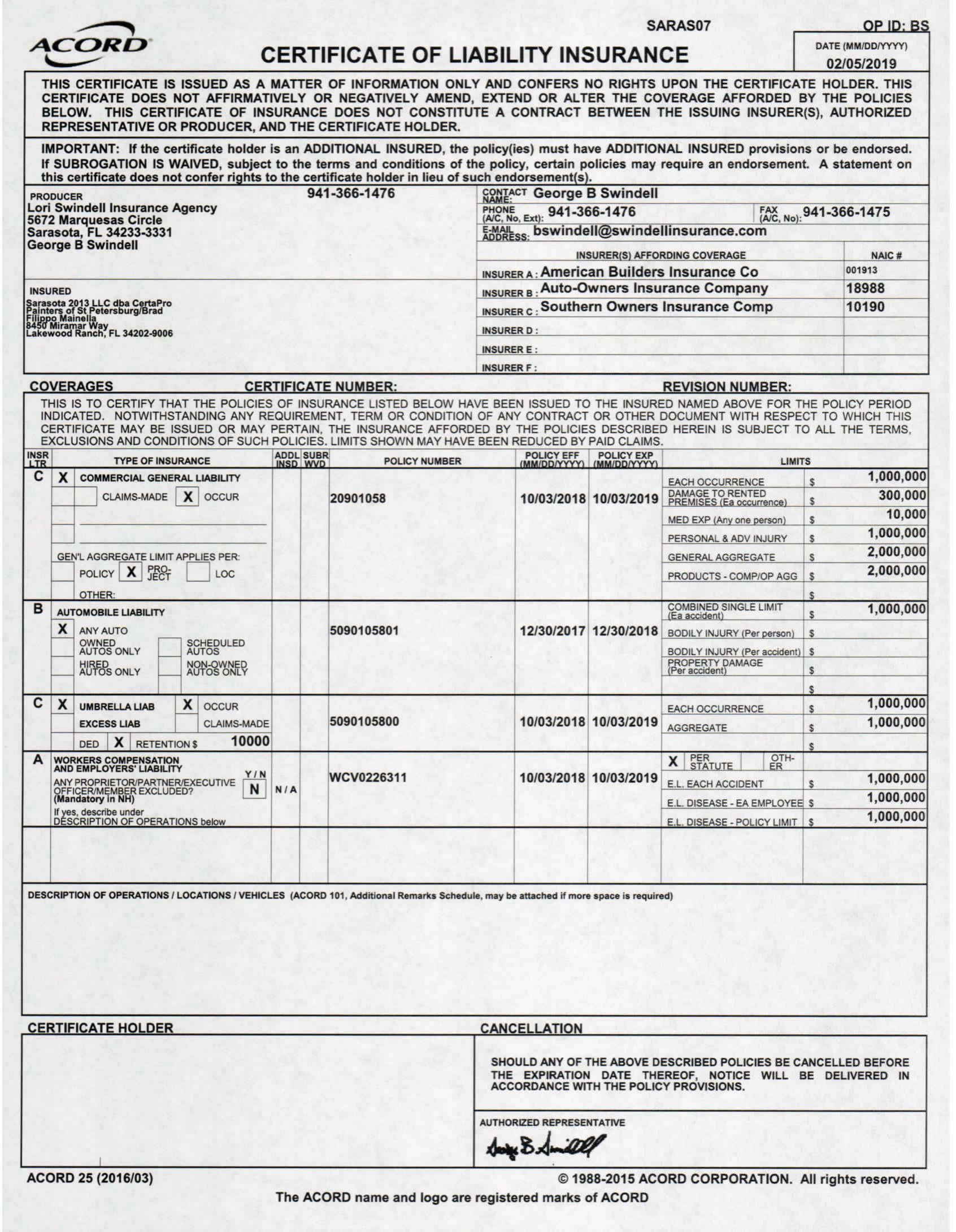

General Liability Insurance - CertaPro Painters of St Petersburg

How Much Does General Liability Insurance Cost