Gap Insurance Vs Full Coverage

Gap Insurance vs Full Coverage: What You Need to Know

Are you looking for the right kind of coverage for your vehicle? If so, you may be considering gap insurance vs full coverage. While both types of coverage have their benefits, understanding the difference between them can help you make the best decision for you and your vehicle. This article will explain the difference between gap insurance and full coverage so you can make an informed decision about what kind of coverage is best for you.

What is Gap Insurance?

Gap insurance is a type of coverage that helps protect you in case your vehicle is totaled or stolen. If the amount you owe on your vehicle is more than the vehicle’s value, gap insurance can help cover the difference. For example, if you owe $20,000 on your car, but its value is only $15,000, gap insurance can help cover the remaining $5,000.

What is Full Coverage?

Full coverage is a type of auto insurance that includes liability, collision, and comprehensive coverage. Liability coverage helps pay for damages that you may cause to another vehicle or person if you are at fault in an accident. Collision coverage helps pay for repairs if your vehicle is damaged in an accident. Comprehensive coverage helps pay for damages to your vehicle caused by things other than an accident, like theft, vandalism, or a natural disaster.

Gap Insurance vs Full Coverage

Gap insurance and full coverage have different benefits and drawbacks. With gap insurance, you are only covered if your vehicle is totaled or stolen and you owe more money on it than its value. With full coverage, you are covered for a variety of damages, including those caused by accidents, theft, and natural disasters. However, full coverage typically costs more than gap insurance.

Which One Should You Choose?

When it comes to gap insurance vs full coverage, it ultimately comes down to what kind of coverage you need and can afford. If you are concerned about owing more money on your vehicle than it is worth, then gap insurance is a good option. If you want more comprehensive protection, then full coverage may be the right choice for you. Be sure to talk to your insurance provider to find out what kind of coverage is best for your situation.

The Bottom Line

Gap insurance and full coverage both have their benefits and drawbacks. It’s important to consider your individual needs and budget when making a decision about which type of coverage is best for you. Be sure to talk to your insurance provider about the different types of coverage available and find out what kind of coverage will best protect you and your vehicle.

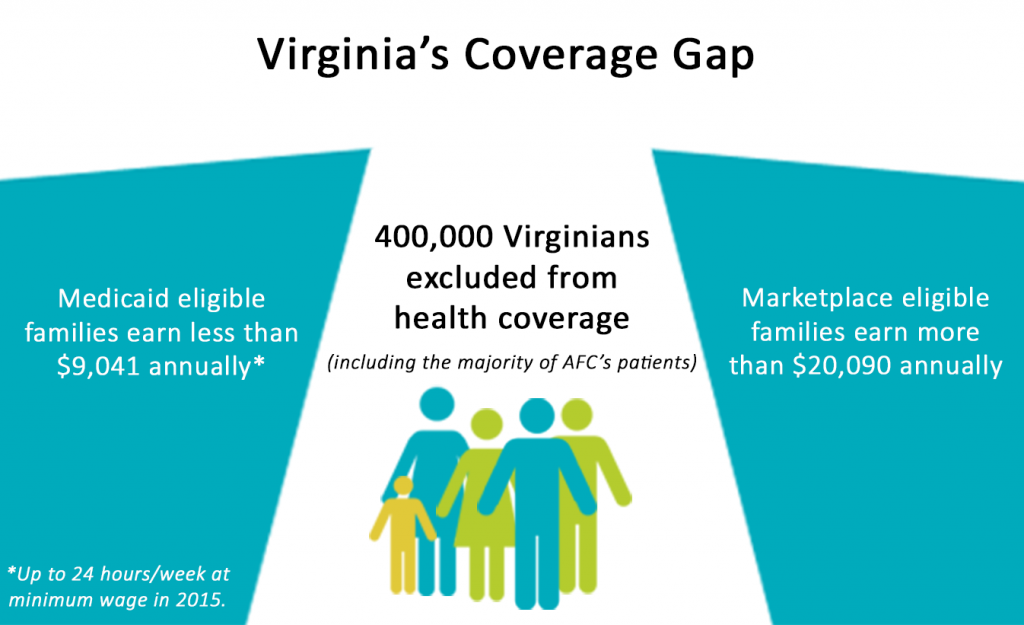

So, who exactly is in the coverage gap? - Care4Carolina

What Is Gap Insurance? - Lexington Law

What is Gap Insurance? Infographic

What is the Coverage Gap - Close the Gap NC

The Affordable Care Act – Arlington Free Clinic