Full Coverage Insurance State Farm

What is Full Coverage Insurance State Farm?

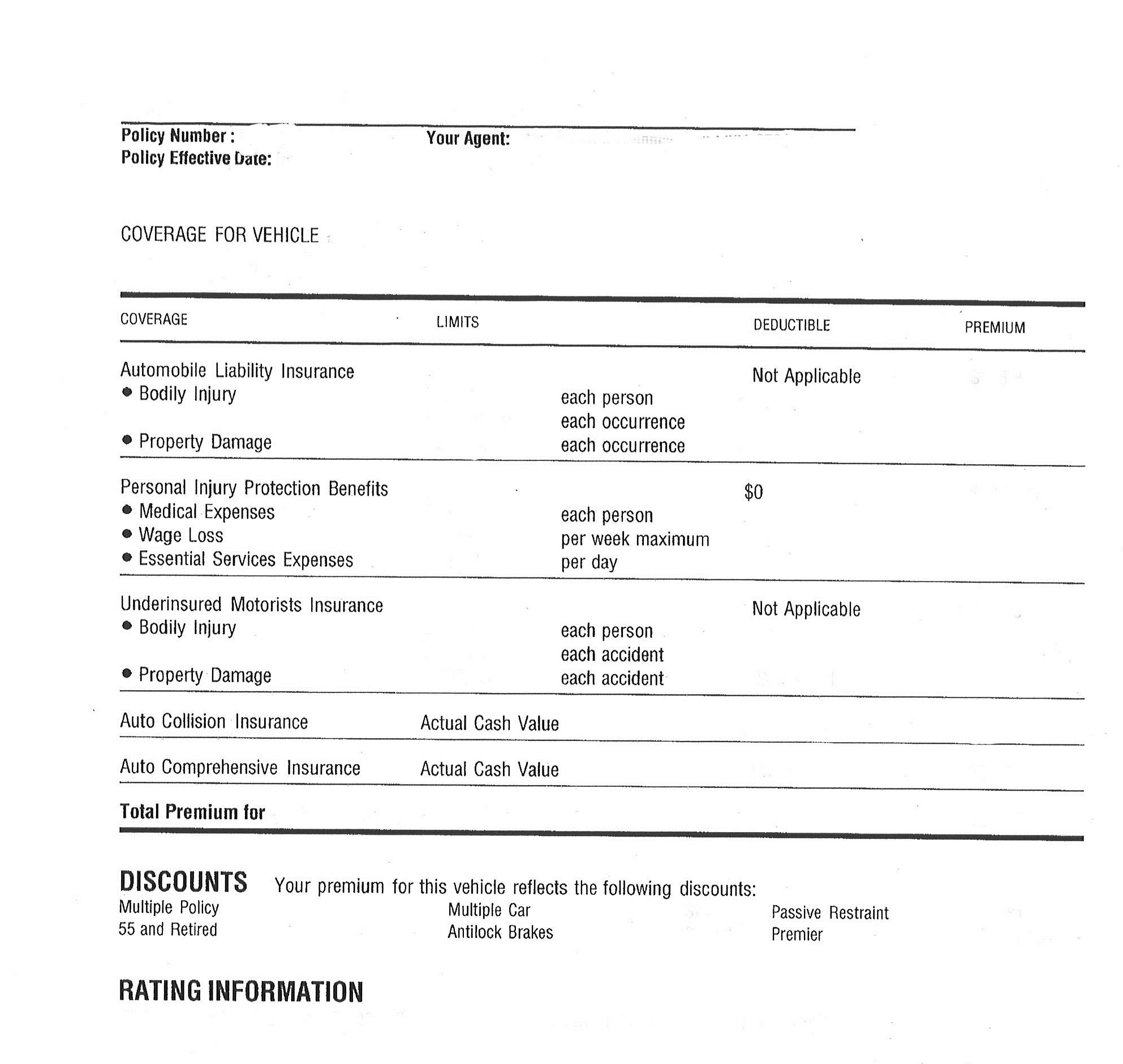

Full coverage insurance from State Farm is a comprehensive insurance policy that provides financial protection for yourself and your assets. It provides protection for your car, home, and other personal property, as well as liability coverage for bodily injury and property damage. With full coverage insurance from State Farm, you can rest easy knowing that you’re financially protected from a wide range of risks. This type of policy is especially important if you own a home or vehicle, as it offers a greater level of financial security than basic policies.

What Does Full Coverage Insurance State Farm Cover?

Full coverage insurance from State Farm covers a wide range of risks, including damage to your property, liability for bodily injury and property damage, theft, and personal injury. As a comprehensive policy, it also provides protection for other risks, such as fire, vandalism, and natural disasters. State Farm also offers additional coverage options such as uninsured/underinsured motorist protection, rental car reimbursement, and towing and labor costs. Depending on the type of policy you select, you may also be able to add coverage for roadside assistance, rental property, and other special situations.

What Does Full Coverage Insurance State Farm Cost?

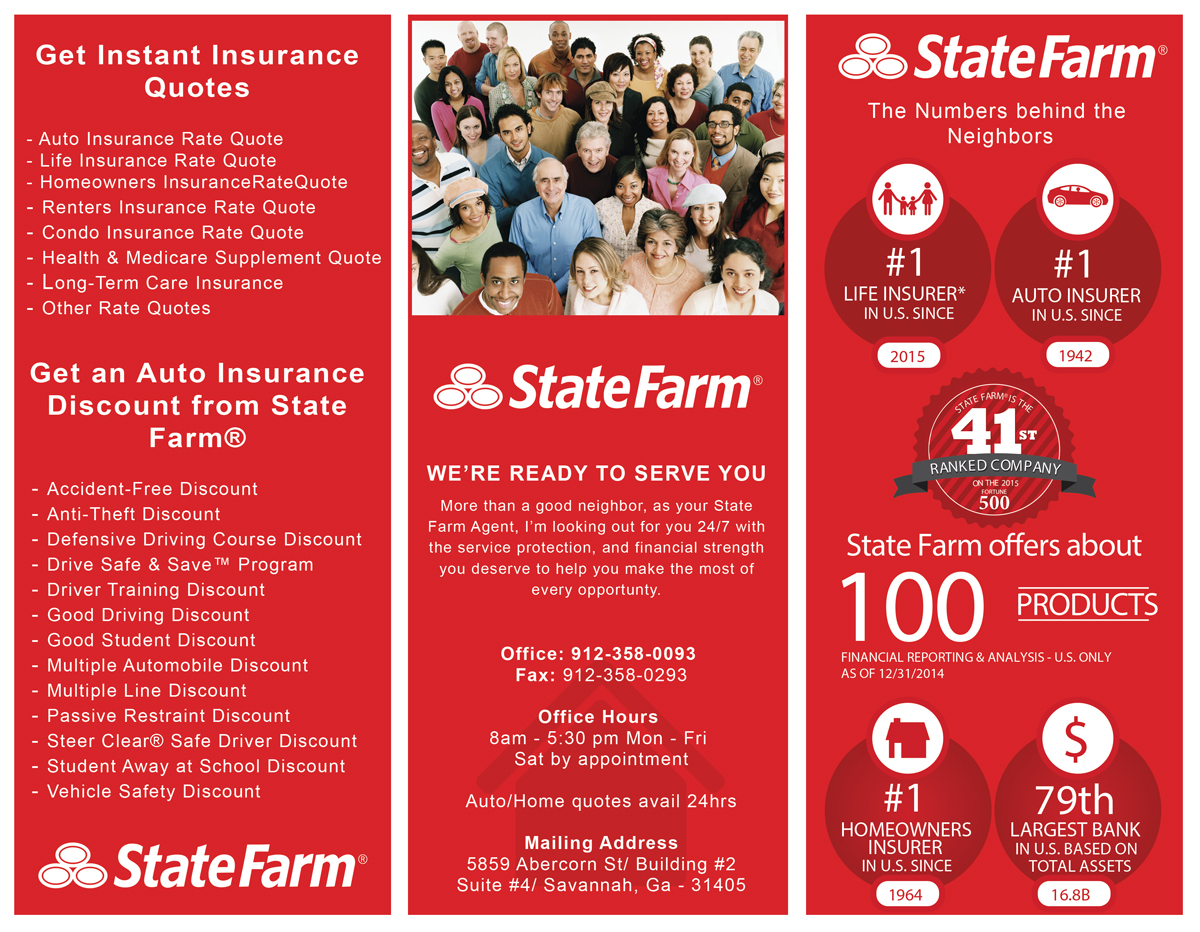

The cost of full coverage insurance from State Farm varies depending on a variety of factors, including the type of policy you select and the amount of coverage you want. Generally speaking, full coverage insurance costs more than basic policies because it provides more coverage. However, the cost is worth it for the added protection it provides. You can get an estimate of the cost of a full coverage policy from State Farm by contacting your local agent or using the online quote tool.

What Are the Benefits of Full Coverage Insurance State Farm?

The main benefit of full coverage insurance from State Farm is the added layer of financial protection it provides. With a comprehensive policy, you can rest easy knowing that you’re financially protected from a wide range of risks. Additionally, full coverage insurance from State Farm can help you save money in the long run. If you ever need to file a claim, you won’t have to worry about paying out of pocket for expensive repairs or medical bills. The policy will cover the costs, saving you money in the long run.

How Can I Get Full Coverage Insurance State Farm?

You can get full coverage insurance from State Farm by contacting your local agent or using the online quote tool. Your agent can help you select a policy that meets your needs and budget and can provide you with an estimate of the cost. Once you’ve chosen a policy, you can purchase it online or over the phone. Your policy will be active once you’ve paid the premiums, giving you the added protection you need.

80+ Car Insurance Full Coverage Quotes - Hutomo Sungkar

How Does State Farm Rideshare Insurance Work?

State Farm Stays Profitable Despite Higher Losses, Lower Premiums | WGLT

State Farm Renters Insurance Payment - Home Collection

State Farm Homeowners Insurance Declaration Page Sample