Ct State Minimum Car Insurance

Wednesday, June 4, 2025

Edit

What You Need to Know About Connecticut's State Minimum Car Insurance

Why You Need Car Insurance

Car insurance is an important investment that every driver needs to make. It is a legal requirement, and it can help to protect you and your vehicle in the event of an accident, as well as to protect other drivers and their vehicles. While it can be tempting to forego car insurance and save money in the short term, the financial repercussions of being without the coverage could be significant.

Connecticut's State Minimum Car Insurance Requirements

Connecticut is one of the many states that has enacted laws requiring drivers to have a minimum amount of car insurance coverage. In the state of Connecticut, all drivers must have a minimum of $25,000 in bodily injury coverage per person, $50,000 in bodily injury coverage per accident, and $25,000 in property damage coverage per accident. This is known as the 25/50/25 rule, and it is the minimum level of coverage that must be maintained in the state of Connecticut.

What Is Not Covered Under the Minimum Coverage?

It is important to understand that the minimum coverage required in the state of Connecticut only covers certain types of damages. It does not cover any damages to the driver's own vehicle—for that, the driver must purchase additional coverage. It also does not cover any medical expenses incurred by the driver or any of the passengers in the event of an accident. In addition, it does not cover any liability for damage to property other than the vehicle involved in the accident.

What Are the Penalties for Not Having Insurance?

Drivers who are found to be operating their vehicle without the proper insurance coverage can face severe penalties. The penalties for not having the minimum required coverage can include fines, the suspension of the driver's license, and even jail time. In addition, if an accident occurs without the proper insurance coverage, the driver can be held financially liable for any damages incurred.

Ways to Save on Insurance Costs

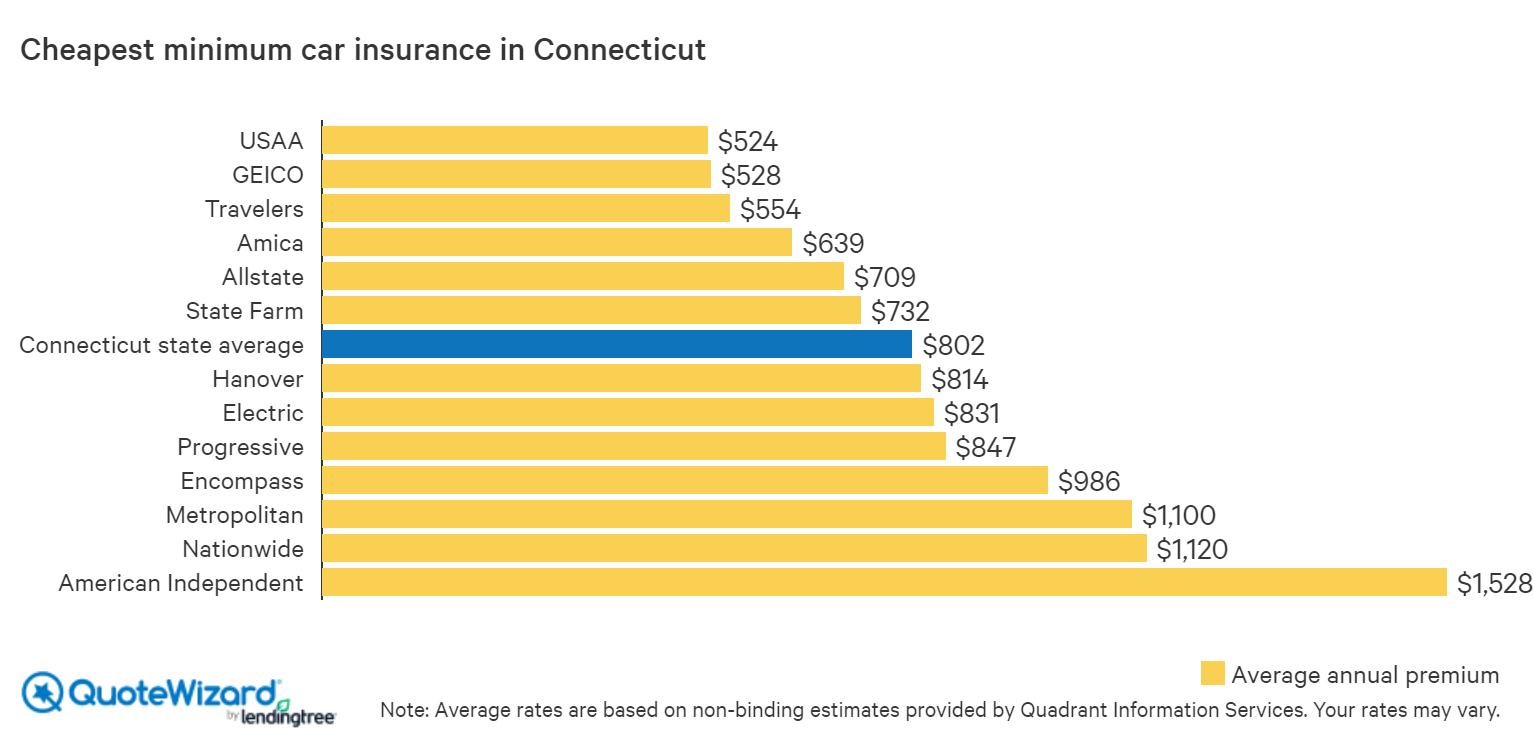

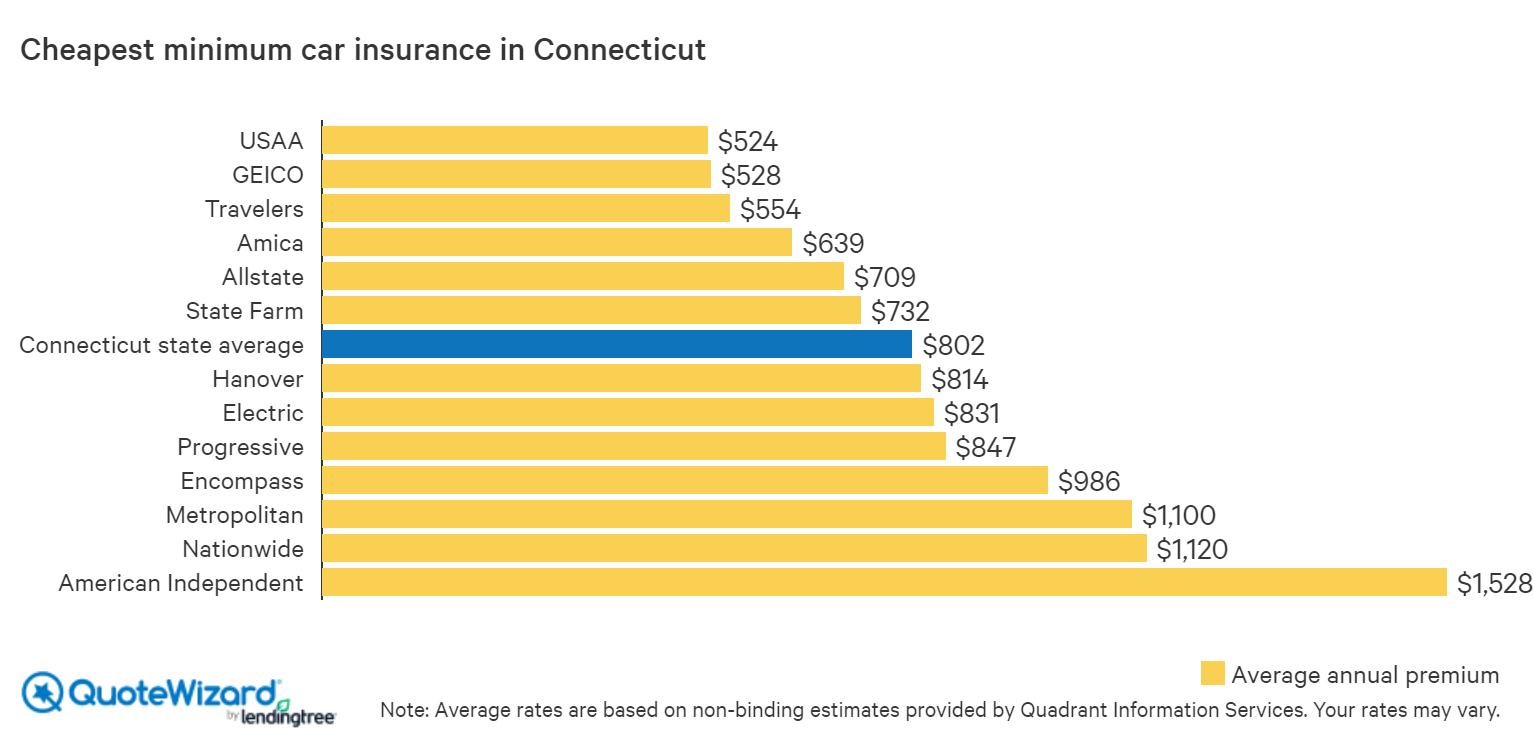

There are ways to save money on car insurance costs, even if you are required to maintain the minimum coverage. Many insurance companies offer discounts for drivers who have completed driver safety courses, or who maintain a good driving record. In addition, many insurers offer discounts for drivers who have multiple vehicles insured with the same company. Shopping around and comparing rates can also help you find the best deal.

Conclusion

Maintaining the minimum car insurance coverage as required by the state of Connecticut is an important responsibility for all drivers. Not only is it the law, but it can also save you money in the event of an accident. There are ways to save on the cost of insurance, and it is important to shop around and compare rates to find the best deal.

Get Cheap Car Insurance in Connecticut | QuoteWizard

What's the Cost of State Minimum Car Insurance? | Car Insurancee

Things You Should Know About Purchasing Car Insurance In The USA by

State of ct minimum wage 2020 | Governor Lamont Signs Minimum Wage

Texas Minimum Car Insurance Requirements - dailydesigns2