Cholamandalam Car Insurance Claim Settlement Ratio

Cholamandalam Car Insurance Claim Settlement Ratio

Introduction

Cholamandalam Car Insurance is a leading provider of motor insurance services in India. It is a joint venture between the Murugappa Group and Mitsui Sumitomo Insurance Co. Ltd. The company offers comprehensive car insurance policies with a wide range of features and benefits. It also provides additional benefits like cashless repair services and 24x7 roadside assistance. Cholamandalam Car Insurance has a good track record when it comes to claim settlement ratio. In this article, we take a look at the Cholamandalam Car Insurance claim settlement ratio and how it compares to other insurers.

Claim Settlement Ratio

The Claim Settlement Ratio (CSR) is a metric used to measure the performance of an insurance company in terms of disbursing claims. It is calculated by dividing the number of claims settled by the total number of claims made. A higher CSR indicates a better performance by the insurer. The Cholamandalam Car Insurance claim settlement ratio for the fiscal year 2021-22 is 96.82%, which is very good. This indicates that the company is settling the majority of the claims it receives in a timely manner.

Comparison with Other Insurers

When compared to other car insurance providers in India, Cholamandalam Car Insurance has a competitive claim settlement ratio. For instance, the CSR of Bajaj Allianz Car Insurance is 94.38%, while the CSR of ICICI Lombard Car Insurance is 94.31%. This shows that Cholamandalam Car Insurance is performing better when it comes to settling claims. Furthermore, the company has a dedicated customer service team that helps customers with the claim process, which makes the process smoother and hassle-free.

Factors that Affect the Claim Settlement Ratio

There are a number of factors that can affect the claim settlement ratio of an insurer. These include the type of policy, the insurer's claims processing procedure, the expertise of the insurance provider, the customer service provided by the insurer, the quality of the insurer's risk management practices, and the quality of the insurer's reinsurance arrangements. It is important to consider all these factors when selecting an insurance provider.

Benefits of High Claim Settlement Ratio

A high claim settlement ratio is beneficial to both the insurer and the insured. A higher CSR indicates that the insurer is settling claims quickly and efficiently. This means that the insured can expect to receive their claim amount in a timely manner. Furthermore, a higher claim settlement ratio also helps the insurer in building a good reputation among customers, which can help to attract more customers and increase the company's market share.

Conclusion

Cholamandalam Car Insurance has a very good claim settlement ratio of 96.82%. This indicates that the company is efficient in settling claims and is committed to providing timely and satisfactory services to its customers. Furthermore, the company has a dedicated customer service team that helps customers with the claim process and provides timely assistance. Therefore, customers can be assured that their claims will be settled quickly and efficiently.

Download Claim Form - Cholamandalam Ms Car Insurance Title: Download

Best Health Insurance & Motor Insurance Companies

Car Insurance Renewal - Check Claim Settlement Ratios

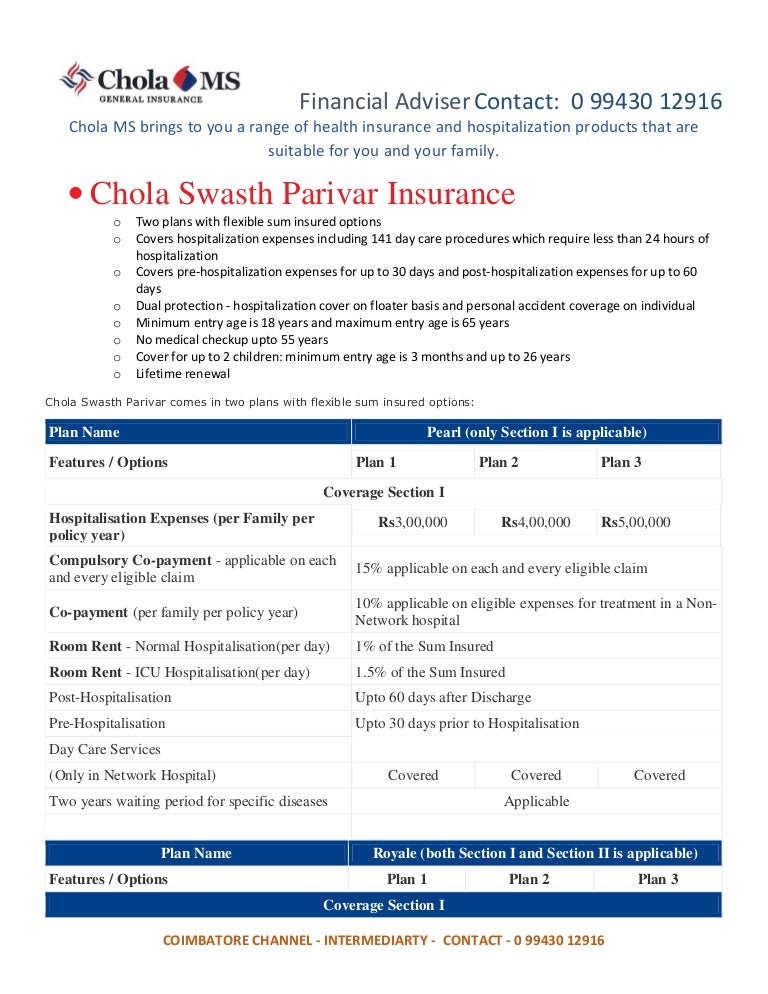

CHOLA SWASTH PARIVAR INSURANCE | Cholamandalam MS HEALTH INSURANCE

Hdfc Health Insurance Claim Settlement Ratio - idesignque