Best Gap Insurance For Medicare

What is Gap Insurance for Medicare?

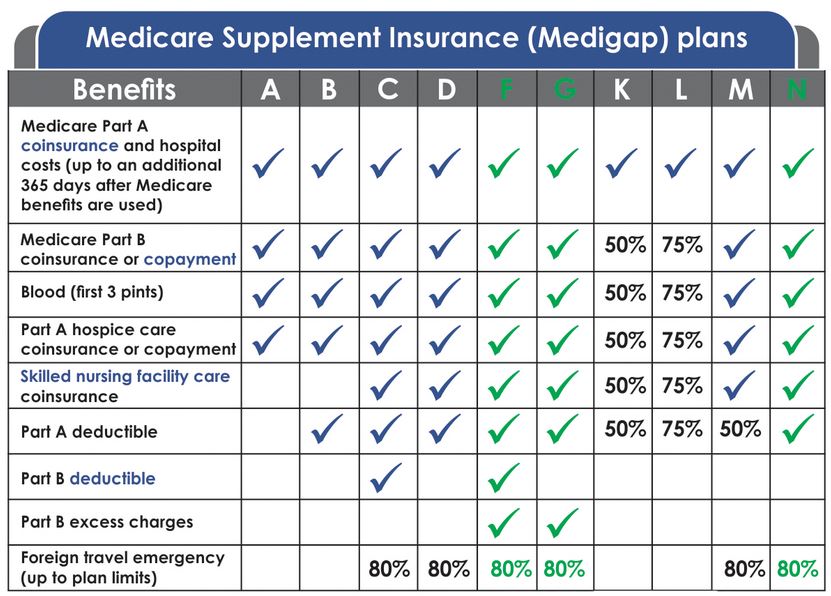

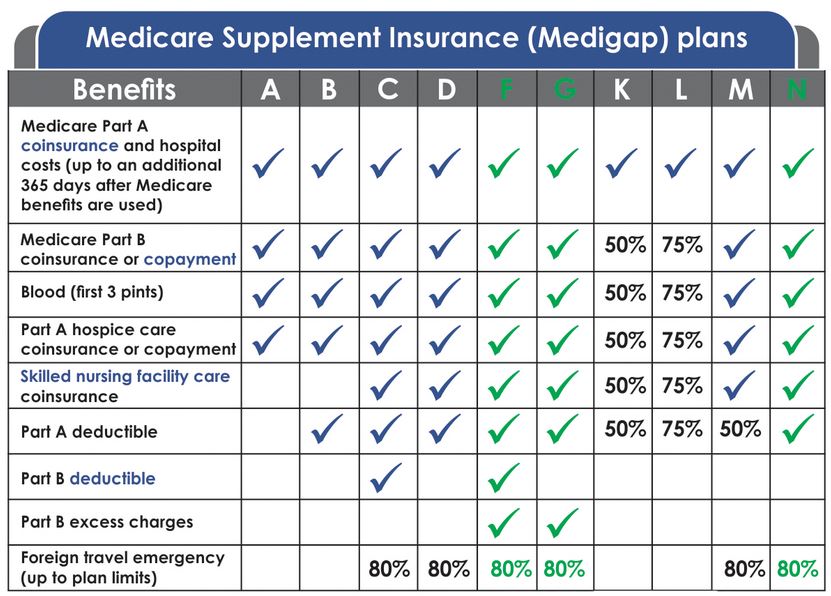

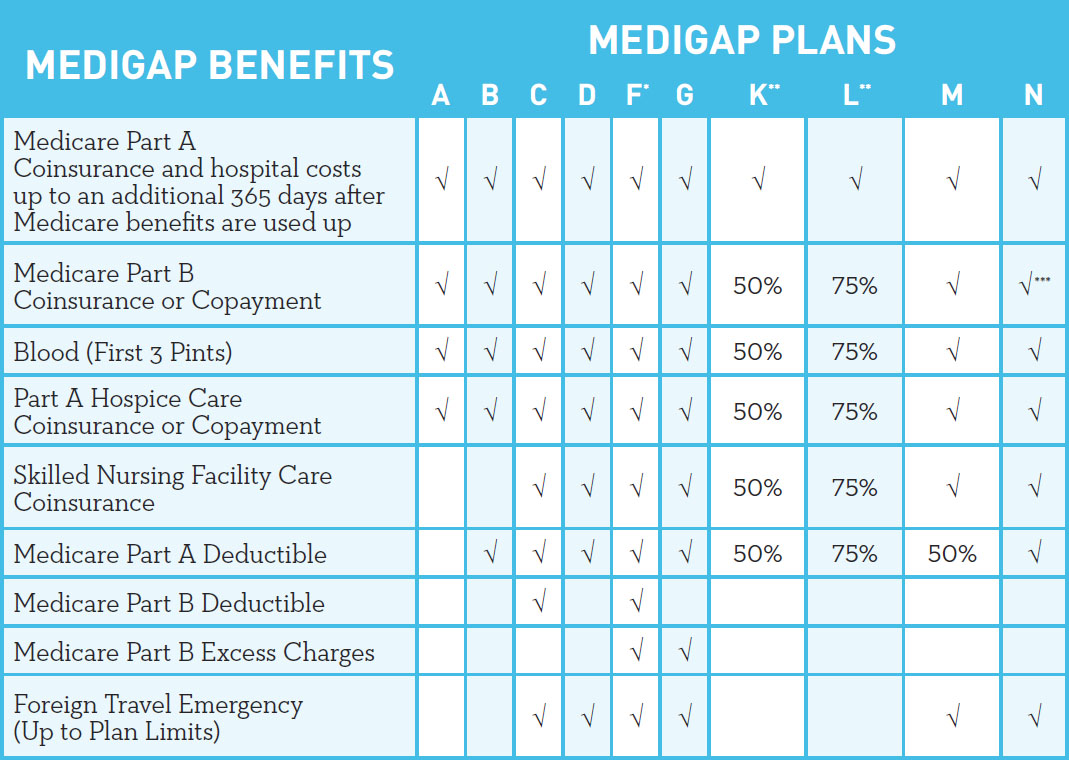

Gap insurance for Medicare is a type of health insurance that covers the gaps in coverage the government-backed Medicare plan does not. It is designed to supplement the coverage you get from Medicare, covering medical expenses that Medicare does not. Gap insurance for Medicare is usually sold in the form of a supplemental policy or a Medicare Advantage plan. These plans are designed to provide additional coverage for medical expenses, such as deductibles and copays. Gap insurance for Medicare can also provide coverage for services not covered by traditional Medicare, such as vision, hearing and dental care.

What Does Gap Insurance for Medicare Cover?

Gap insurance for Medicare typically covers medical expenses that Medicare does not. This includes deductibles and copays for doctors’ visits and hospital stays, as well as coverage for services that Medicare does not cover, such as vision, hearing and dental care. Some gap insurance policies also cover prescription drugs and emergency medical services. Gap insurance can also provide coverage for other types of services, such as home health care and long-term care.

How Does Gap Insurance for Medicare Work?

Gap insurance for Medicare works by supplementing the coverage provided by traditional Medicare. It pays for medical expenses that Medicare does not cover, such as deductibles and copays. It also provides coverage for services not covered by Medicare, such as vision, hearing and dental care. Gap insurance for Medicare can also provide coverage for prescription drugs and emergency medical services. Gap insurance typically pays a set amount for each medical expense, up to a predetermined limit.

How Much Does Gap Insurance for Medicare Cost?

The cost of gap insurance for Medicare varies depending on the type of policy you choose and the coverage it provides. Generally, gap insurance policies cost between $50 and $200 per month, depending on the coverage they offer. The cost of gap insurance is typically less than the cost of traditional Medicare, but it is important to compare the cost of coverage with the cost of traditional Medicare before making a decision. It is also important to consider the type of coverage offered by the gap insurance policy to make sure it meets your needs.

What Are the Benefits of Gap Insurance for Medicare?

The main benefit of gap insurance for Medicare is that it provides coverage for medical expenses that traditional Medicare does not cover. Gap insurance can also provide coverage for services not covered by traditional Medicare, such as vision, hearing and dental care. Gap insurance can also provide coverage for prescription drugs and emergency medical services. Additionally, gap insurance can provide protection against out-of-pocket medical expenses and can help to protect your financial security in the event of a medical emergency.

Who Should Consider Gap Insurance for Medicare?

Gap insurance for Medicare is an important consideration for anyone who is enrolled in the government-backed Medicare plan. It can provide coverage for medical expenses that Medicare does not cover, as well as coverage for services not covered by traditional Medicare, such as vision, hearing and dental care. Gap insurance can also provide coverage for prescription drugs and emergency medical services. Additionally, gap insurance can provide protection against out-of-pocket medical expenses and can help to protect your financial security in the event of a medical emergency. Gap insurance for Medicare is an important consideration for anyone who is enrolled in the government-backed Medicare plan.

The Best Medicare Supplement? Plan F vs Plan G vs Plan N

Medicare Supplement FAQs

2019 Medicare Supplement (Medigap) Plans - Maine's Health Insurance

What Is Medicare Supplement Insurance: Everything about Medigap

Best Medicare Supplement Insurance Companies