30 Day Grace Period Car Insurance

30 Day Grace Period Car Insurance

What is a 30 Day Grace Period Car Insurance?

30 Day Grace Period Car Insurance is a type of car insurance policy that offers a 30 day grace period for policyholders who fail to pay their premium on time. This type of policy is designed to help policyholders maintain their coverage without having to pay hefty late fees. In most cases, the grace period will begin from the date the policy was bought. During this period, the policyholder will still be covered under the policy and any claims made during this time will be handled as normal.

Benefits of 30 Day Grace Period Car Insurance

The main benefit of having a 30 Day Grace Period Car Insurance policy is the flexibility it provides. It allows policyholders to maintain their coverage without having to worry about late fees or having their policy cancelled. It also gives them some extra time to make their premium payments in case they experience any unexpected financial difficulties. Furthermore, it can help policyholders avoid any gaps in their coverage that could result from a lapse in payments.

Are There Any Downsides to 30 Day Grace Period Car Insurance?

Like any insurance policy, 30 Day Grace Period Car Insurance does come with some drawbacks. For instance, the policyholder may be subject to higher rates than those who make their payments on time. Also, the policyholder may have to pay a late fee if they are unable to make the payment by the end of the grace period. Additionally, the policyholder may have to provide additional evidence of their financial situation in order to obtain the grace period.

How Can I Get the Most Out of My 30 Day Grace Period Car Insurance?

If you have opted for a 30 Day Grace Period Car Insurance policy, it is important to make sure that you are aware of the terms and conditions of the policy. Be sure to understand the length of the grace period, as well as the associated fees and requirements. Additionally, you should make sure you are making your payments on time to avoid any late fees or cancellation of your policy. Finally, make sure to review your policy regularly to ensure that it is still providing you with the coverage you need and that you are still getting the best rate possible.

Conclusion

30 Day Grace Period Car Insurance is a great option for policyholders who may have difficulty making their premium payments on time. It provides them with some extra time to make the payment without having to worry about late fees or cancellation of their policy. However, it is important to be aware of the terms and conditions of the policy, as well as the associated fees and requirements. By understanding the policy and making timely payments, policyholders can ensure they get the most out of their 30 Day Grace Period Car Insurance.

102 reference of Auto Insurance 30 Day Grace Period in 2020

Grace Period Insurance New Car

FAQ: 30-day Grace Period for Car, Home Loan clients | Metrobank

LOOK: Pag-ibig Fund gived grace period on all loan payments

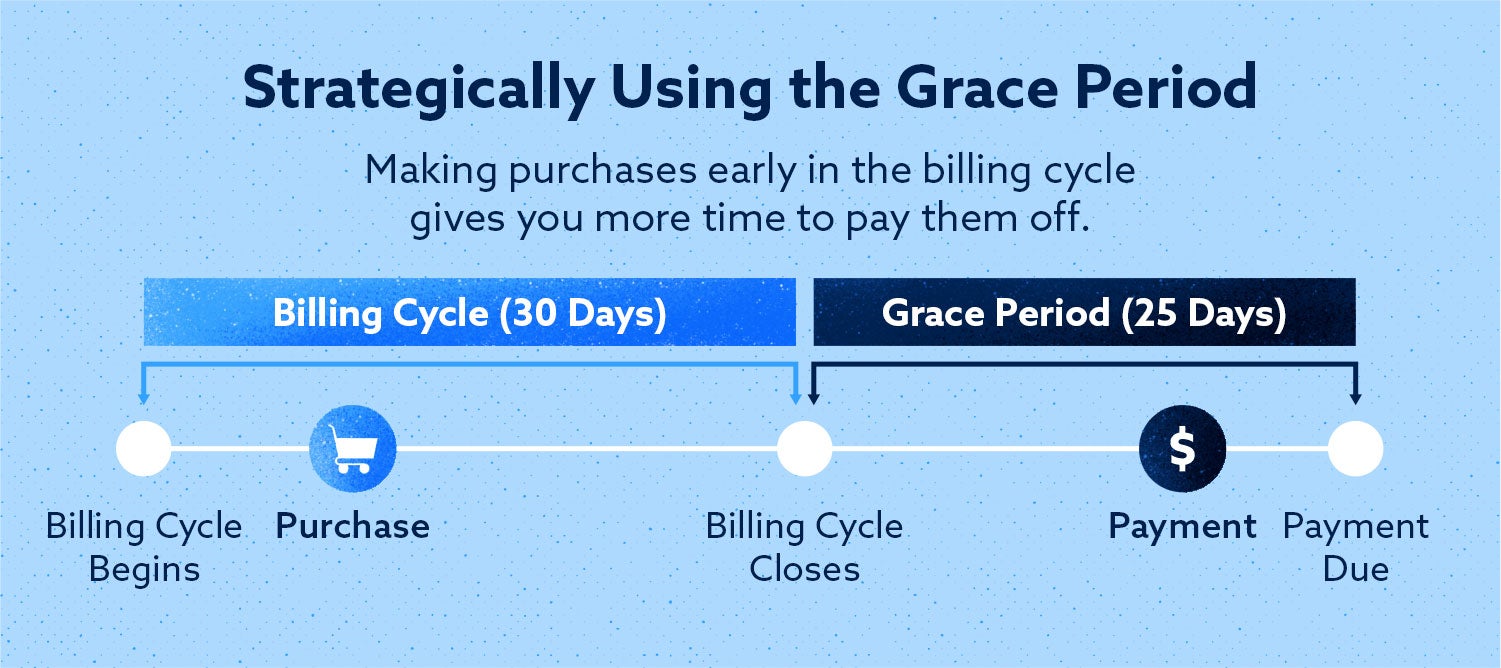

In Credit Card What Is The Grace Period Of Payment : Grace Period