1st Party Insurance And Long Term Disability Lien Texas

Friday, June 13, 2025

Edit

What You Should Know About 1st Party Insurance And Long Term Disability Lien Texas

What is 1st Party Insurance?

1st Party Insurance is an insurance policy that provides coverage for first-party losses, meaning those losses that are directly incurred by the policyholder. This type of insurance is especially important for individuals who own businesses or properties, as it can help to protect them from the financial losses that can be caused by natural disasters, theft, and other unexpected events. 1st Party Insurance typically covers things such as property damage, medical expenses, and legal costs, allowing the policyholder to be protected from financial loss if they are ever faced with an unexpected or unexpected expense.

Understanding Long Term Disability Lien in Texas

Long Term Disability Lien in Texas is a type of insurance policy that provides benefits to individuals who are unable to work due to a disability or illness. This type of insurance is designed to help those who may be unable to work for an extended period of time due to a disability or illness, by providing them with financial assistance to help them manage the costs associated with a disability. This type of insurance is particularly important for those who may not be able to work for a long period of time due to a disability or illness, as it can help them to maintain their financial stability during that time.

Why is 1st Party Insurance and Long Term Disability Lien in Texas Important?

1st Party Insurance and Long Term Disability Lien in Texas are important because they can help to protect individuals from the unexpected financial losses that can be caused by a disability or illness. This type of insurance can help to cover medical expenses, lost wages, and other costs associated with a disability or illness, allowing individuals to maintain their financial stability during a difficult time. Additionally, this type of insurance can help to provide individuals with a sense of security, as they will know that they are financially protected in the event of a disability or illness.

What are the Benefits of 1st Party Insurance and Long Term Disability Lien in Texas?

1st Party Insurance and Long Term Disability Lien in Texas can provide a number of benefits for those who may be facing a disability or illness. This type of insurance can help to cover the costs associated with a disability or illness, such as medical expenses, lost wages, and other costs. Additionally, this type of insurance can help to provide individuals with a sense of security, as they will know that they are financially protected in the event of a disability or illness. In addition to these benefits, this type of insurance can also provide individuals with the peace of mind that comes with knowing they are financially protected in the event of a disability or illness.

What Are the Drawbacks of 1st Party Insurance and Long Term Disability Lien in Texas?

1st Party Insurance and Long Term Disability Lien in Texas can be expensive, and may not be suitable for everyone. Additionally, this type of insurance may not cover certain types of losses, such as those caused by a pre-existing medical condition. Furthermore, this type of insurance may not cover the costs associated with a disability or illness, such as lost wages and other costs. Finally, this type of insurance may not be available in all areas, and may not be available to all individuals.

How Can I Get 1st Party Insurance and Long Term Disability Lien in Texas?

1st Party Insurance and Long Term Disability Lien in Texas can be obtained through a variety of different providers, including insurance companies, financial institutions, and government agencies. It is important to research the different providers and compare their policies, as each provider may offer different coverage levels and premiums. Additionally, it is important to understand the different types of coverage that are available, and to choose the policy that best fits the individual’s needs. Finally, it is important to make sure that the policy is up to date and that the provider is reputable and reliable.

What You Need To Know About Long Term Disability (LTD) Claims

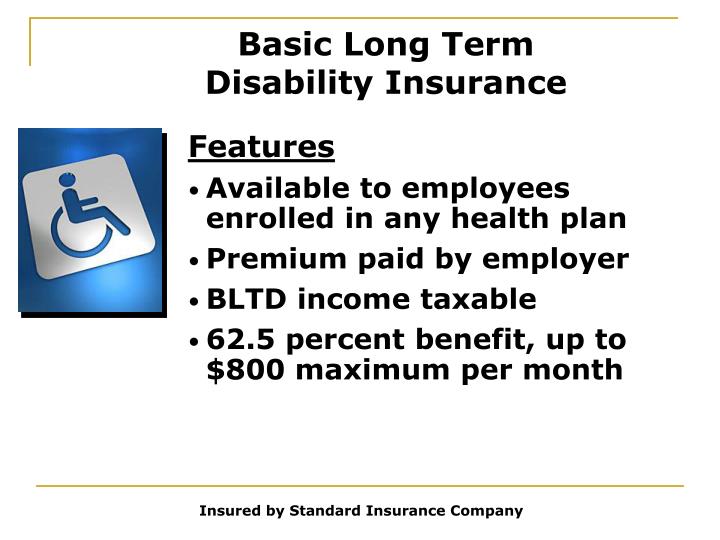

PPT - Basic Life Insurance PowerPoint Presentation - ID:3793378

Long Term Disability Insurance Application Document Stock Photo

Dos And Don Ts Long Term Disability Insurance

Why employees should purchase LTD coverage | Employee Benefit Adviser