When Does Male Car Insurance Go Down

When Does Male Car Insurance Go Down?

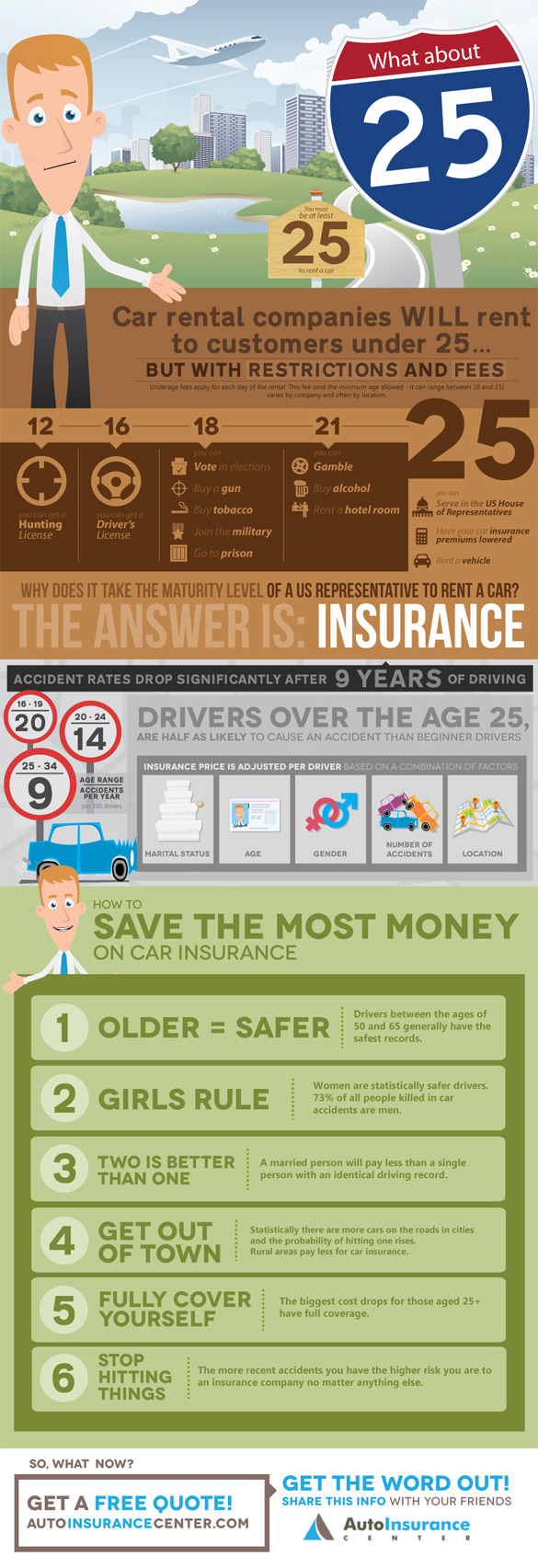

Are you a young male driver looking to save money on car insurance? You’ve likely heard that premiums can be lower for female drivers. But when does male car insurance go down? The answer to that question is a bit complicated. It depends on a variety of factors, such as the type of car, the driver’s age, and the amount of coverage.

Factors That Affect Male Car Insurance Rates

Car insurance rates are determined by a variety of factors. Some of the most important ones include the type and age of the car, the driver’s age and driving record, the amount of coverage purchased, and where the car is garaged. All of these factors can significantly impact the cost of car insurance for male drivers.

Car Age and Type

The age and type of car you drive will have an impact on your car insurance rates. Insurance rates are typically higher for brand new cars because they are more expensive to replace. Older cars, on the other hand, can be cheaper to insure because they cost less to repair or replace. Additionally, the type of car you drive will also have an impact on your rates. Sporty cars, luxury cars, and cars with high performance engines tend to cost more to insure because they are more likely to be involved in an accident.

Driver Age

The age of the driver is another important factor when it comes to car insurance rates. Young drivers are generally considered to be a higher risk than older drivers, so their rates tend to be higher. However, as drivers get older and gain more experience, their rates typically go down. Some insurance companies offer special discounts for older drivers as well.

Driving Record

Your driving record is another factor that can affect your car insurance rates. Insurance companies take your driving record into account when calculating your rates. If you have a history of speeding tickets or other moving violations, your rates will likely be higher. On the other hand, if you have a clean driving record, your rates may be lower. Additionally, if you have taken a driver safety class or other defensive driving course, you may be eligible for discounts from your insurance company.

Amount of Coverage and Location

The amount of coverage you purchase and where your car is garaged can also have an impact on your car insurance rates. Increasing your coverage limits can result in higher rates, while decreasing your coverage limits can result in lower rates. Additionally, the location where your car is garaged can affect your rates. Insurance companies take into account the crime rate and the number of accidents in the area when calculating rates.

In conclusion, there are a variety of factors that can affect the cost of car insurance for male drivers. These include the age and type of car, the driver’s age and driving record, the amount of coverage purchased, and the location where the car is garaged. While rates may be higher for younger drivers, they can go down as drivers gain more experience and maintain a clean driving record.

Does Insurance Go Down Every Year – Haibae Insurance Class

What Age Does Insurance Drop - Business insolvencies drop to lowest

When Does Car Insurance Go Down For Young Drivers : Car Insurance For

Does Car Insurance Lower When Car Is Paid Off - Car Retro

Does Car Insurance Go Down at 25 in the UK? | Compare UK Quotes