Tesco Ireland Car Insurance Quotes

Comparing Tesco Ireland Car Insurance Quotes

Car insurance is an important investment that every car owner should make. If you're looking for car insurance in Ireland, Tesco Ireland is one of the most popular and trusted providers. With so many different types of cover and policies, it can be difficult to make the right choice. That's why having the ability to compare different Tesco Ireland Car Insurance quotes online is essential. This article will provide an overview of the different types of car insurance available and explain how to get the best quotes.

Types of Tesco Ireland Car Insurance

Tesco Ireland offers a range of car insurance policies to suit different needs. There are three main types of policy: Third Party, Third Party Fire and Theft, and Comprehensive. Third party is the most basic level of cover, and will protect you in the event that you cause damage to another person's property or vehicle. Third Party Fire and Theft covers you for the same things as Third Party cover, but also includes cover for your vehicle if it is stolen or damaged by fire. Comprehensive cover is the most comprehensive level of cover, and includes all the features of the two lower levels, plus cover for accidental damage to your own vehicle.

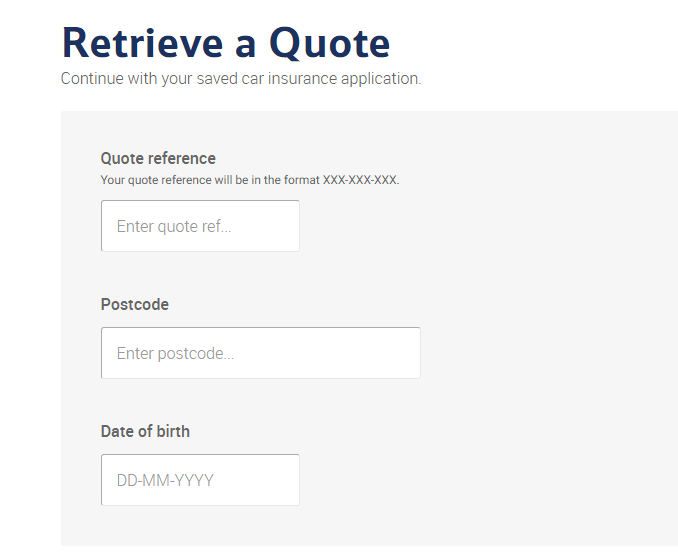

Getting Quotes

The best way to get the best Tesco Ireland Car Insurance quotes is to shop around and compare different policies online. To get started, visit the Tesco Ireland website and enter your details. You'll be asked to provide details about your vehicle, such as its make, model, age and mileage. You'll also need to provide personal information such as your age, occupation, address and other details. Once you've entered your details, Tesco Ireland will provide you with a range of quotes from different providers.

What Affects My Quote?

There are a number of factors that can affect the cost of your car insurance. These include the level of cover you choose, your age, the type of car you drive, your driving history, and where you live. Tesco Ireland will take all of these factors into account when providing you with quotes, so it is important to provide accurate information. The more accurate the information you provide, the more accurate the quotes will be.

Making a Claim

Making a claim with Tesco Ireland is straightforward and easy. All you need to do is contact their customer service team and they will help you through the process. They will provide you with a claim form, which you will need to fill out and return. Once your claim has been processed, Tesco Ireland will contact you with the outcome of your claim.

Getting the Best Value for Money

When comparing different Tesco Ireland Car Insurance quotes, it is important to make sure you are getting the best value for money. Different policies may offer different levels of cover, so make sure you understand what each policy includes and excludes. It is also important to consider any additional features or benefits that may be included in the policy. These can include breakdown cover, legal expenses cover, personal accident cover and more. By taking all these factors into account, you can be sure you're getting the best deal on your car insurance.

Tesco Car Insurance Excess

Reddit - Dive into anything

Tesco Car Insurance Contact Number - Call on 0025299011075

Getting a Tesco Car Insurance Online

Tesco Insurance Contact Number - 0843 557 3623